The following is the ending balances of accounts at December

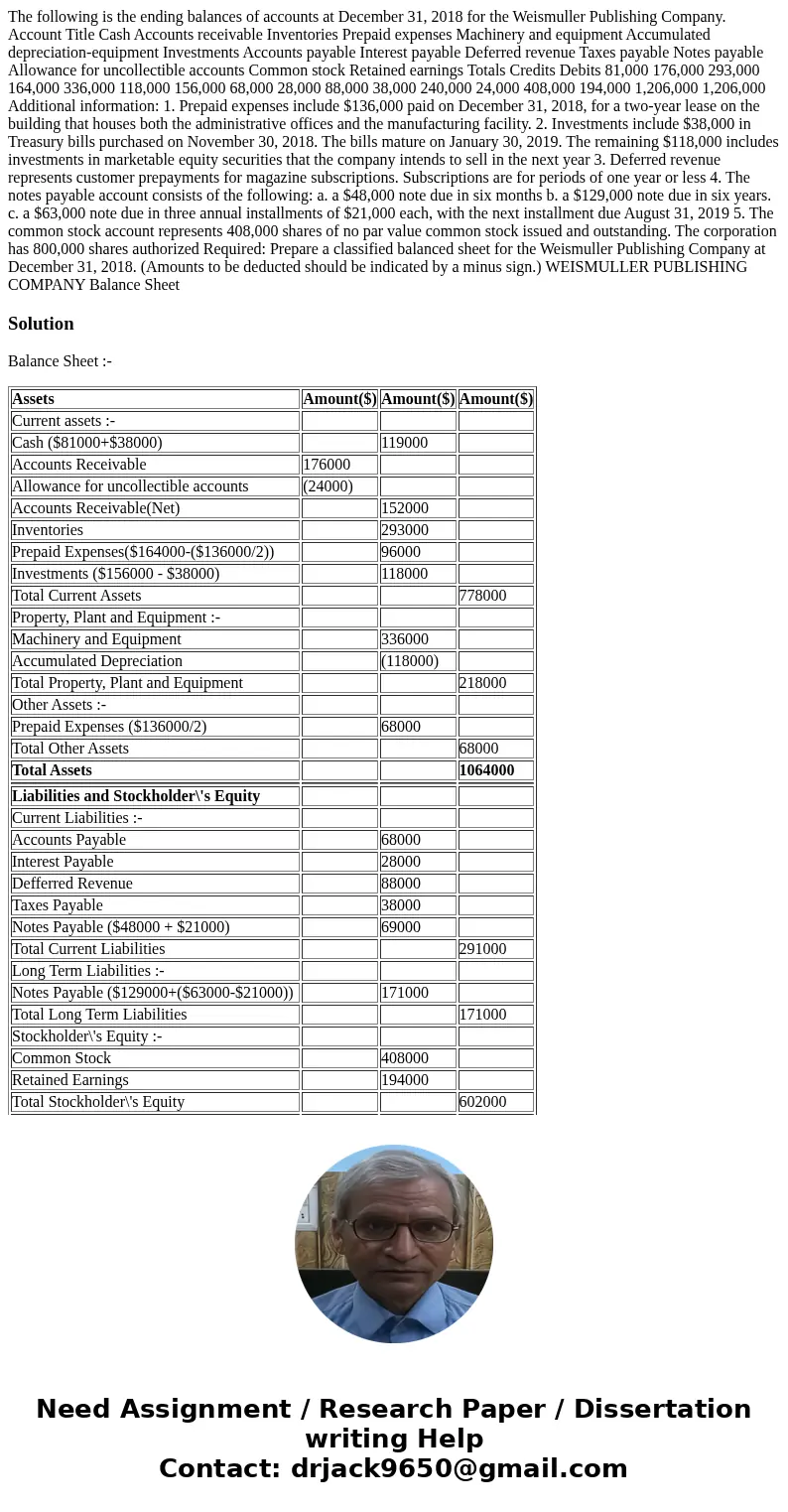

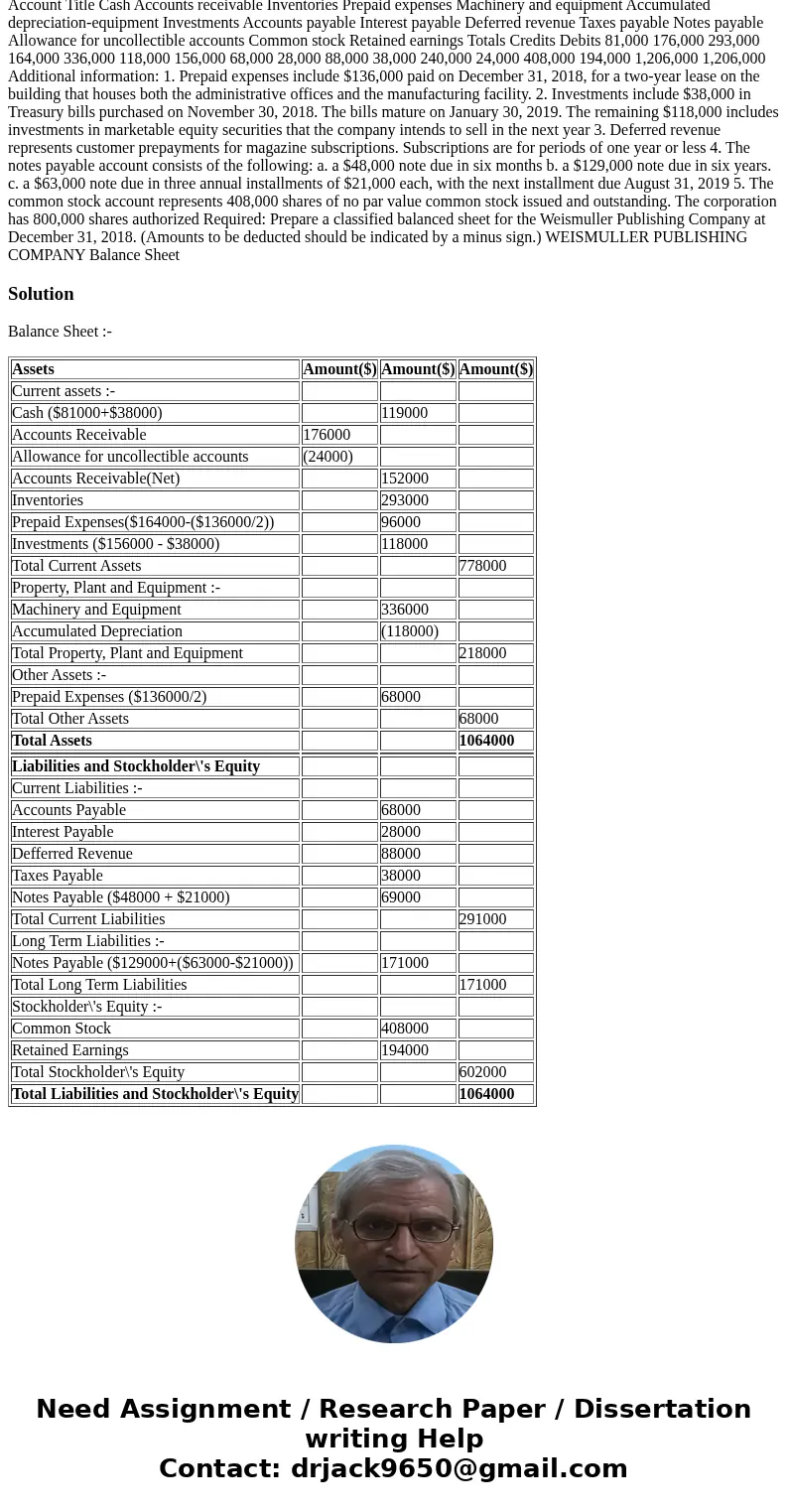

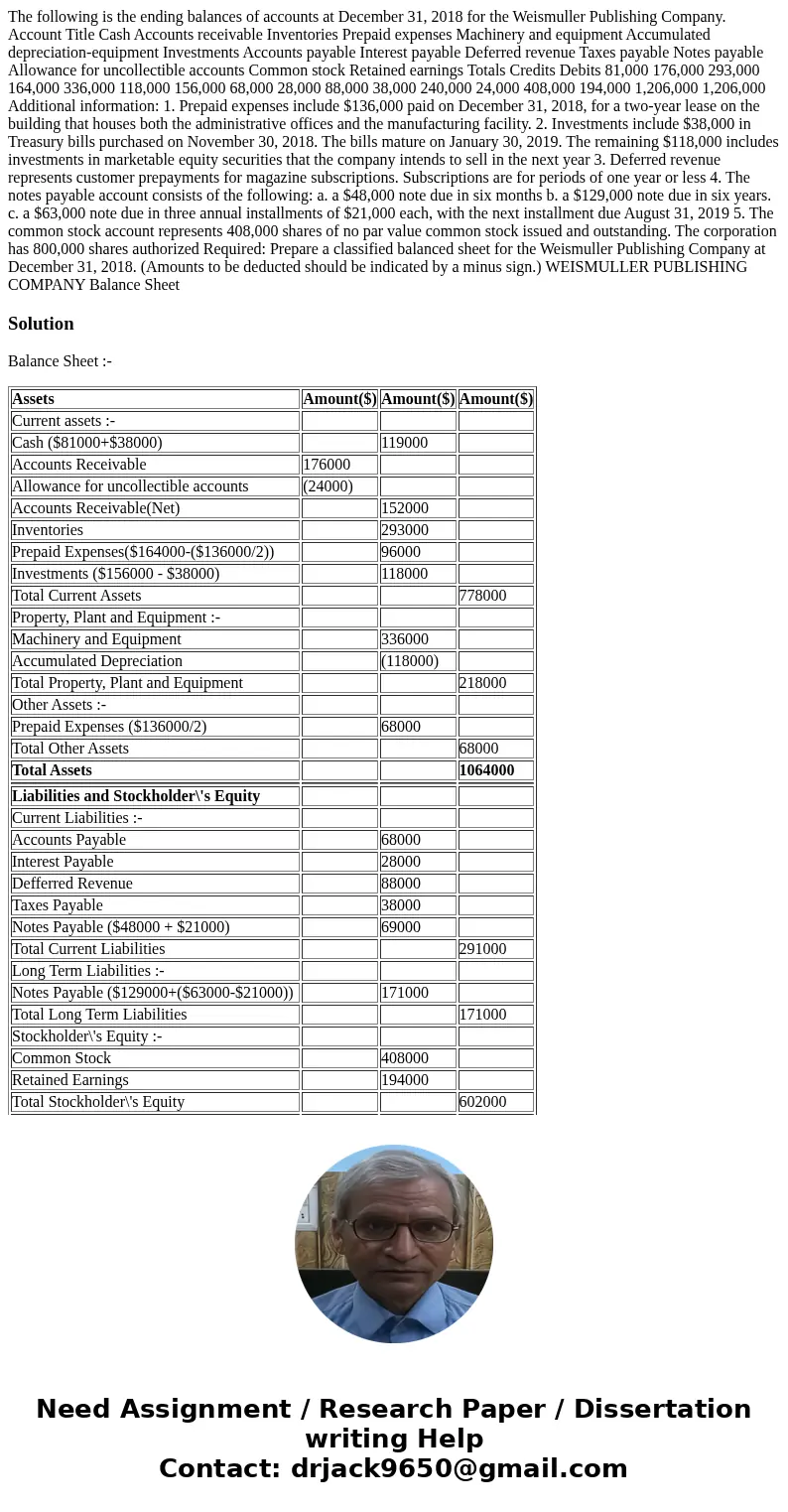

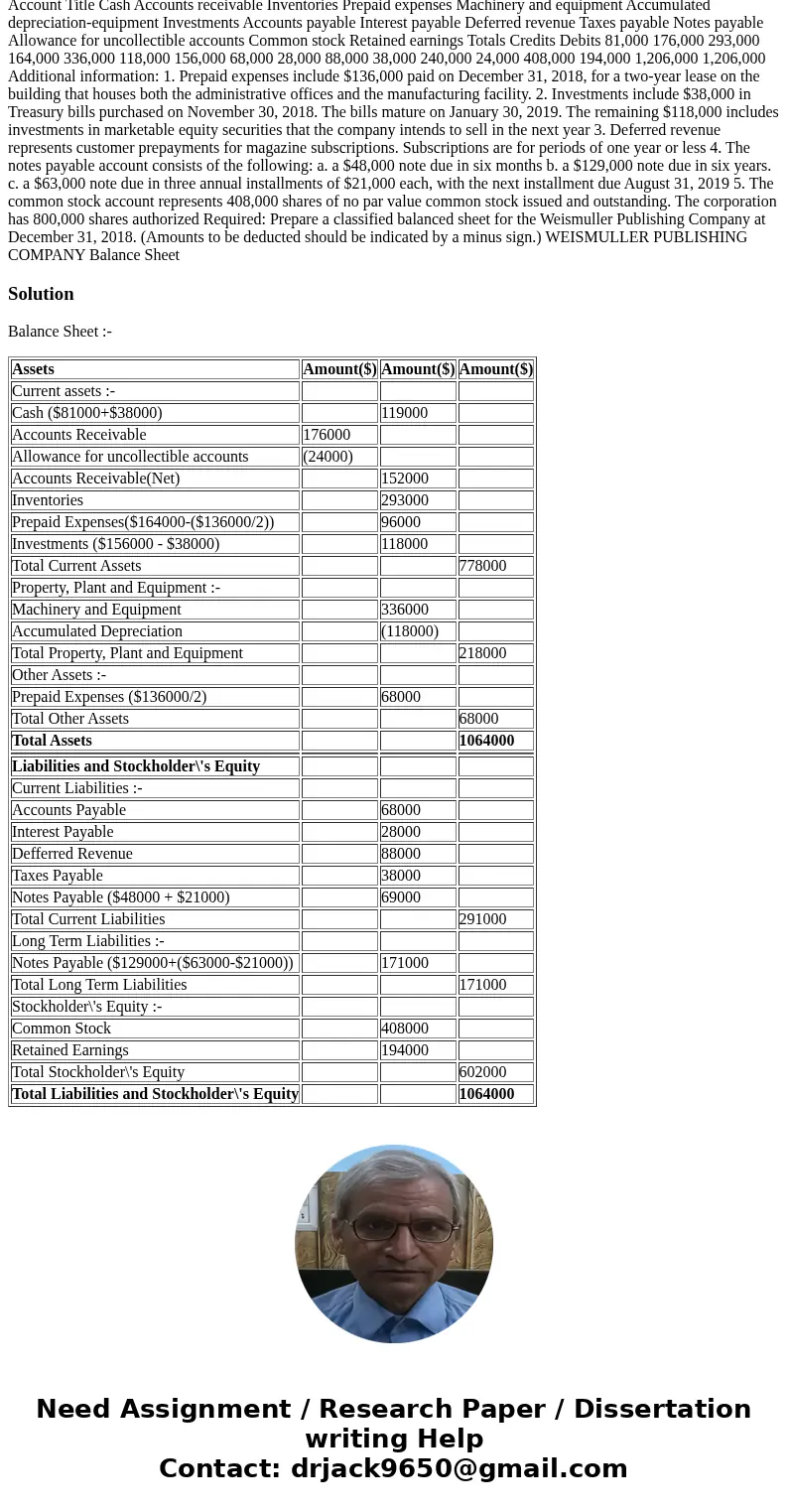

The following is the ending balances of accounts at December 31, 2018 for the Weismuller Publishing Company. Account Title Cash Accounts receivable Inventories Prepaid expenses Machinery and equipment Accumulated depreciation-equipment Investments Accounts payable Interest payable Deferred revenue Taxes payable Notes payable Allowance for uncollectible accounts Common stock Retained earnings Totals Credits Debits 81,000 176,000 293,000 164,000 336,000 118,000 156,000 68,000 28,000 88,000 38,000 240,000 24,000 408,000 194,000 1,206,000 1,206,000 Additional information: 1. Prepaid expenses include $136,000 paid on