Assume that you have compiled the following information rega

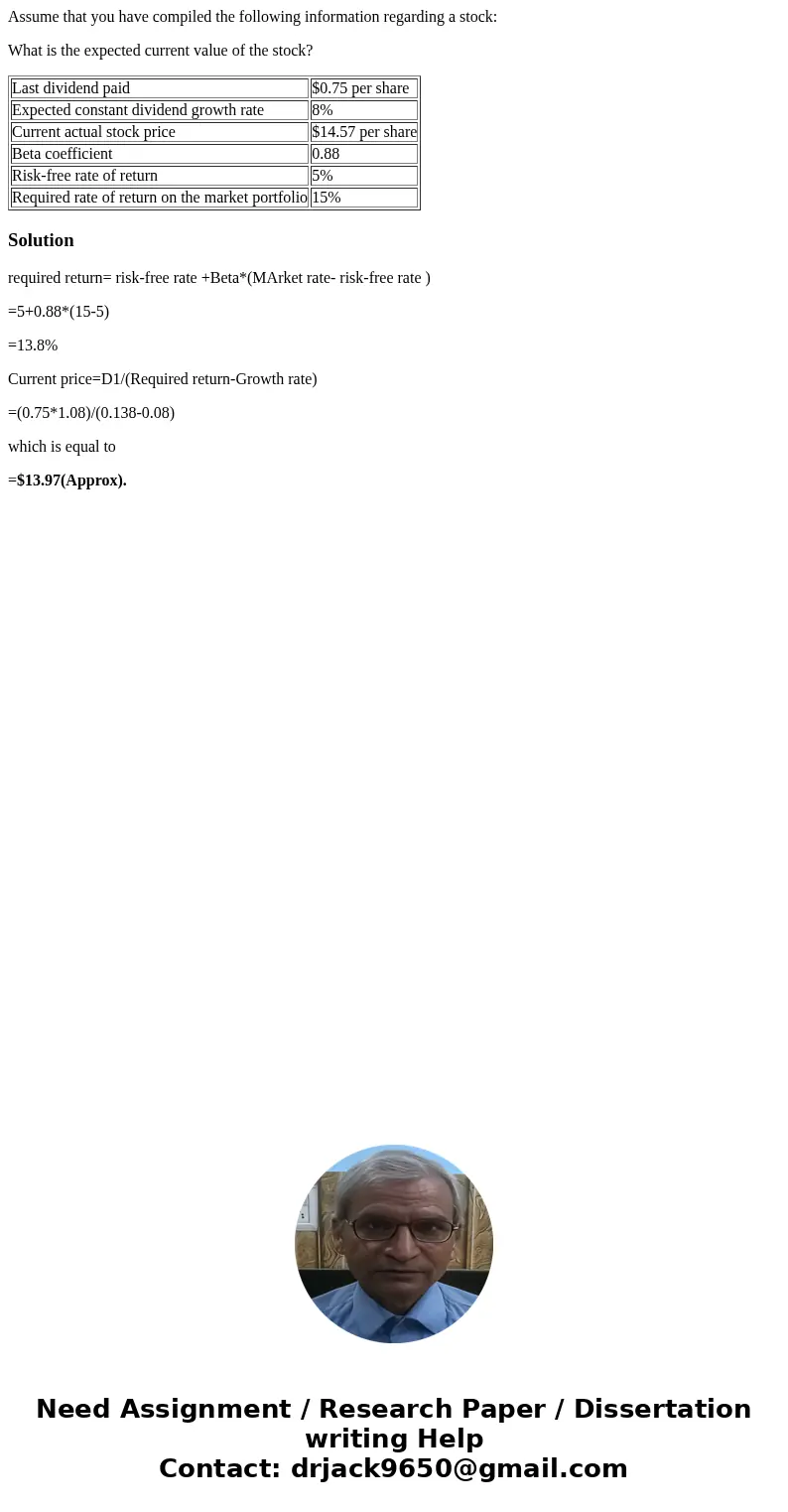

Assume that you have compiled the following information regarding a stock:

What is the expected current value of the stock?

| Last dividend paid | $0.75 per share |

| Expected constant dividend growth rate | 8% |

| Current actual stock price | $14.57 per share |

| Beta coefficient | 0.88 |

| Risk-free rate of return | 5% |

| Required rate of return on the market portfolio | 15% |

Solution

required return= risk-free rate +Beta*(MArket rate- risk-free rate )

=5+0.88*(15-5)

=13.8%

Current price=D1/(Required return-Growth rate)

=(0.75*1.08)/(0.138-0.08)

which is equal to

=$13.97(Approx).

Homework Sourse

Homework Sourse