w CengageNowa l OnlirC Exercise 1318 Cash Dix DriveGoogle

Solution

Answer

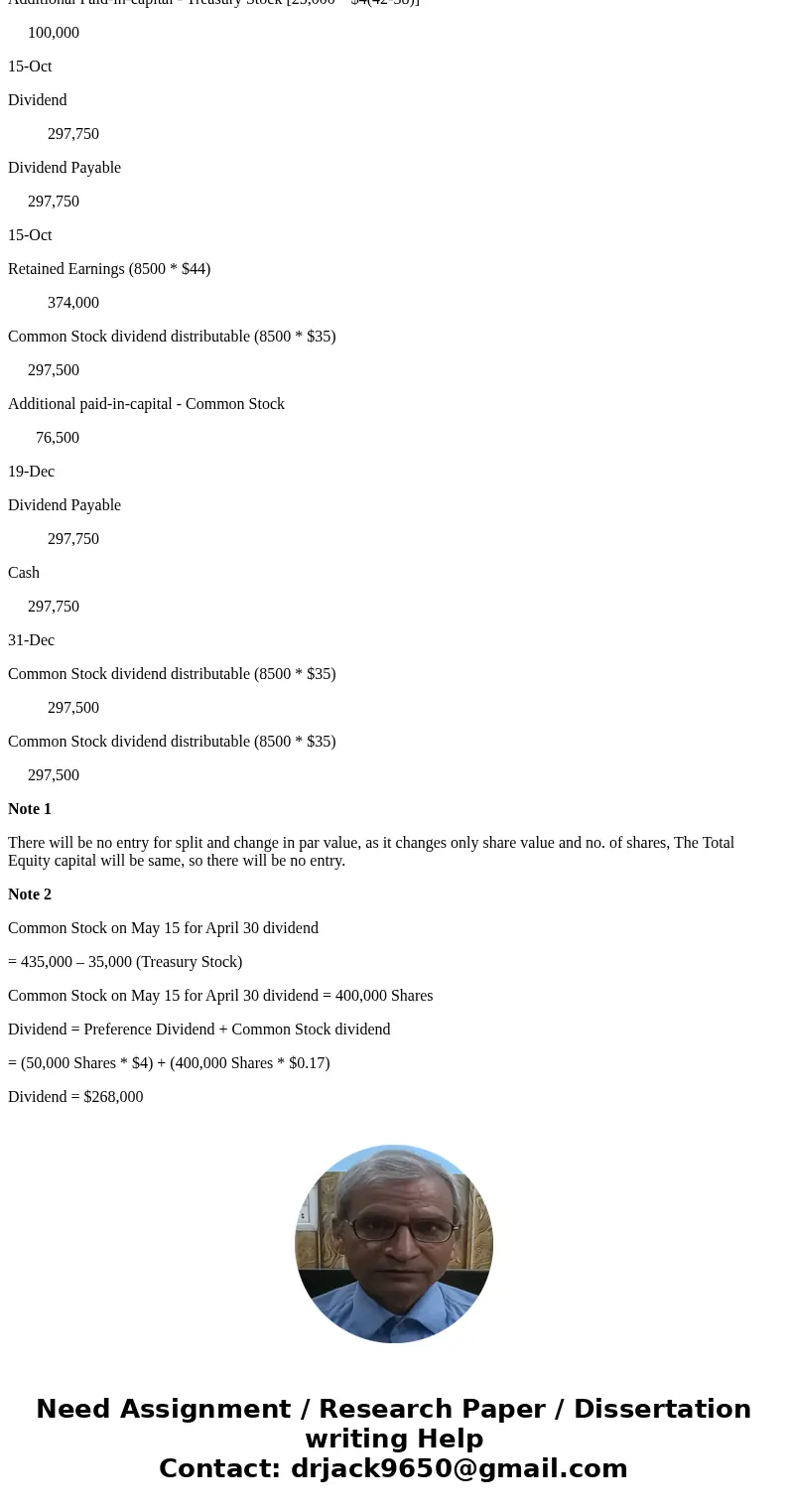

Date

Dr. $

Cr. $

5-Jan

No Entry

10-Mar

Treasury Stock (35,000 Shares * $38)

1,330,000

Cash

1,330,000

30-Apr

Dividend

268,000

Dividend Payable

268,000

15-Jun

Dividend Payable

268,000

Cash

268,000

20-Aug

Cash (25,000 * $42)

1,050,000

Treasury Stock (25,000 * $38)

950,000

Additional Paid-in-capital - Treasury Stock [25,000 * $4(42-38)]

100,000

15-Oct

Dividend

297,750

Dividend Payable

297,750

15-Oct

Retained Earnings (8500 * $44)

374,000

Common Stock dividend distributable (8500 * $35)

297,500

Additional paid-in-capital - Common Stock

76,500

19-Dec

Dividend Payable

297,750

Cash

297,750

31-Dec

Common Stock dividend distributable (8500 * $35)

297,500

Common Stock dividend distributable (8500 * $35)

297,500

Note 1

There will be no entry for split and change in par value, as it changes only share value and no. of shares, The Total Equity capital will be same, so there will be no entry.

