N11123E1 Section B Answer both questions Total marks availab

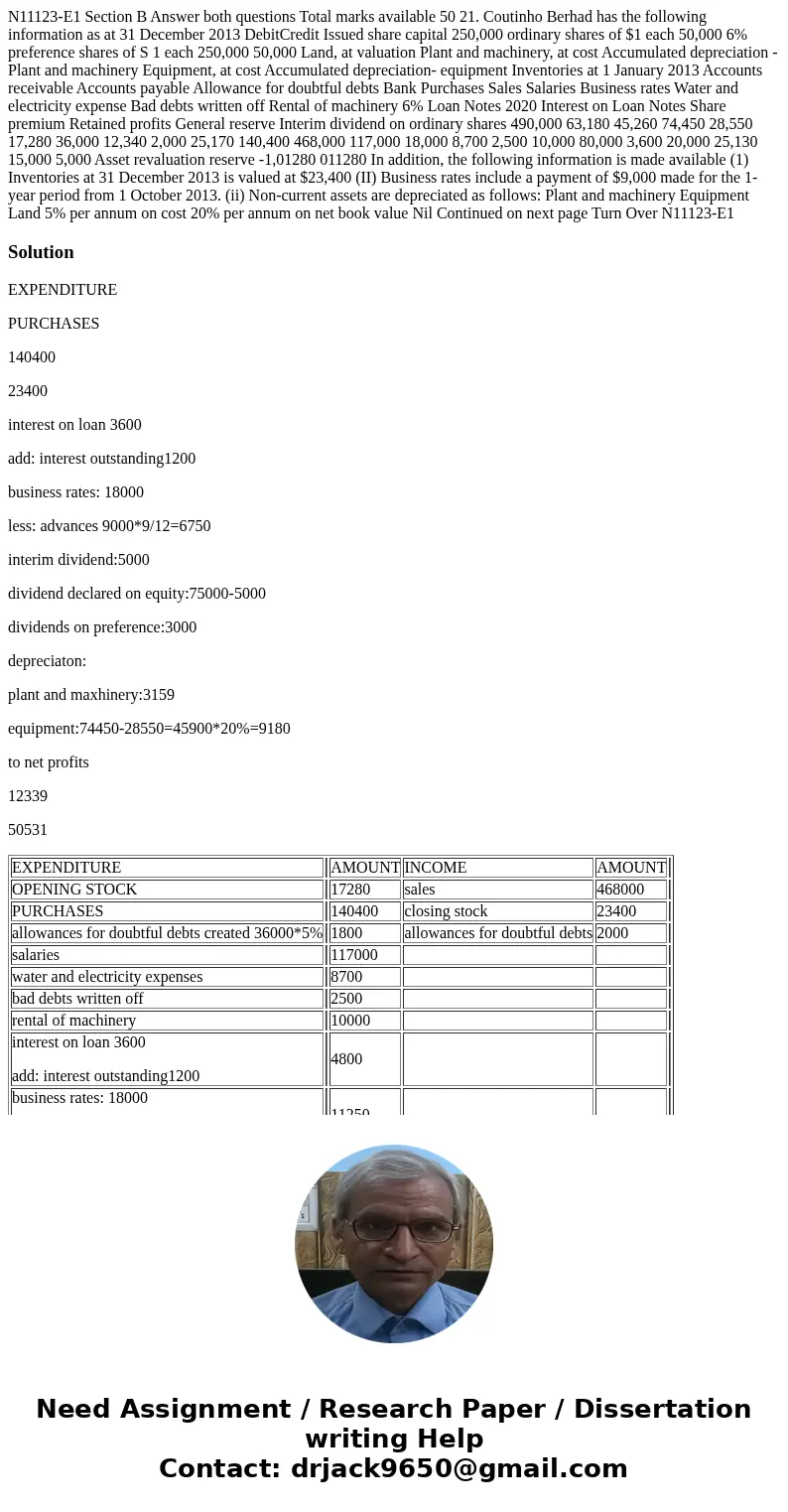

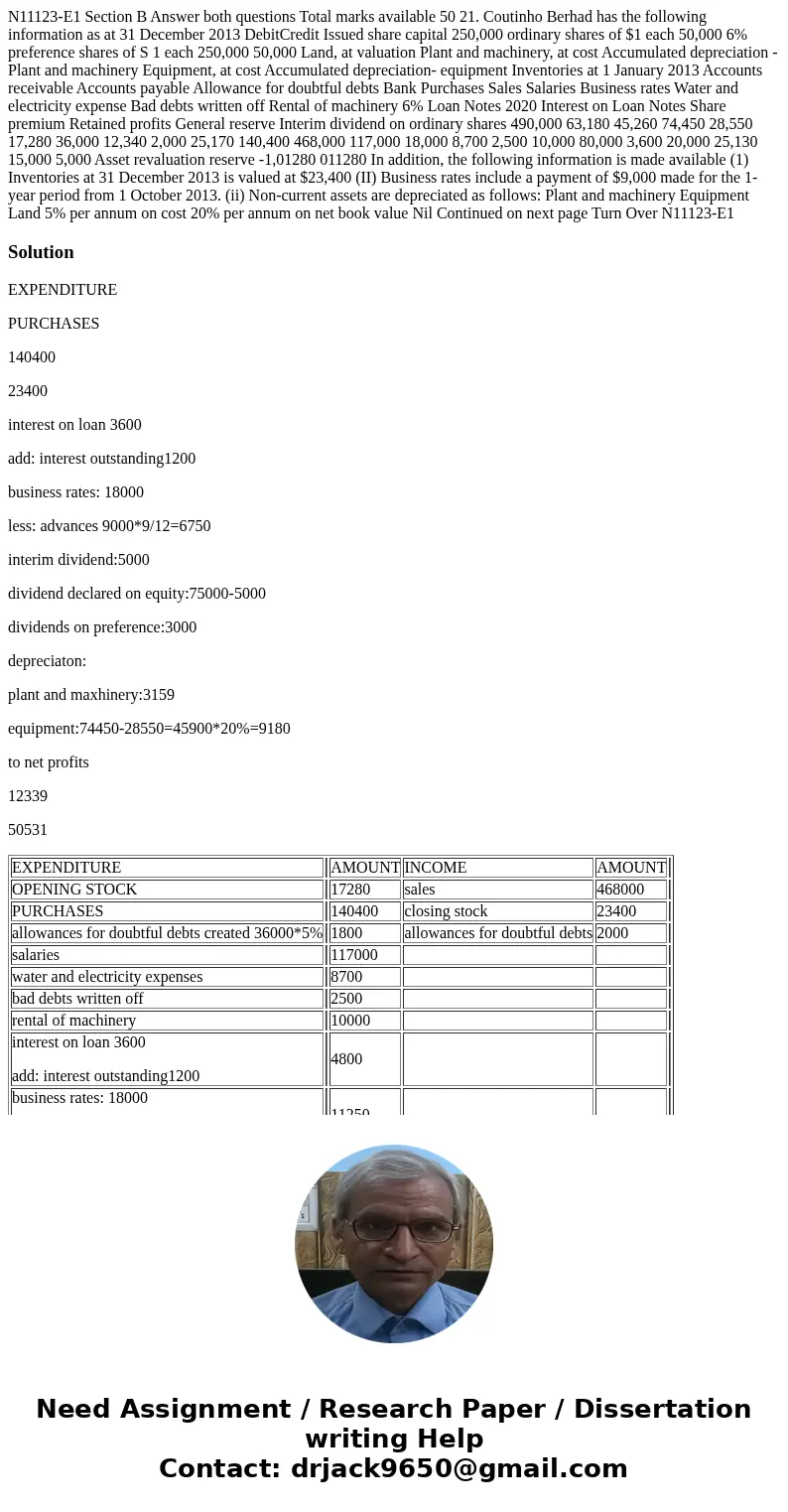

N11123-E1 Section B Answer both questions Total marks available 50 21. Coutinho Berhad has the following information as at 31 December 2013 DebitCredit Issued share capital 250,000 ordinary shares of $1 each 50,000 6% preference shares of S 1 each 250,000 50,000 Land, at valuation Plant and machinery, at cost Accumulated depreciation - Plant and machinery Equipment, at cost Accumulated depreciation- equipment Inventories at 1 January 2013 Accounts receivable Accounts payable Allowance for doubtful debts Bank Purchases Sales Salaries Business rates Water and electricity expense Bad debts written off Rental of machinery 6% Loan Notes 2020 Interest on Loan Notes Share premium Retained profits General reserve Interim dividend on ordinary shares 490,000 63,180 45,260 74,450 28,550 17,280 36,000 12,340 2,000 25,170 140,400 468,000 117,000 18,000 8,700 2,500 10,000 80,000 3,600 20,000 25,130 15,000 5,000 Asset revaluation reserve -1,01280 011280 In addition, the following information is made available (1) Inventories at 31 December 2013 is valued at $23,400 (II) Business rates include a payment of $9,000 made for the 1-year period from 1 October 2013. (ii) Non-current assets are depreciated as follows: Plant and machinery Equipment Land 5% per annum on cost 20% per annum on net book value Nil Continued on next page Turn Over N11123-E1

