15 pts The manufacturing facility where you work wants to bu

Solution

Computation of cash flow:

Year 2 and 3:

Cash inflow = Sales – expenses

= $ 1,500,000 - $ 1,100,000 = $ 400,000

Year 4 through 10:

Cash inflow = Sales – expenses

= $ 2,500,000 - $ 1,100,000 = $1,400,000

Year 11:

Cash inflow = Sales – expenses + sales proceeds of building

= $ 2,500,000 - $ 1,100,000 + $ 3,000,000

= $ 4,400,000

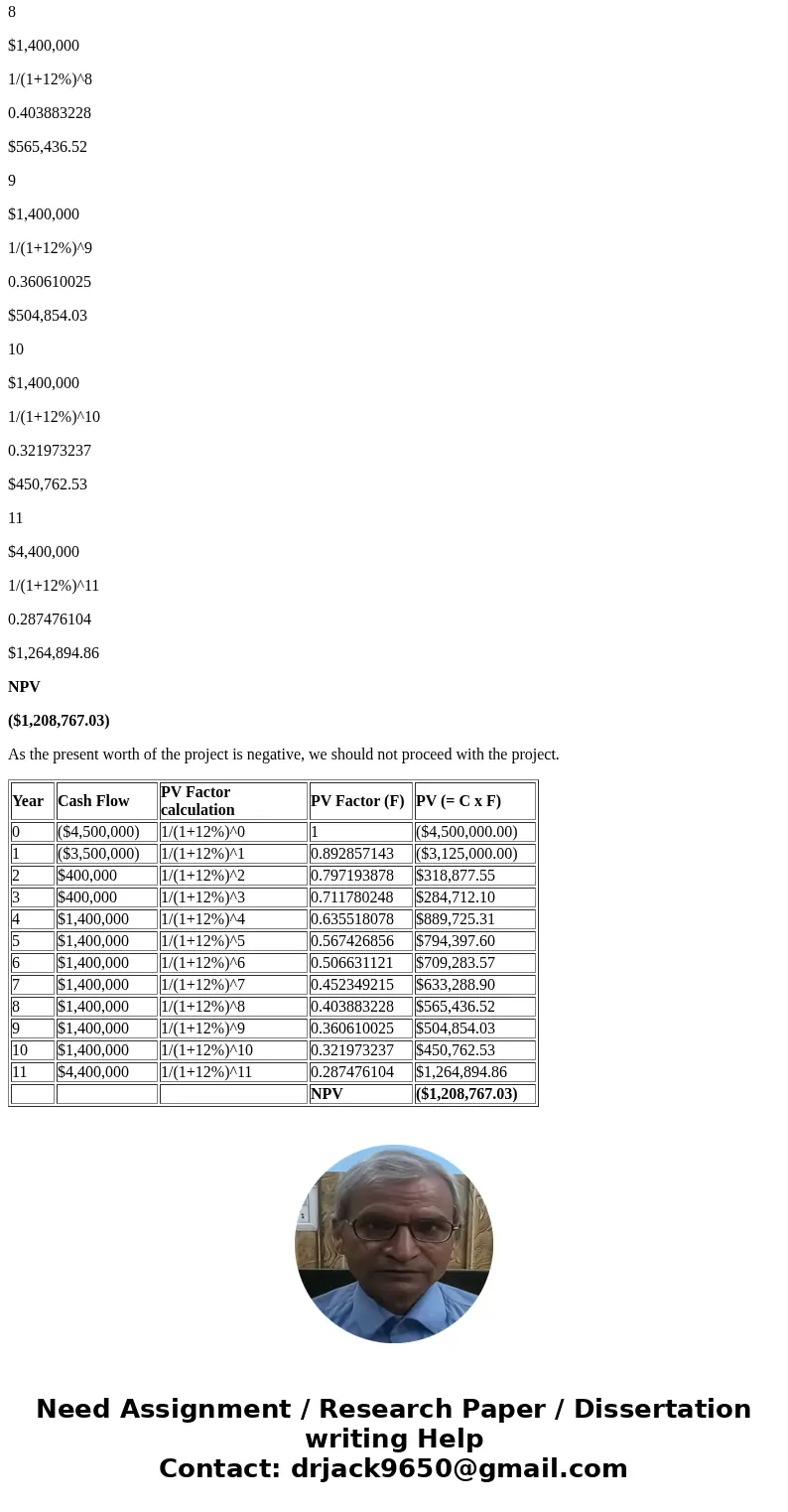

Computation of present worth or NPV of project:

Year

Cash Flow

PV Factor calculation

PV Factor (F)

PV (= C x F)

0

($4,500,000)

1/(1+12%)^0

1

($4,500,000.00)

1

($3,500,000)

1/(1+12%)^1

0.892857143

($3,125,000.00)

2

$400,000

1/(1+12%)^2

0.797193878

$318,877.55

3

$400,000

1/(1+12%)^3

0.711780248

$284,712.10

4

$1,400,000

1/(1+12%)^4

0.635518078

$889,725.31

5

$1,400,000

1/(1+12%)^5

0.567426856

$794,397.60

6

$1,400,000

1/(1+12%)^6

0.506631121

$709,283.57

7

$1,400,000

1/(1+12%)^7

0.452349215

$633,288.90

8

$1,400,000

1/(1+12%)^8

0.403883228

$565,436.52

9

$1,400,000

1/(1+12%)^9

0.360610025

$504,854.03

10

$1,400,000

1/(1+12%)^10

0.321973237

$450,762.53

11

$4,400,000

1/(1+12%)^11

0.287476104

$1,264,894.86

NPV

($1,208,767.03)

As the present worth of the project is negative, we should not proceed with the project.

| Year | Cash Flow | PV Factor calculation | PV Factor (F) | PV (= C x F) |

| 0 | ($4,500,000) | 1/(1+12%)^0 | 1 | ($4,500,000.00) |

| 1 | ($3,500,000) | 1/(1+12%)^1 | 0.892857143 | ($3,125,000.00) |

| 2 | $400,000 | 1/(1+12%)^2 | 0.797193878 | $318,877.55 |

| 3 | $400,000 | 1/(1+12%)^3 | 0.711780248 | $284,712.10 |

| 4 | $1,400,000 | 1/(1+12%)^4 | 0.635518078 | $889,725.31 |

| 5 | $1,400,000 | 1/(1+12%)^5 | 0.567426856 | $794,397.60 |

| 6 | $1,400,000 | 1/(1+12%)^6 | 0.506631121 | $709,283.57 |

| 7 | $1,400,000 | 1/(1+12%)^7 | 0.452349215 | $633,288.90 |

| 8 | $1,400,000 | 1/(1+12%)^8 | 0.403883228 | $565,436.52 |

| 9 | $1,400,000 | 1/(1+12%)^9 | 0.360610025 | $504,854.03 |

| 10 | $1,400,000 | 1/(1+12%)^10 | 0.321973237 | $450,762.53 |

| 11 | $4,400,000 | 1/(1+12%)^11 | 0.287476104 | $1,264,894.86 |

| NPV | ($1,208,767.03) |

Homework Sourse

Homework Sourse