A trust has been established to fund scholarships in perpetu

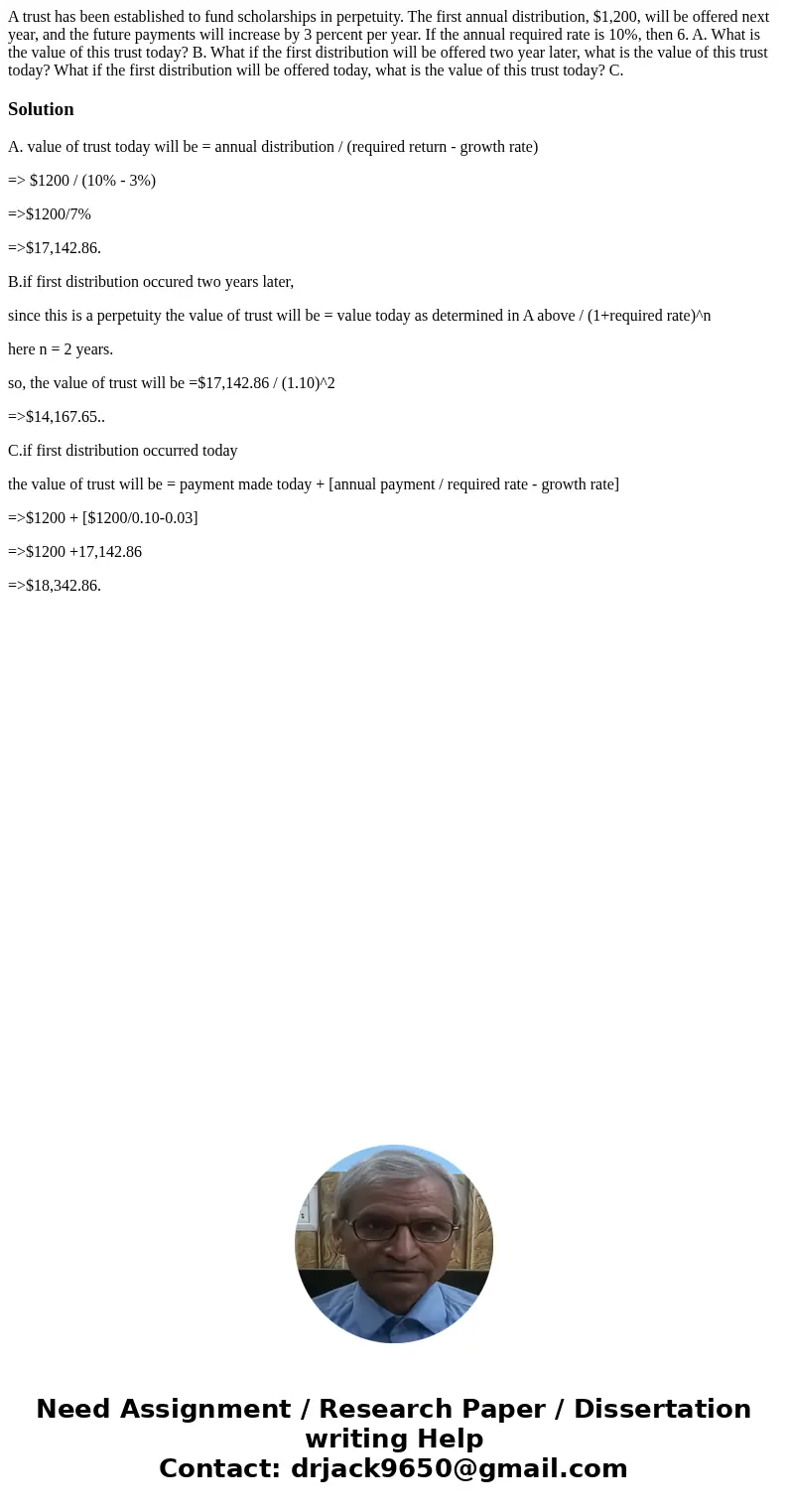

A trust has been established to fund scholarships in perpetuity. The first annual distribution, $1,200, will be offered next year, and the future payments will increase by 3 percent per year. If the annual required rate is 10%, then 6. A. What is the value of this trust today? B. What if the first distribution will be offered two year later, what is the value of this trust today? What if the first distribution will be offered today, what is the value of this trust today? C.

Solution

A. value of trust today will be = annual distribution / (required return - growth rate)

=> $1200 / (10% - 3%)

=>$1200/7%

=>$17,142.86.

B.if first distribution occured two years later,

since this is a perpetuity the value of trust will be = value today as determined in A above / (1+required rate)^n

here n = 2 years.

so, the value of trust will be =$17,142.86 / (1.10)^2

=>$14,167.65..

C.if first distribution occurred today

the value of trust will be = payment made today + [annual payment / required rate - growth rate]

=>$1200 + [$1200/0.10-0.03]

=>$1200 +17,142.86

=>$18,342.86.

Homework Sourse

Homework Sourse