Total 20 Questions 19 Multiple choice and 1 calculation Mult

Solution

1.

Correct option is > B. Yield to Maturity

Yield to maturity is the current or market interest rate on bond that is held till maturity

2.

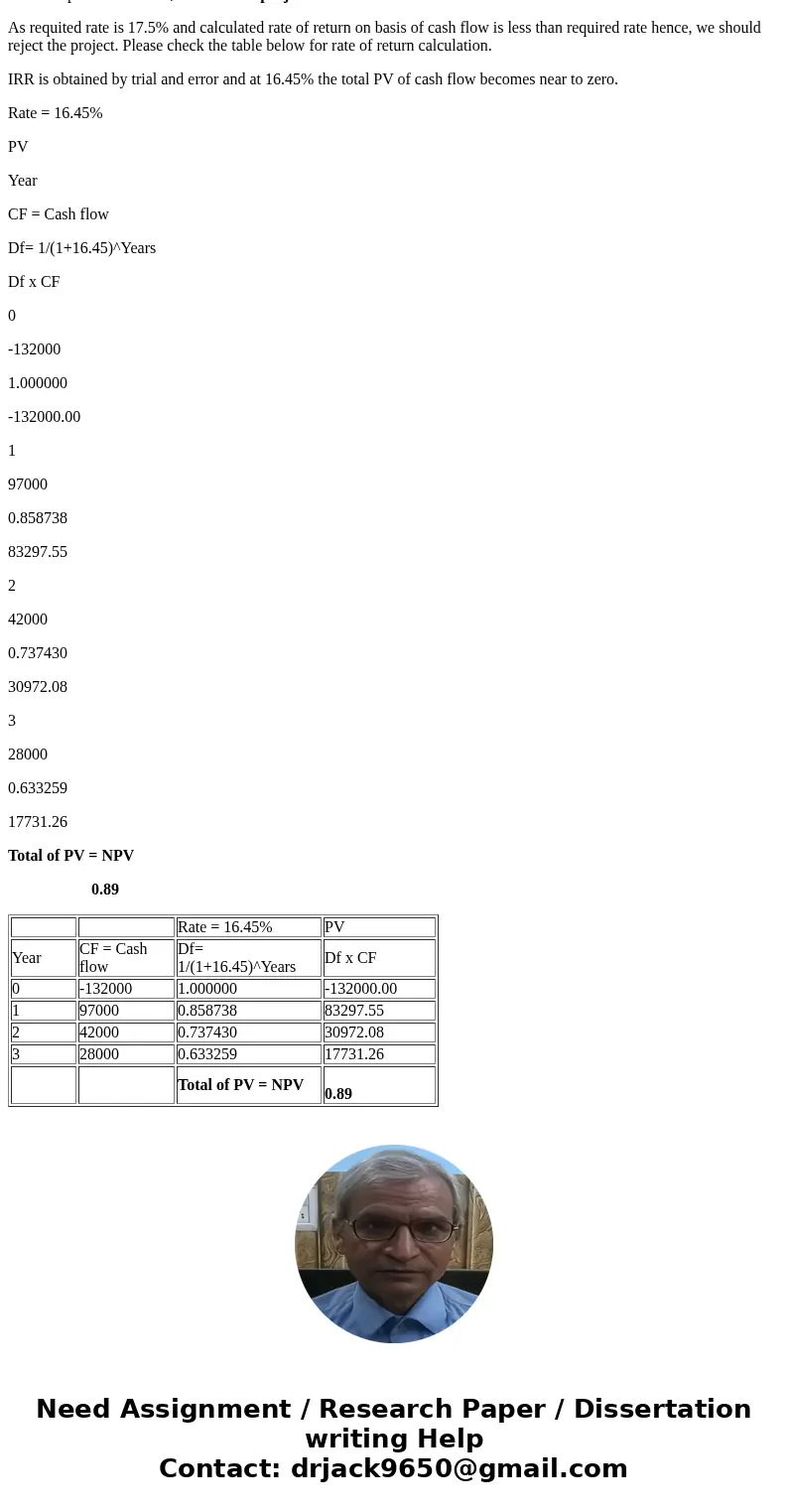

Correct option is > C. No, because the project’s rate of return is 16.45%

As requited rate is 17.5% and calculated rate of return on basis of cash flow is less than required rate hence, we should reject the project. Please check the table below for rate of return calculation.

IRR is obtained by trial and error and at 16.45% the total PV of cash flow becomes near to zero.

Rate = 16.45%

PV

Year

CF = Cash flow

Df= 1/(1+16.45)^Years

Df x CF

0

-132000

1.000000

-132000.00

1

97000

0.858738

83297.55

2

42000

0.737430

30972.08

3

28000

0.633259

17731.26

Total of PV = NPV

0.89

| Rate = 16.45% | PV | ||

| Year | CF = Cash flow | Df= 1/(1+16.45)^Years | Df x CF |

| 0 | -132000 | 1.000000 | -132000.00 |

| 1 | 97000 | 0.858738 | 83297.55 |

| 2 | 42000 | 0.737430 | 30972.08 |

| 3 | 28000 | 0.633259 | 17731.26 |

| Total of PV = NPV | 0.89 |

Homework Sourse

Homework Sourse