nent CULATOR FULL SCREEN PRINTER VERSION BACK Exercise 99 Sh

Solution

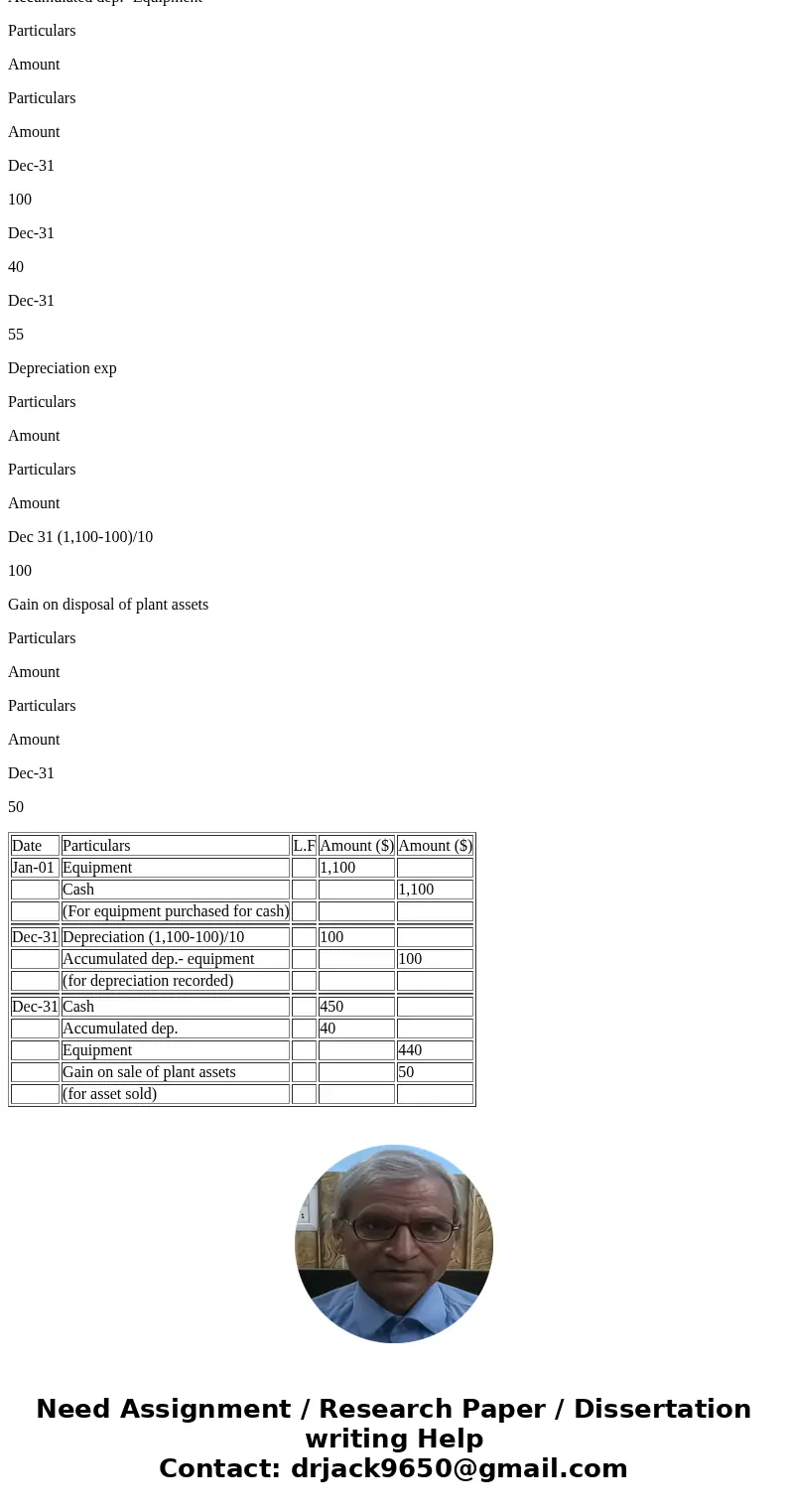

Journal entries to record the purchase and sale of equipment is as shown below:

Date

Particulars

L.F

Amount ($)

Amount ($)

Jan-01

Equipment

1,100

Cash

1,100

(For equipment purchased for cash)

Dec-31

Depreciation (1,100-100)/10

100

Accumulated dep.- equipment

100

(for depreciation recorded)

Dec-31

Cash

450

Accumulated dep.

40

Equipment

440

Gain on sale of plant assets

50

(for asset sold)

Cash

Particulars

Amount

Particulars

Amount

Dec-31

450

Jan-01

1,100

Equipment

Particulars

Amount

Particulars

Amount

Jan-01

1,100

Dec-31

440

Accumulated dep.- Equipment

Particulars

Amount

Particulars

Amount

Dec-31

100

Dec-31

40

Dec-31

55

Depreciation exp

Particulars

Amount

Particulars

Amount

Dec 31 (1,100-100)/10

100

Gain on disposal of plant assets

Particulars

Amount

Particulars

Amount

Dec-31

50

| Date | Particulars | L.F | Amount ($) | Amount ($) |

| Jan-01 | Equipment | 1,100 | ||

| Cash | 1,100 | |||

| (For equipment purchased for cash) | ||||

| Dec-31 | Depreciation (1,100-100)/10 | 100 | ||

| Accumulated dep.- equipment | 100 | |||

| (for depreciation recorded) | ||||

| Dec-31 | Cash | 450 | ||

| Accumulated dep. | 40 | |||

| Equipment | 440 | |||

| Gain on sale of plant assets | 50 | |||

| (for asset sold) |

Homework Sourse

Homework Sourse