Tangshang Industries production budget from the 2nd quarter

Tangshang Industries production budget from the 2nd quarter of 2018, projected the following amounts of units to be produced:

April 1,000 units

May 1,200 units

June 1,250 units

Each unit requires 2 parts of component A and 3 parts of component B. Component A cost is $1.25 per unit and component B cost is $.80 per unit.

Each unit requires the following labor:

2 hours in the processing department

1 hour in the assembly department

Processing department labor rate is $4/hour

Assembly department labor rate is $6/hour

Variable Factory overhead is $.60 per unit

Fixed Factory overhead is $1,000 monthly

Using the information from the production budget of Tangshang Industries

1.Calculate total variable overhead cost for May 2018

2.Calculate total variable overhead cost for the quarter April - June 2018

3.Calculate total overhead cost for the quarter April - June 2018

4.Calculate total product cost for the quarter April - June 2018

Solution

1-

total variable overhead cost in may

no of units produced*variable overhead rate

1200*.6

720

2-

total variable overhead from Apl to June

Month

Units

variable cost per units

total variable overhead for the month

April

1000

0.6

600

May

1200

0.6

720

June

1250

0.6

750

total variable overhead from Apl to June

2070

3-

total overhead cost = total variable overhead+(fixed overhead per month*no of months)

(2070)+(1000*3)

5070

4-

total product cost April- june

April

May

June

Direct material = unit of component A*price of component per unit* total units produced + unit of component B*price of component per unit* total units produced

(1000*2*1.25)+(1000*3*.8)

4900

(1200*2*1.25)+(1200*3*.8)

5880

(1250*2*1.25)+(1250*3*0.8)

6125

Direct labor =(labor hour in processing*labor cost per hours* total units produced) +( labor hour in assembly*labor cost per hour* total units produced)

(1000*2*4)+(1000*1*6)

14000

(1200*2*4)+(1200*1*6)

16800

(1250*2*4)+(1250*1*6)

17500

variable overheads

1000*.6

600

1200*.6

720

1250*.6

750

fixed overheads

1000

1000

1000

total product cost

20500

24400

25375

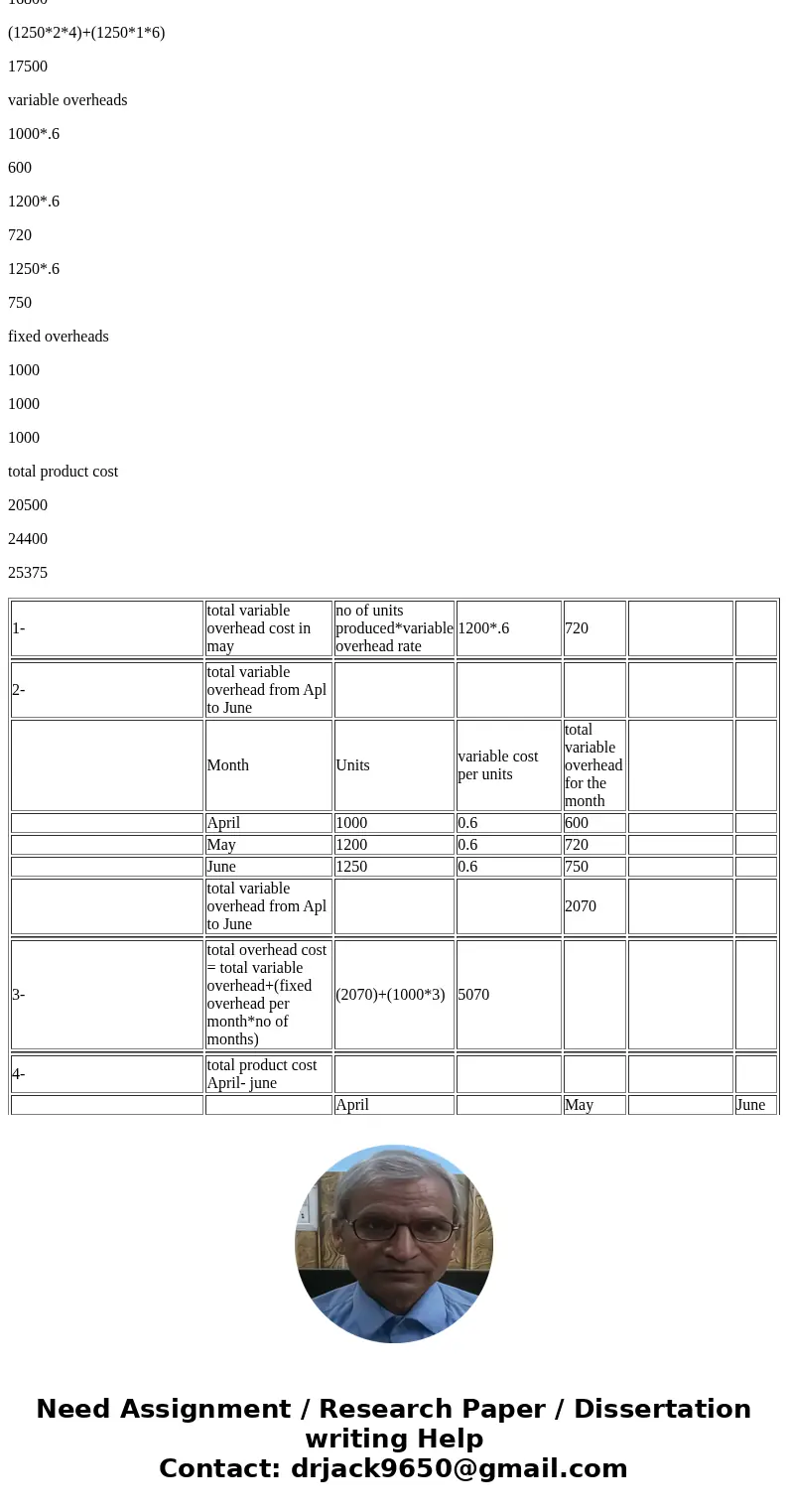

| 1- | total variable overhead cost in may | no of units produced*variable overhead rate | 1200*.6 | 720 | ||

| 2- | total variable overhead from Apl to June | |||||

| Month | Units | variable cost per units | total variable overhead for the month | |||

| April | 1000 | 0.6 | 600 | |||

| May | 1200 | 0.6 | 720 | |||

| June | 1250 | 0.6 | 750 | |||

| total variable overhead from Apl to June | 2070 | |||||

| 3- | total overhead cost = total variable overhead+(fixed overhead per month*no of months) | (2070)+(1000*3) | 5070 | |||

| 4- | total product cost April- june | |||||

| April | May | June | ||||

| Direct material = unit of component A*price of component per unit* total units produced + unit of component B*price of component per unit* total units produced | (1000*2*1.25)+(1000*3*.8) | 4900 | (1200*2*1.25)+(1200*3*.8) | 5880 | (1250*2*1.25)+(1250*3*0.8) | 6125 |

| Direct labor =(labor hour in processing*labor cost per hours* total units produced) +( labor hour in assembly*labor cost per hour* total units produced) | (1000*2*4)+(1000*1*6) | 14000 | (1200*2*4)+(1200*1*6) | 16800 | (1250*2*4)+(1250*1*6) | 17500 |

| variable overheads | 1000*.6 | 600 | 1200*.6 | 720 | 1250*.6 | 750 |

| fixed overheads | 1000 | 1000 | 1000 | |||

| total product cost | 20500 | 24400 | 25375 |

Homework Sourse

Homework Sourse