Milden Company has an exclusive franchise to purchase a prod

Solution

Answer

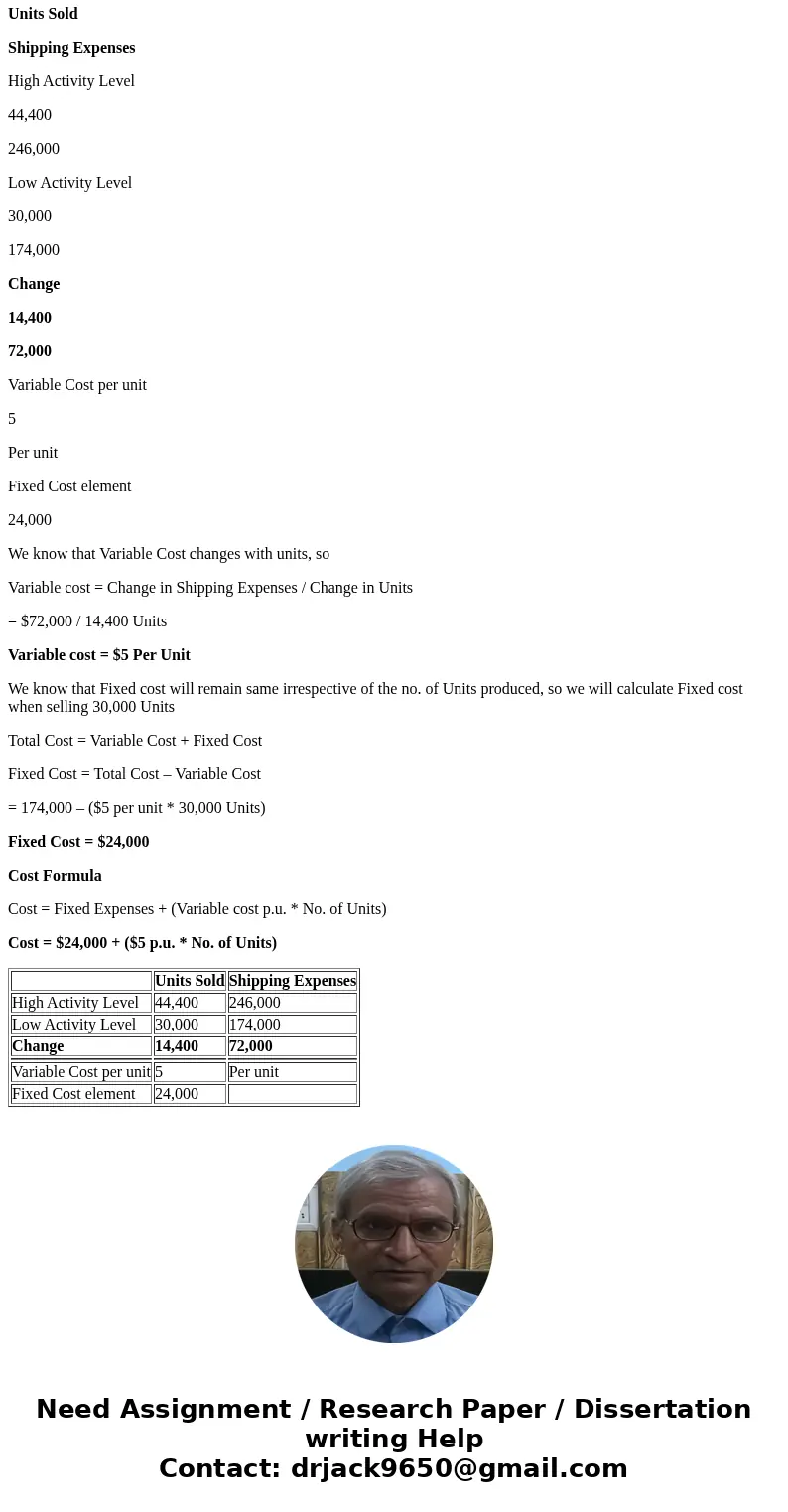

High Activity level is the level when we sold the Maximum no. of Units i.e. 3rd Quarter of 2nd Year (44,400 Units)

Low Activity Level is the level when we sold the minimum no. of units i.e. 1st Quarter of 1st Year (30,000 Units)

Units Sold

Shipping Expenses

High Activity Level

44,400

246,000

Low Activity Level

30,000

174,000

Change

14,400

72,000

Variable Cost per unit

5

Per unit

Fixed Cost element

24,000

We know that Variable Cost changes with units, so

Variable cost = Change in Shipping Expenses / Change in Units

= $72,000 / 14,400 Units

Variable cost = $5 Per Unit

We know that Fixed cost will remain same irrespective of the no. of Units produced, so we will calculate Fixed cost when selling 30,000 Units

Total Cost = Variable Cost + Fixed Cost

Fixed Cost = Total Cost – Variable Cost

= 174,000 – ($5 per unit * 30,000 Units)

Fixed Cost = $24,000

Cost Formula

Cost = Fixed Expenses + (Variable cost p.u. * No. of Units)

Cost = $24,000 + ($5 p.u. * No. of Units)

| Units Sold | Shipping Expenses | |

| High Activity Level | 44,400 | 246,000 |

| Low Activity Level | 30,000 | 174,000 |

| Change | 14,400 | 72,000 |

| Variable Cost per unit | 5 | Per unit |

| Fixed Cost element | 24,000 |

Homework Sourse

Homework Sourse