Your client is facing a possible personal holding company ta

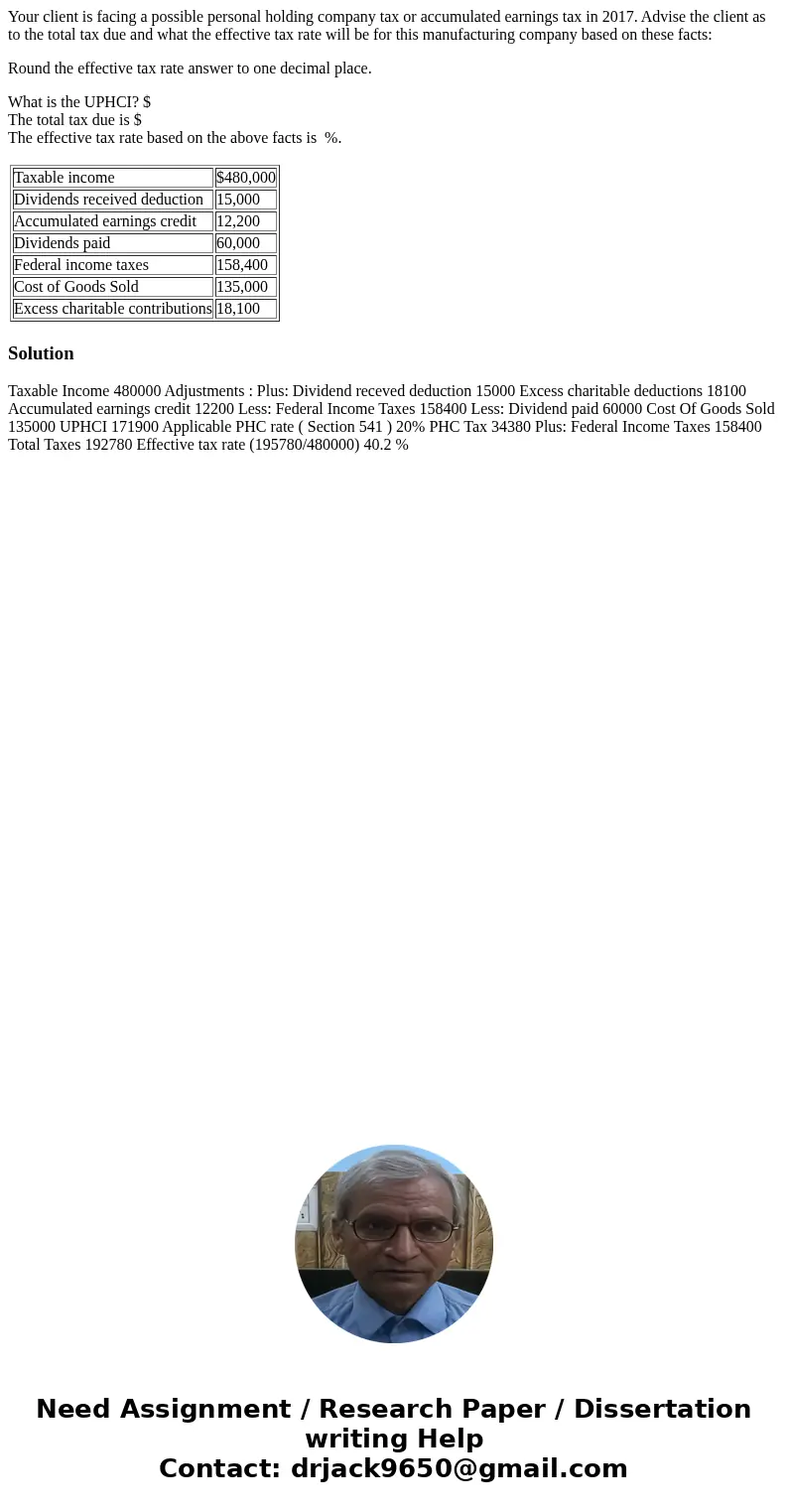

Your client is facing a possible personal holding company tax or accumulated earnings tax in 2017. Advise the client as to the total tax due and what the effective tax rate will be for this manufacturing company based on these facts:

Round the effective tax rate answer to one decimal place.

What is the UPHCI? $

The total tax due is $

The effective tax rate based on the above facts is %.

|

Solution

Taxable Income 480000 Adjustments : Plus: Dividend receved deduction 15000 Excess charitable deductions 18100 Accumulated earnings credit 12200 Less: Federal Income Taxes 158400 Less: Dividend paid 60000 Cost Of Goods Sold 135000 UPHCI 171900 Applicable PHC rate ( Section 541 ) 20% PHC Tax 34380 Plus: Federal Income Taxes 158400 Total Taxes 192780 Effective tax rate (195780/480000) 40.2 %

Homework Sourse

Homework Sourse