Given the following tax schedule what is the tax liability f

Given the following tax schedule, what is the tax liability for a corporation with taxable income of $8 million

Corporate Tax Rates. Taxable Income

15%. $0-50,000

25%. $50,001-75,000

34%. $75,001-10,000,000

35%. Over $10,000,000

A $2,715,000

B $2,720,000

C $2,694,500

D $2,708,250

Given the following tax schedule, what is the tax liability for a corporation with taxable income of $8 million

Corporate Tax Rates. Taxable Income

15%. $0-50,000

25%. $50,001-75,000

34%. $75,001-10,000,000

35%. Over $10,000,000

A $2,715,000

B $2,720,000

C $2,694,500

D $2,708,250

Corporate Tax Rates. Taxable Income

15%. $0-50,000

25%. $50,001-75,000

34%. $75,001-10,000,000

35%. Over $10,000,000

A $2,715,000

B $2,720,000

C $2,694,500

D $2,708,250

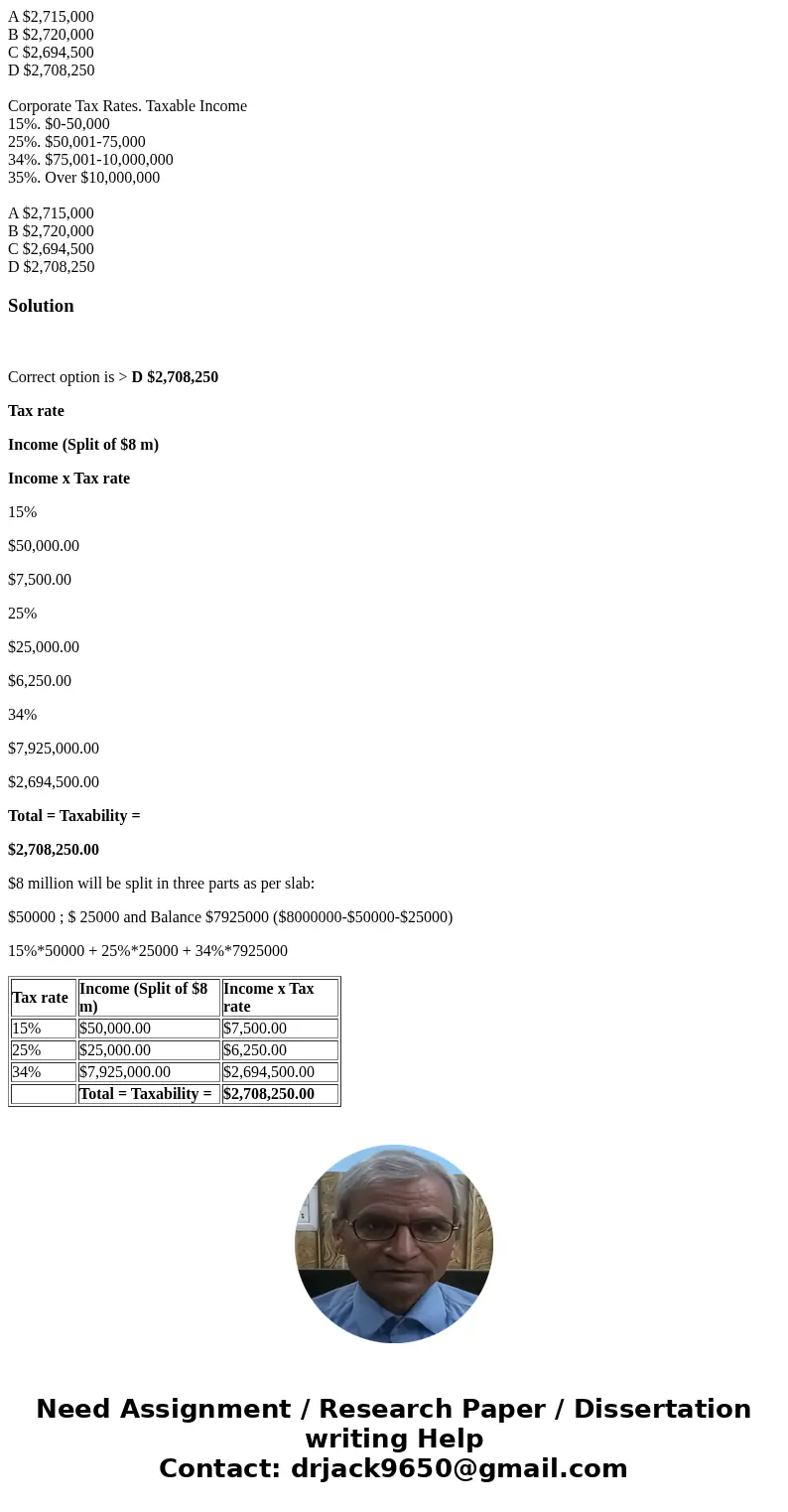

Solution

Correct option is > D $2,708,250

Tax rate

Income (Split of $8 m)

Income x Tax rate

15%

$50,000.00

$7,500.00

25%

$25,000.00

$6,250.00

34%

$7,925,000.00

$2,694,500.00

Total = Taxability =

$2,708,250.00

$8 million will be split in three parts as per slab:

$50000 ; $ 25000 and Balance $7925000 ($8000000-$50000-$25000)

15%*50000 + 25%*25000 + 34%*7925000

| Tax rate | Income (Split of $8 m) | Income x Tax rate |

| 15% | $50,000.00 | $7,500.00 |

| 25% | $25,000.00 | $6,250.00 |

| 34% | $7,925,000.00 | $2,694,500.00 |

| Total = Taxability = | $2,708,250.00 |

Homework Sourse

Homework Sourse