eBook Show Me How Calculator Selected Chart of Accounts The

Solution

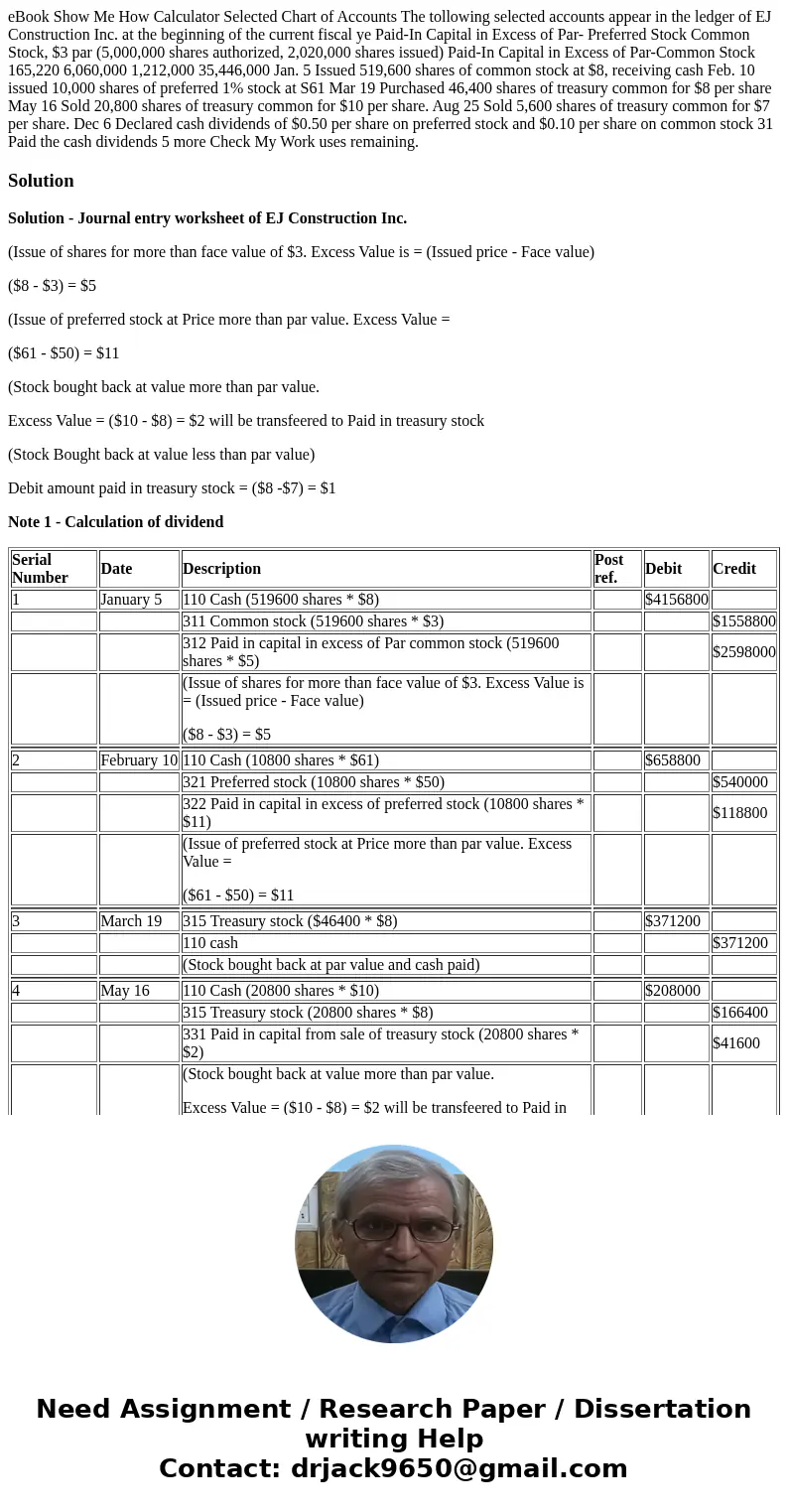

Solution - Journal entry worksheet of EJ Construction Inc.

(Issue of shares for more than face value of $3. Excess Value is = (Issued price - Face value)

($8 - $3) = $5

(Issue of preferred stock at Price more than par value. Excess Value =

($61 - $50) = $11

(Stock bought back at value more than par value.

Excess Value = ($10 - $8) = $2 will be transfeered to Paid in treasury stock

(Stock Bought back at value less than par value)

Debit amount paid in treasury stock = ($8 -$7) = $1

Note 1 - Calculation of dividend

| Serial Number | Date | Description | Post ref. | Debit | Credit |

| 1 | January 5 | 110 Cash (519600 shares * $8) | $4156800 | ||

| 311 Common stock (519600 shares * $3) | $1558800 | ||||

| 312 Paid in capital in excess of Par common stock (519600 shares * $5) | $2598000 | ||||

| (Issue of shares for more than face value of $3. Excess Value is = (Issued price - Face value) ($8 - $3) = $5 | |||||

| 2 | February 10 | 110 Cash (10800 shares * $61) | $658800 | ||

| 321 Preferred stock (10800 shares * $50) | $540000 | ||||

| 322 Paid in capital in excess of preferred stock (10800 shares * $11) | $118800 | ||||

| (Issue of preferred stock at Price more than par value. Excess Value = ($61 - $50) = $11 | |||||

| 3 | March 19 | 315 Treasury stock ($46400 * $8) | $371200 | ||

| 110 cash | $371200 | ||||

| (Stock bought back at par value and cash paid) | |||||

| 4 | May 16 | 110 Cash (20800 shares * $10) | $208000 | ||

| 315 Treasury stock (20800 shares * $8) | $166400 | ||||

| 331 Paid in capital from sale of treasury stock (20800 shares * $2) | $41600 | ||||

| (Stock bought back at value more than par value. Excess Value = ($10 - $8) = $2 will be transfeered to Paid in treasury stock | |||||

