Ben is in the 25 bracket and has 15000 available for investm

Ben is in the 25% bracket and has $15,000 available for investment during her current tax year. Assume that he remains in the same tax bracket over the next 7 years and determine the accumulated amount of his investment if he puts the $15,000 into the following.

(a) a tax-deferred annuity that pays 5%/year (compounded annually), tax deferred for 7 years $

______________ (after taxes)

(b) a taxable instrument that pays 5%/year (compounded annually) for 7 years (Hint: In this case, the yield is 3.75%/year.)

___________

Solution

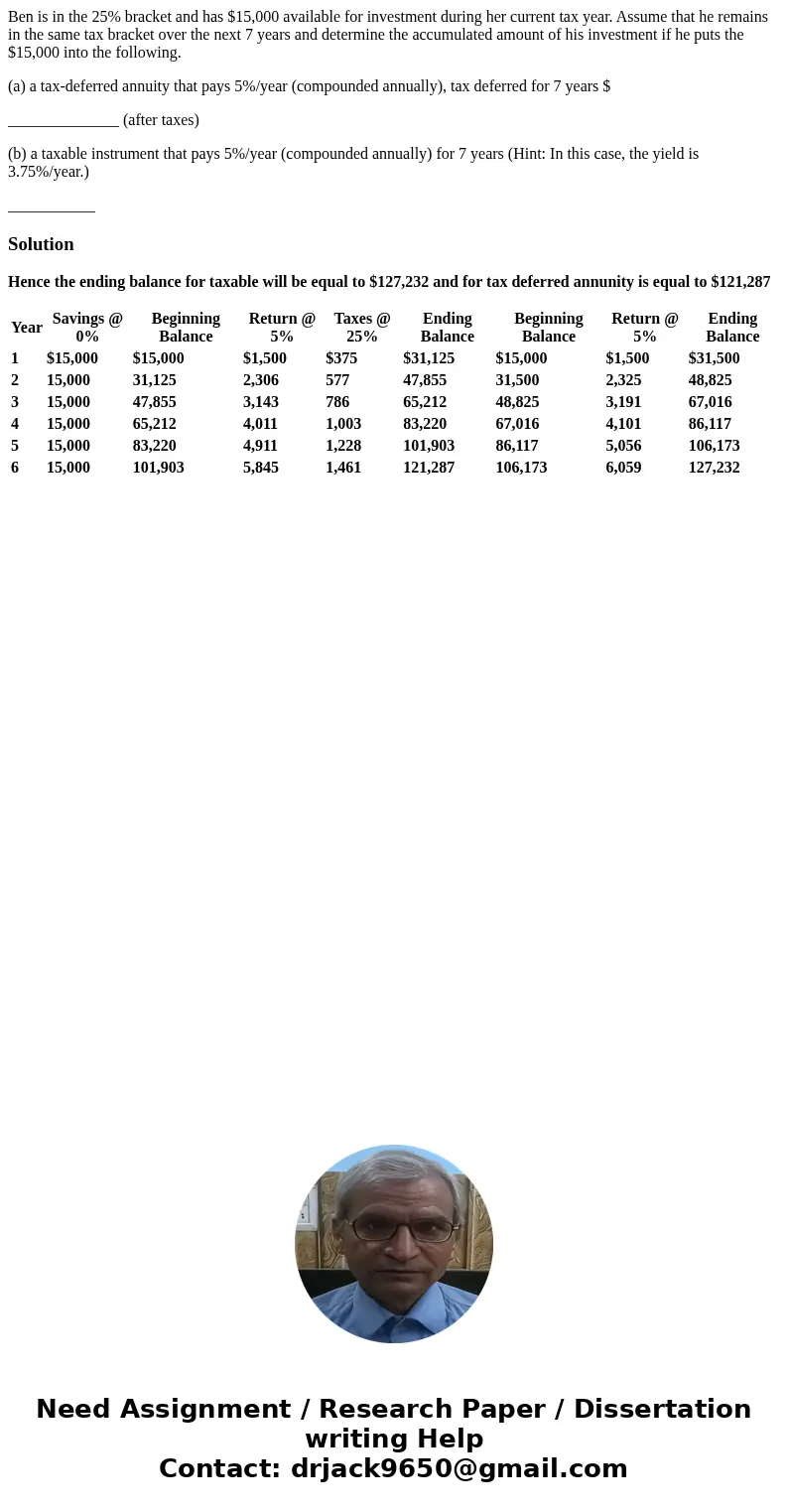

Hence the ending balance for taxable will be equal to $127,232 and for tax deferred annunity is equal to $121,287

| Year | Savings @ 0% | Beginning Balance | Return @ 5% | Taxes @ 25% | Ending Balance | Beginning Balance | Return @ 5% | Ending Balance |

|---|---|---|---|---|---|---|---|---|

| 1 | $15,000 | $15,000 | $1,500 | $375 | $31,125 | $15,000 | $1,500 | $31,500 |

| 2 | 15,000 | 31,125 | 2,306 | 577 | 47,855 | 31,500 | 2,325 | 48,825 |

| 3 | 15,000 | 47,855 | 3,143 | 786 | 65,212 | 48,825 | 3,191 | 67,016 |

| 4 | 15,000 | 65,212 | 4,011 | 1,003 | 83,220 | 67,016 | 4,101 | 86,117 |

| 5 | 15,000 | 83,220 | 4,911 | 1,228 | 101,903 | 86,117 | 5,056 | 106,173 |

| 6 | 15,000 | 101,903 | 5,845 | 1,461 | 121,287 | 106,173 | 6,059 | 127,232 |

Homework Sourse

Homework Sourse