Chapter 5 Homework Q Search Sheet AutoSave oFF Homc Insert P

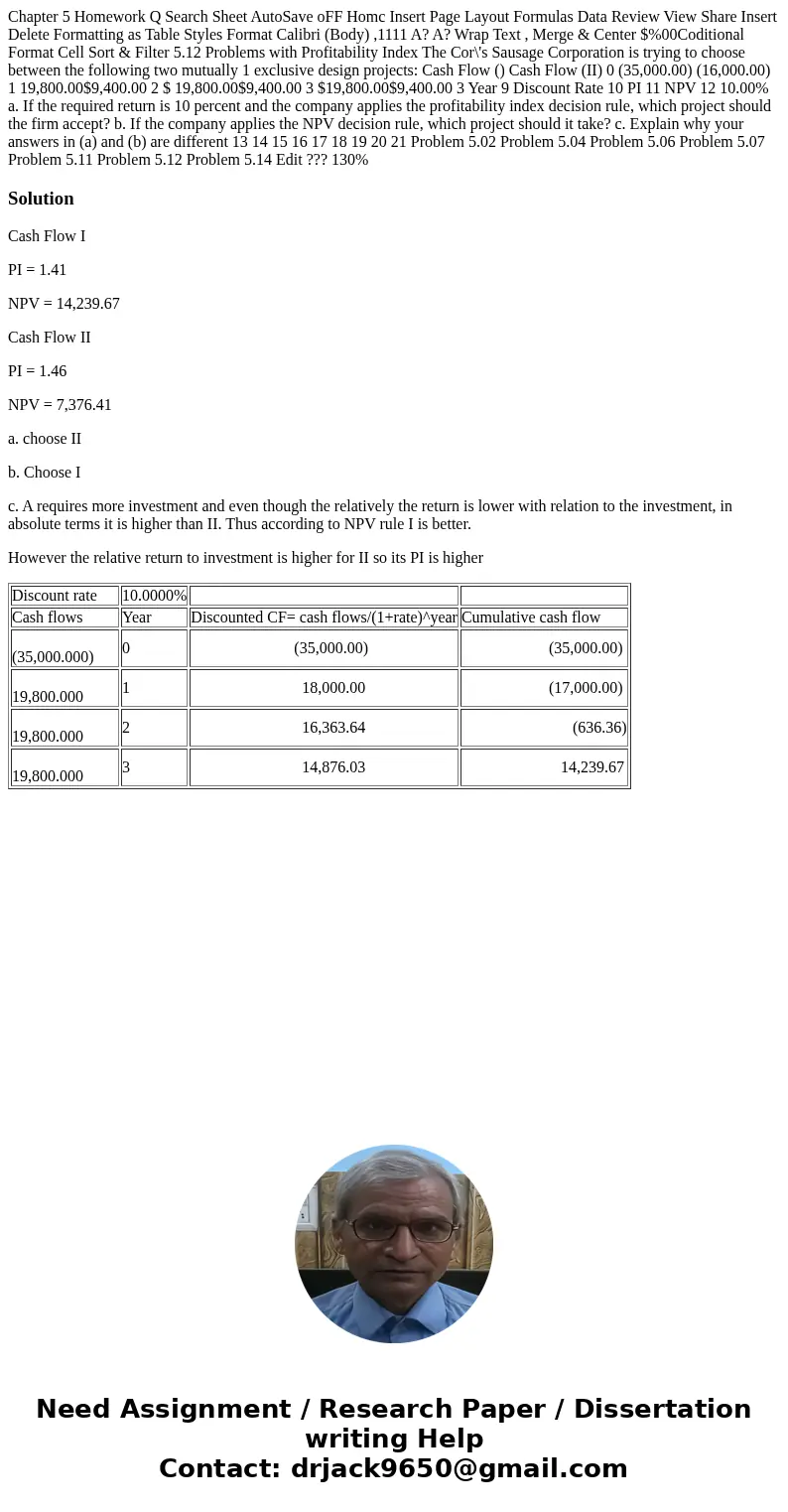

Chapter 5 Homework Q Search Sheet AutoSave oFF Homc Insert Page Layout Formulas Data Review View Share Insert Delete Formatting as Table Styles Format Calibri (Body) ,1111 A? A? Wrap Text , Merge & Center $%00Coditional Format Cell Sort & Filter 5.12 Problems with Profitability Index The Cor\'s Sausage Corporation is trying to choose between the following two mutually 1 exclusive design projects: Cash Flow () Cash Flow (II) 0 (35,000.00) (16,000.00) 1 19,800.00$9,400.00 2 $ 19,800.00$9,400.00 3 $19,800.00$9,400.00 3 Year 9 Discount Rate 10 PI 11 NPV 12 10.00% a. If the required return is 10 percent and the company applies the profitability index decision rule, which project should the firm accept? b. If the company applies the NPV decision rule, which project should it take? c. Explain why your answers in (a) and (b) are different 13 14 15 16 17 18 19 20 21 Problem 5.02 Problem 5.04 Problem 5.06 Problem 5.07 Problem 5.11 Problem 5.12 Problem 5.14 Edit ??? 130%

Solution

Cash Flow I

PI = 1.41

NPV = 14,239.67

Cash Flow II

PI = 1.46

NPV = 7,376.41

a. choose II

b. Choose I

c. A requires more investment and even though the relatively the return is lower with relation to the investment, in absolute terms it is higher than II. Thus according to NPV rule I is better.

However the relative return to investment is higher for II so its PI is higher

| Discount rate | 10.0000% | ||

| Cash flows | Year | Discounted CF= cash flows/(1+rate)^year | Cumulative cash flow |

| (35,000.000) | 0 | (35,000.00) | (35,000.00) |

| 19,800.000 | 1 | 18,000.00 | (17,000.00) |

| 19,800.000 | 2 | 16,363.64 | (636.36) |

| 19,800.000 | 3 | 14,876.03 | 14,239.67 |

Homework Sourse

Homework Sourse