Brief Exercise 102 Hanson Company is constructing a building

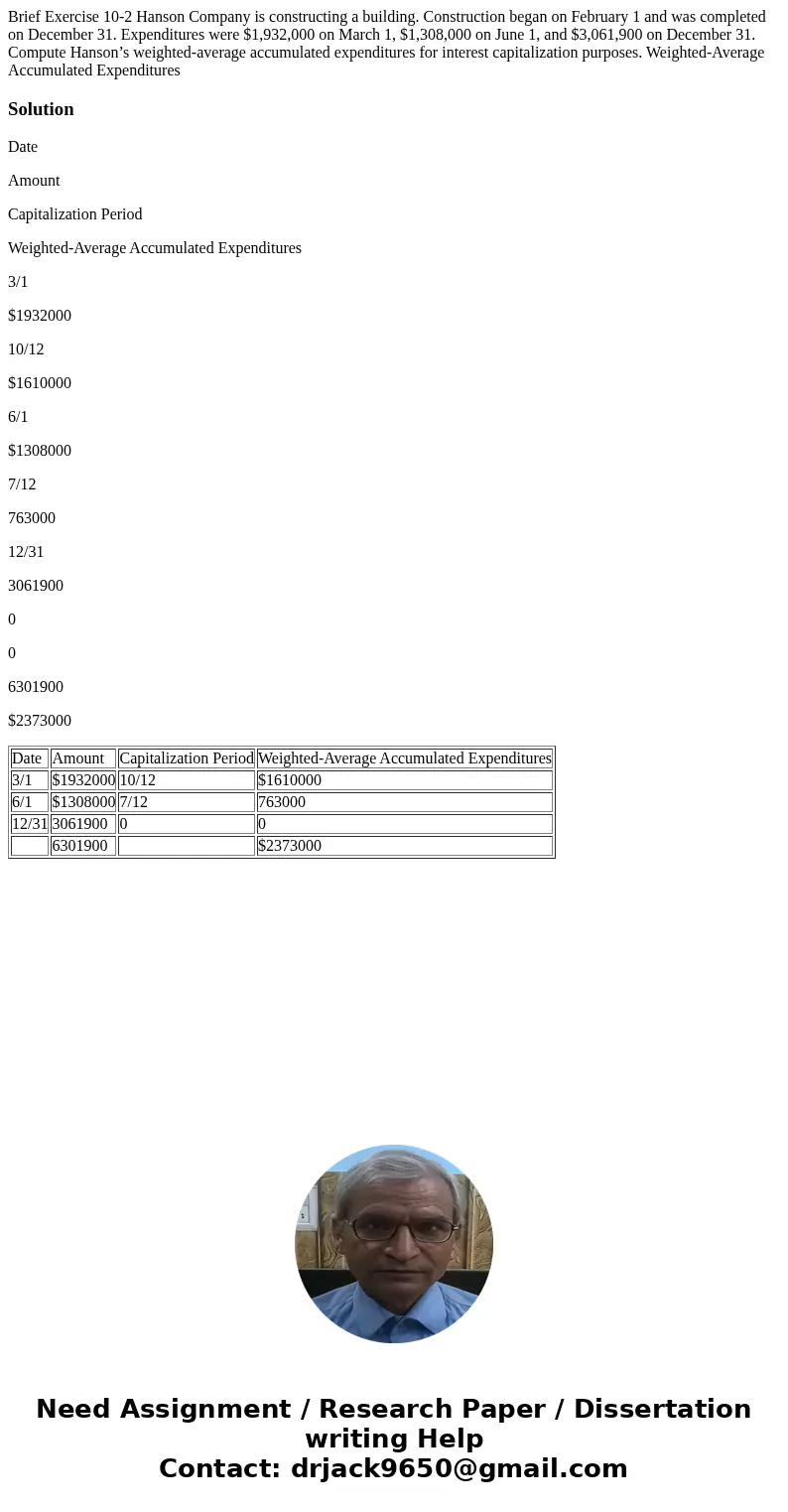

Brief Exercise 10-2 Hanson Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $1,932,000 on March 1, $1,308,000 on June 1, and $3,061,900 on December 31. Compute Hanson’s weighted-average accumulated expenditures for interest capitalization purposes. Weighted-Average Accumulated Expenditures

Solution

Date

Amount

Capitalization Period

Weighted-Average Accumulated Expenditures

3/1

$1932000

10/12

$1610000

6/1

$1308000

7/12

763000

12/31

3061900

0

0

6301900

$2373000

| Date | Amount | Capitalization Period | Weighted-Average Accumulated Expenditures |

| 3/1 | $1932000 | 10/12 | $1610000 |

| 6/1 | $1308000 | 7/12 | 763000 |

| 12/31 | 3061900 | 0 | 0 |

| 6301900 | $2373000 |

Homework Sourse

Homework Sourse