Note 2

Common Stock on May 15 for April 30 dividend

= 435,000 – 35,000 (Treasury Stock)

Common Stock on May 15 for April 30 dividend = 400,000 Shares

Dividend = Preference Dividend + Common Stock dividend

= (50,000 Shares * $4) + (400,000 Shares * $0.17)

Dividend = $268,000

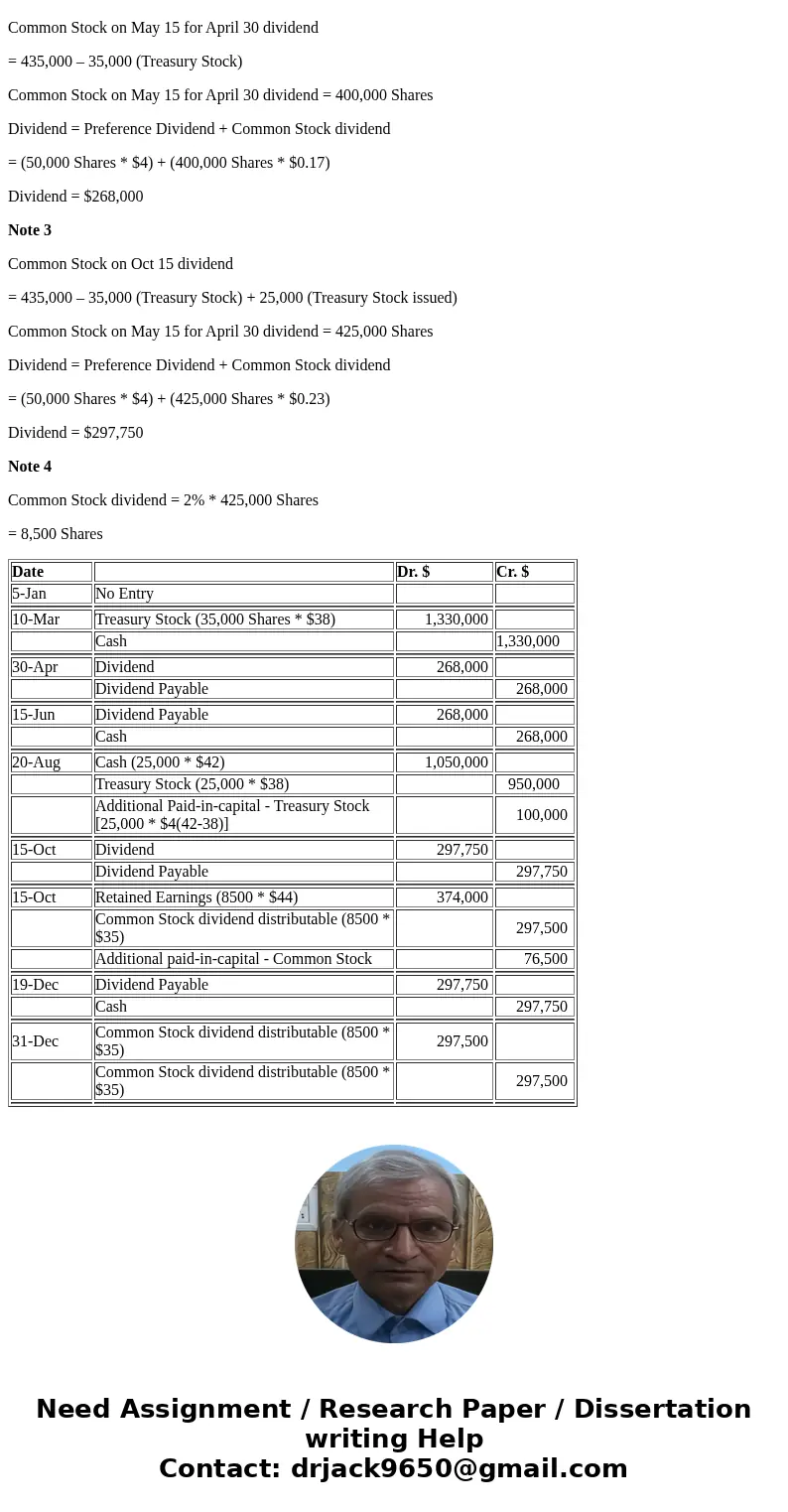

Note 3

Common Stock on Oct 15 dividend

= 435,000 – 35,000 (Treasury Stock) + 25,000 (Treasury Stock issued)

Common Stock on May 15 for April 30 dividend = 425,000 Shares

Dividend = Preference Dividend + Common Stock dividend

= (50,000 Shares * $4) + (425,000 Shares * $0.23)

Dividend = $297,750

Note 4

Common Stock dividend = 2% * 425,000 Shares

= 8,500 Shares

| Date | Dr. $ | Cr. $ | |

| 5-Jan | No Entry | ||

| 10-Mar | Treasury Stock (35,000 Shares * $38) | 1,330,000 | |

| Cash | 1,330,000 | ||

| 30-Apr | Dividend | 268,000 | |

| Dividend Payable | 268,000 | ||

| 15-Jun | Dividend Payable | 268,000 | |

| Cash | 268,000 | ||

| 20-Aug | Cash (25,000 * $42) | 1,050,000 | |

| Treasury Stock (25,000 * $38) | 950,000 | ||

| Additional Paid-in-capital - Treasury Stock [25,000 * $4(42-38)] | 100,000 | ||

| 15-Oct | Dividend | 297,750 | |

| Dividend Payable | 297,750 | ||

| 15-Oct | Retained Earnings (8500 * $44) | 374,000 | |

| Common Stock dividend distributable (8500 * $35) | 297,500 | ||

| Additional paid-in-capital - Common Stock | 76,500 | ||

| 19-Dec | Dividend Payable | 297,750 | |

| Cash | 297,750 | ||

| 31-Dec | Common Stock dividend distributable (8500 * $35) | 297,500 | |

| Common Stock dividend distributable (8500 * $35) | 297,500 | ||

Homework Sourse

Homework Sourse