Suppose that the 6month 12month 18month and 24month zero rat

Suppose that the 6-month, 12-month, 18-month, and 24-month zero rates are 5%, 6%, 6.5%, and 7% respectively. What is the two-year par yield?

**Can you please explain step by step on how to do this question*** and please show formulas used so I can understand how to do it on my own. thank you.

Solution

Given:

m = No. of years = 2

d = e ^ -0.07*2

A = e ^(-0.05*.5) + e ^ (-0.06*1)+ e^(-0.065*1.5) + e ^ (-0.07* 2)

Formula to compute par yield:

2* (100-d*100) / A

=> (2* (100-100*e^(-0.07*2)) / (e ^(-0.05*0.5)+e ^(-0.06*1) + e ^ (-0.065 * 1.5) + e ^(-0.07*2))

Now, Calculating the value of A above, we have:

Total of A (1+2+3+4)= 3.693535

Value of d = 0.869358

(100-100*0.869358) / 3.693535

Two - year Par Yield:

=> (2*(100-86.9358)) / 3.693535

=> 13.06418*2 / 3.693535

=> 26.12835 /3.693535

Answer : The two-year par yield = 7.074077 or 7.074 %

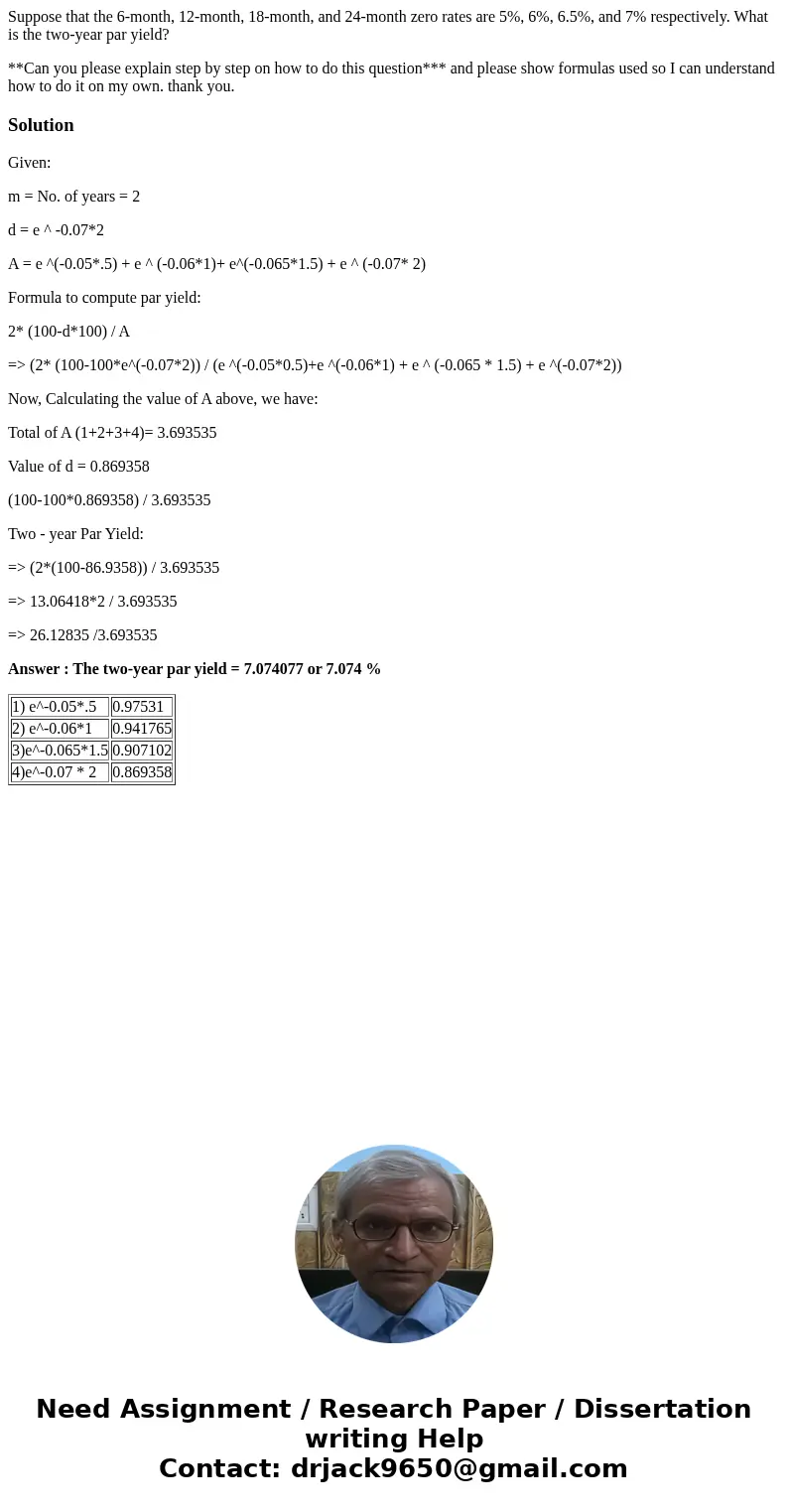

| 1) e^-0.05*.5 | 0.97531 |

| 2) e^-0.06*1 | 0.941765 |

| 3)e^-0.065*1.5 | 0.907102 |

| 4)e^-0.07 * 2 | 0.869358 |

Homework Sourse

Homework Sourse