5 Exercises 6 Saved You received no credit for this question

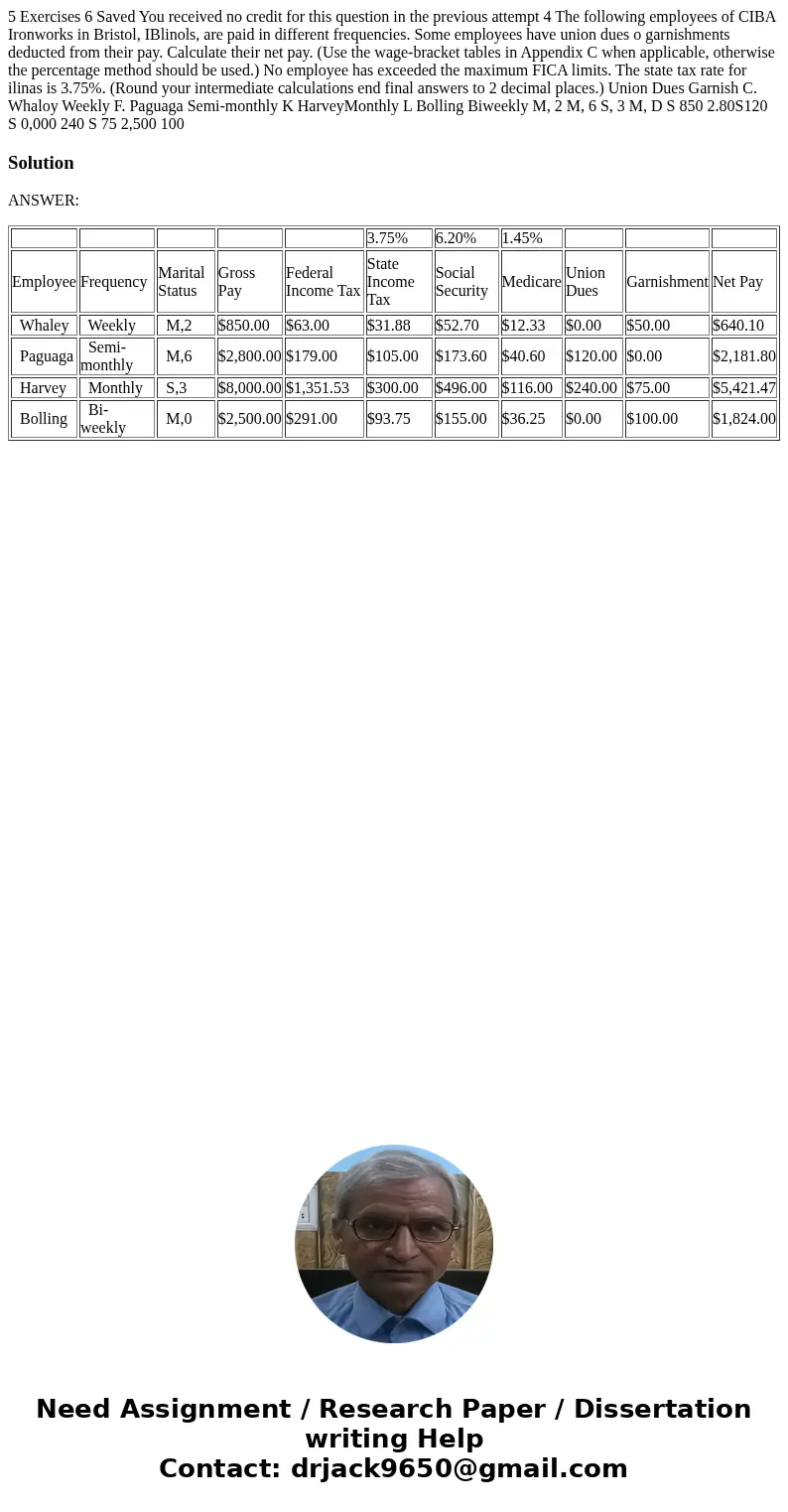

5 Exercises 6 Saved You received no credit for this question in the previous attempt 4 The following employees of CIBA Ironworks in Bristol, IBlinols, are paid in different frequencies. Some employees have union dues o garnishments deducted from their pay. Calculate their net pay. (Use the wage-bracket tables in Appendix C when applicable, otherwise the percentage method should be used.) No employee has exceeded the maximum FICA limits. The state tax rate for ilinas is 3.75%. (Round your intermediate calculations end final answers to 2 decimal places.) Union Dues Garnish C. Whaloy Weekly F. Paguaga Semi-monthly K HarveyMonthly L Bolling Biweekly M, 2 M, 6 S, 3 M, D S 850 2.80S120 S 0,000 240 S 75 2,500 100

Solution

ANSWER:

| 3.75% | 6.20% | 1.45% | ||||||||

| Employee | Frequency | Marital Status | Gross Pay | Federal Income Tax | State Income Tax | Social Security | Medicare | Union Dues | Garnishment | Net Pay |

| Whaley | Weekly | M,2 | $850.00 | $63.00 | $31.88 | $52.70 | $12.33 | $0.00 | $50.00 | $640.10 |

| Paguaga | Semi-monthly | M,6 | $2,800.00 | $179.00 | $105.00 | $173.60 | $40.60 | $120.00 | $0.00 | $2,181.80 |

| Harvey | Monthly | S,3 | $8,000.00 | $1,351.53 | $300.00 | $496.00 | $116.00 | $240.00 | $75.00 | $5,421.47 |

| Bolling | Bi-weekly | M,0 | $2,500.00 | $291.00 | $93.75 | $155.00 | $36.25 | $0.00 | $100.00 | $1,824.00 |

Homework Sourse

Homework Sourse