Data Table More Info a Acquisition of plant assets is 121000

Solution

Answer

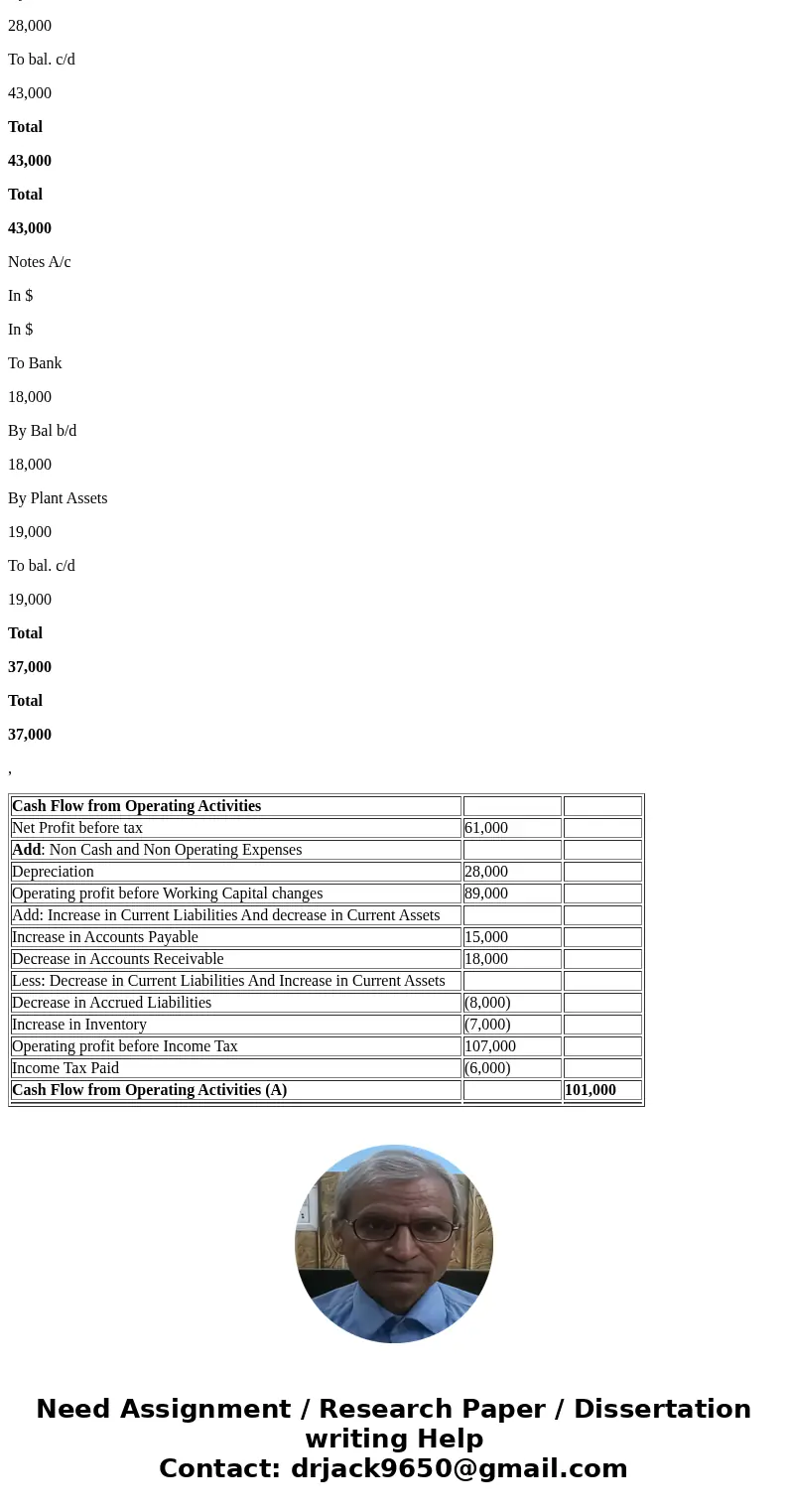

Cash Flow from Operating Activities

Net Profit before tax

61,000

Add: Non Cash and Non Operating Expenses

Depreciation

28,000

Operating profit before Working Capital changes

89,000

Add: Increase in Current Liabilities And decrease in Current Assets

Increase in Accounts Payable

15,000

Decrease in Accounts Receivable

18,000

Less: Decrease in Current Liabilities And Increase in Current Assets

Decrease in Accrued Liabilities

(8,000)

Increase in Inventory

(7,000)

Operating profit before Income Tax

107,000

Income Tax Paid

(6,000)

Cash Flow from Operating Activities (A)

101,000

Cash Flow from Investing Activities

Sale of Land

21,000

Purchase of Plant

(102,000)

Cash Used in Investing Activities (B)

(81,000)

Cash Flow from Financing Activities

Issue of Shares

33,000

Dividend Paid

(13,000)

Payment of Notes

(18,000)

Cash from Financing Activities ( C )

2,000

Increase in Cash Flow (A+B+C)

22,000

Opening Cash

9,000

Closing Cash

31,000

NON Cash Investing and Financing Activities

NON Cash Investing Activities

Purchase of Plant Assets by issuing Notes

19,000

Non Cash Financing Activities

Issue of Notes for purchasing Plant Assets

19,000

Equipment A/c

In $

In $

To Bal b/d

90,000

To Notes

19,000

To Bank

102,000

By Bal c/d

211,000

Total

211,000

Total

211,000

Acc. Depreciation A/c

In $

In $

By Bal b/d

15,000

By P&L

28,000

To bal. c/d

43,000

Total

43,000

Total

43,000

Notes A/c

In $

In $

To Bank

18,000

By Bal b/d

18,000

By Plant Assets

19,000

To bal. c/d

19,000

Total

37,000

Total

37,000

,

| Cash Flow from Operating Activities | ||

| Net Profit before tax | 61,000 | |

| Add: Non Cash and Non Operating Expenses | ||

| Depreciation | 28,000 | |

| Operating profit before Working Capital changes | 89,000 | |

| Add: Increase in Current Liabilities And decrease in Current Assets | ||

| Increase in Accounts Payable | 15,000 | |

| Decrease in Accounts Receivable | 18,000 | |

| Less: Decrease in Current Liabilities And Increase in Current Assets | ||

| Decrease in Accrued Liabilities | (8,000) | |

| Increase in Inventory | (7,000) | |

| Operating profit before Income Tax | 107,000 | |

| Income Tax Paid | (6,000) | |

| Cash Flow from Operating Activities (A) | 101,000 | |

Homework Sourse

Homework Sourse