December 31, 2018, for a two-year lease on the building that houses both the administrative offices and the manufacturing facility. 2. Investments include $38,000 in Treasury bills purchased on November 30, 2018. The bills mature on January 30, 2019. The remaining $118,000 includes investments in marketable equity securities that the company intends to sell in the next year 3. Deferred revenue represents customer prepayments for magazine subscriptions. Subscriptions are for periods of one year or less 4. The notes payable account consists of the following: a. a $48,000 note due in six months b. a $129,000 note due in six years. c. a $63,000 note due in three annual installments of $21,000 each, with the next installment due August 31, 2019 5. The common stock account represents 408,000 shares of no par value common stock issued and outstanding. The corporation has 800,000 shares authorized Required: Prepare a classified balanced sheet for the Weismuller Publishing Company at December 31, 2018. (Amounts to be deducted should be indicated by a minus sign.) WEISMULLER PUBLISHING COMPANY Balance Sheet

Solution

Balance Sheet :-

| Assets | Amount($) | Amount($) | Amount($) |

| Current assets :- | |||

| Cash ($81000+$38000) | 119000 | ||

| Accounts Receivable | 176000 | ||

| Allowance for uncollectible accounts | (24000) | ||

| Accounts Receivable(Net) | 152000 | ||

| Inventories | 293000 | ||

| Prepaid Expenses($164000-($136000/2)) | 96000 | ||

| Investments ($156000 - $38000) | 118000 | ||

| Total Current Assets | 778000 | ||

| Property, Plant and Equipment :- | |||

| Machinery and Equipment | 336000 | ||

| Accumulated Depreciation | (118000) | ||

| Total Property, Plant and Equipment | 218000 | ||

| Other Assets :- | |||

| Prepaid Expenses ($136000/2) | 68000 | ||

| Total Other Assets | 68000 | ||

| Total Assets | 1064000 | ||

| Liabilities and Stockholder\'s Equity | |||

| Current Liabilities :- | |||

| Accounts Payable | 68000 | ||

| Interest Payable | 28000 | ||

| Defferred Revenue | 88000 | ||

| Taxes Payable | 38000 | ||

| Notes Payable ($48000 + $21000) | 69000 | ||

| Total Current Liabilities | 291000 | ||

| Long Term Liabilities :- | |||

| Notes Payable ($129000+($63000-$21000)) | 171000 | ||

| Total Long Term Liabilities | 171000 | ||

| Stockholder\'s Equity :- | |||

| Common Stock | 408000 | ||

| Retained Earnings | 194000 | ||

| Total Stockholder\'s Equity | 602000 | ||

| Total Liabilities and Stockholder\'s Equity | 1064000 |

Homework Sourse

Homework Sourse