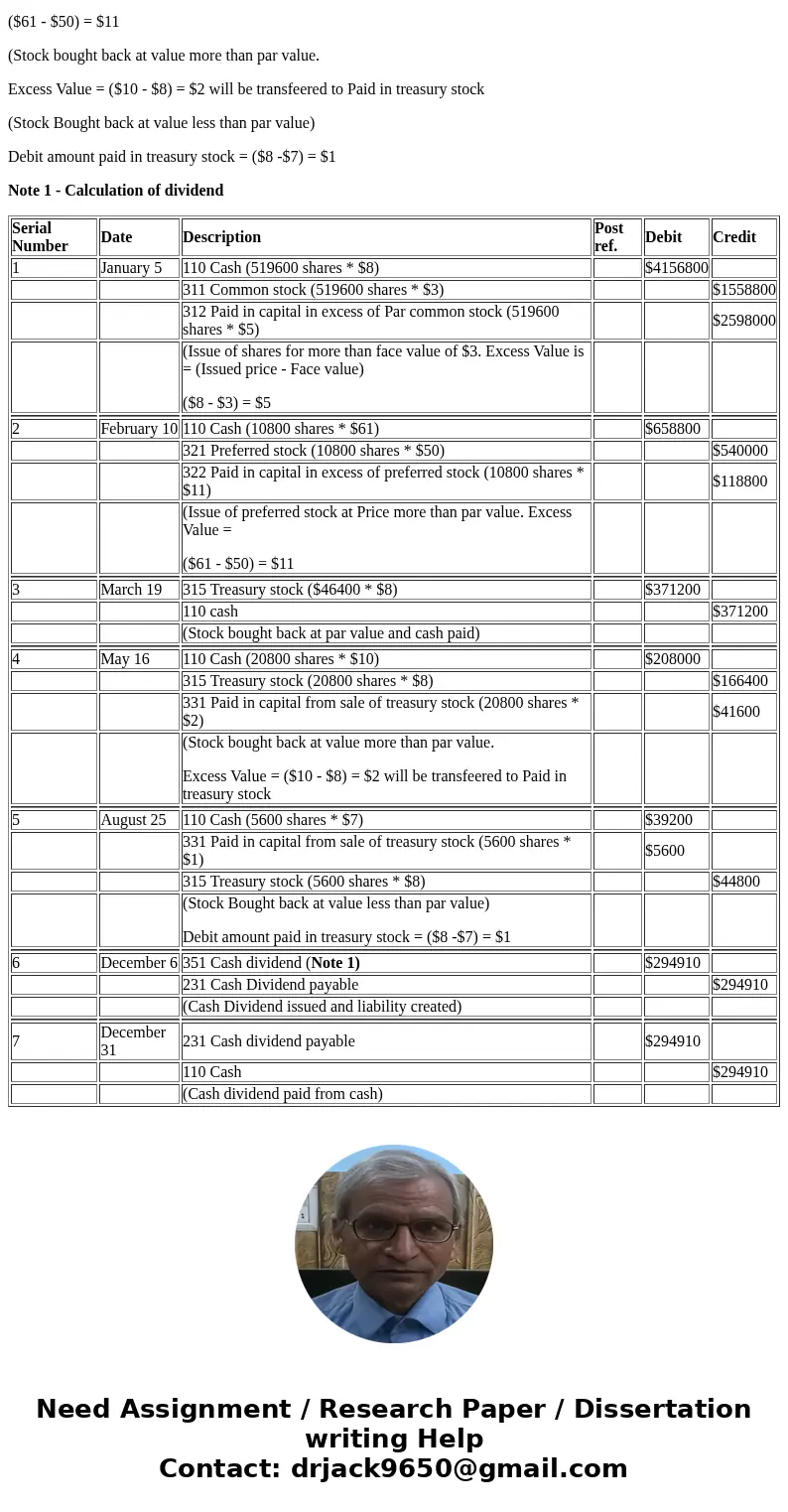

| 5 | August 25 | 110 Cash (5600 shares * $7) | $39200 | ||

| 331 Paid in capital from sale of treasury stock (5600 shares * $1) | $5600 | ||||

| 315 Treasury stock (5600 shares * $8) | $44800 | ||||

| (Stock Bought back at value less than par value) Debit amount paid in treasury stock = ($8 -$7) = $1 | |||||

| 6 | December 6 | 351 Cash dividend (Note 1) | $294910 | ||

| 231 Cash Dividend payable | $294910 | ||||

| (Cash Dividend issued and liability created) | |||||

| 7 | December 31 | 231 Cash dividend payable | $294910 | ||

| 110 Cash | $294910 | ||||

| (Cash dividend paid from cash) |

Homework Sourse

Homework Sourse