ABC Company purchased 96171 of equipment 4 years ago The equ

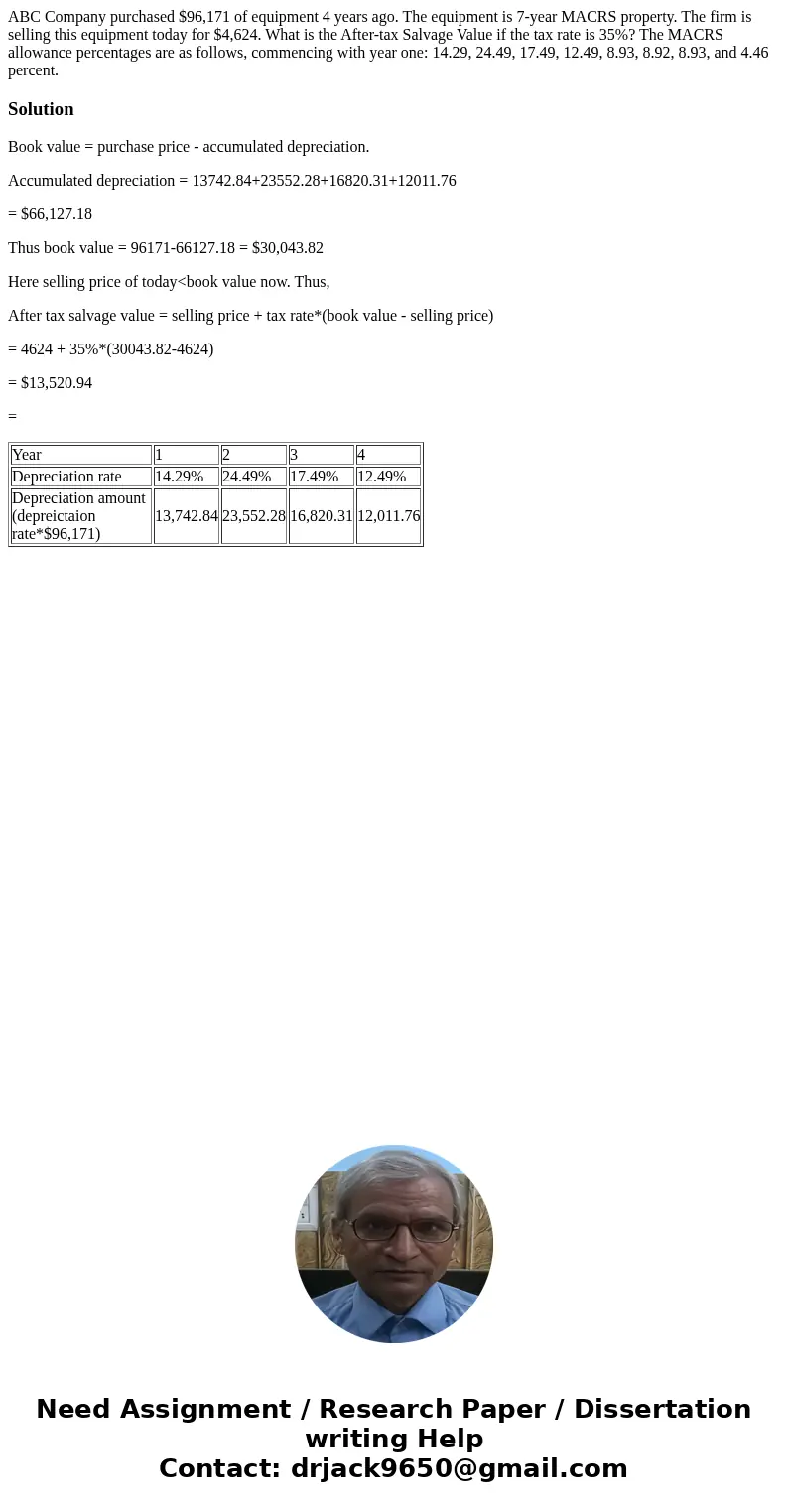

ABC Company purchased $96,171 of equipment 4 years ago. The equipment is 7-year MACRS property. The firm is selling this equipment today for $4,624. What is the After-tax Salvage Value if the tax rate is 35%? The MACRS allowance percentages are as follows, commencing with year one: 14.29, 24.49, 17.49, 12.49, 8.93, 8.92, 8.93, and 4.46 percent.

Solution

Book value = purchase price - accumulated depreciation.

Accumulated depreciation = 13742.84+23552.28+16820.31+12011.76

= $66,127.18

Thus book value = 96171-66127.18 = $30,043.82

Here selling price of today<book value now. Thus,

After tax salvage value = selling price + tax rate*(book value - selling price)

= 4624 + 35%*(30043.82-4624)

= $13,520.94

=

| Year | 1 | 2 | 3 | 4 |

| Depreciation rate | 14.29% | 24.49% | 17.49% | 12.49% |

| Depreciation amount (depreictaion rate*$96,171) | 13,742.84 | 23,552.28 | 16,820.31 | 12,011.76 |

Homework Sourse

Homework Sourse