Solution

EXPENDITURE

PURCHASES

140400

23400

interest on loan 3600

add: interest outstanding1200

business rates: 18000

less: advances 9000*9/12=6750

interim dividend:5000

dividend declared on equity:75000-5000

dividends on preference:3000

depreciaton:

plant and maxhinery:3159

equipment:74450-28550=45900*20%=9180

to net profits

12339

50531

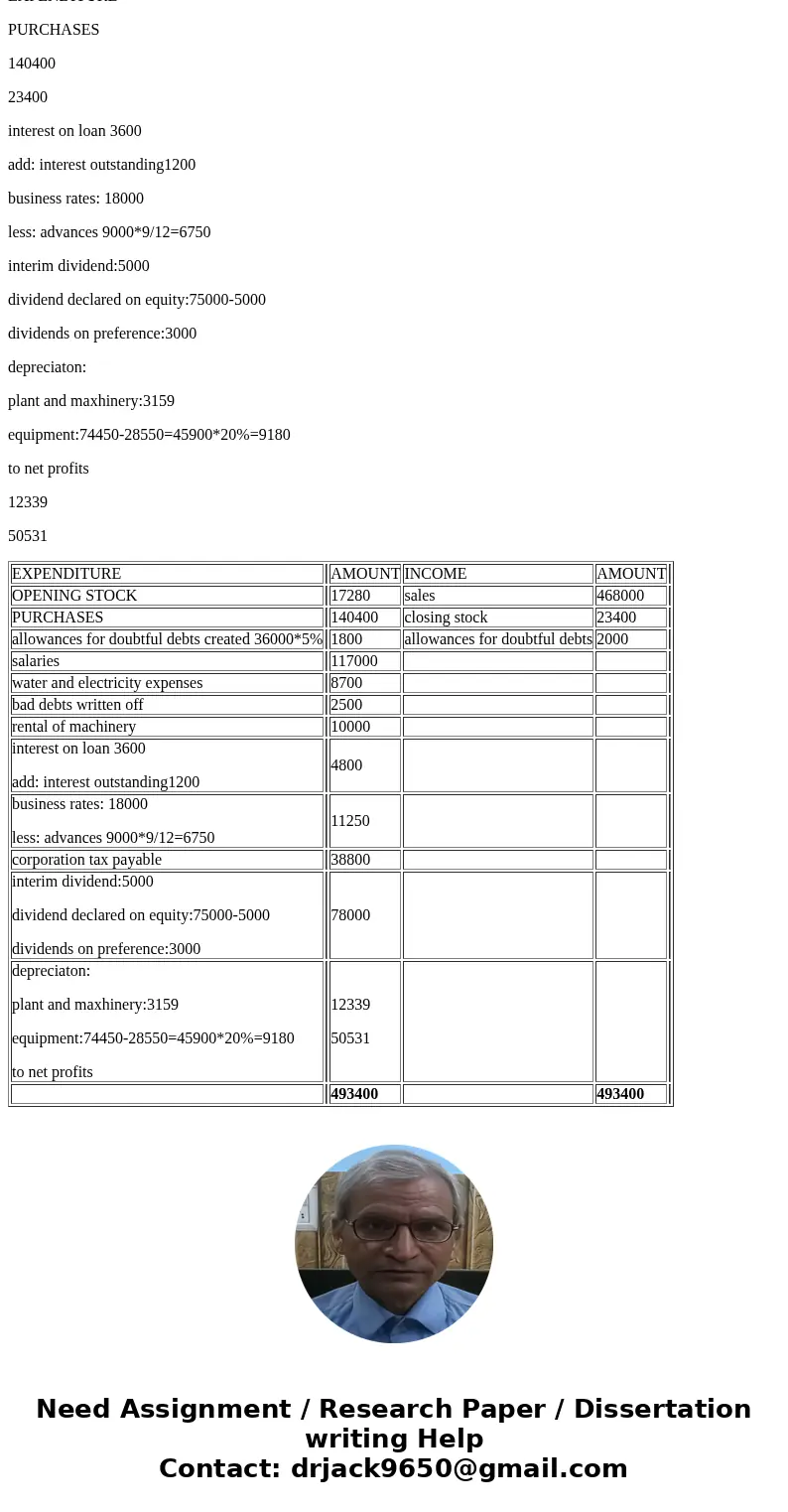

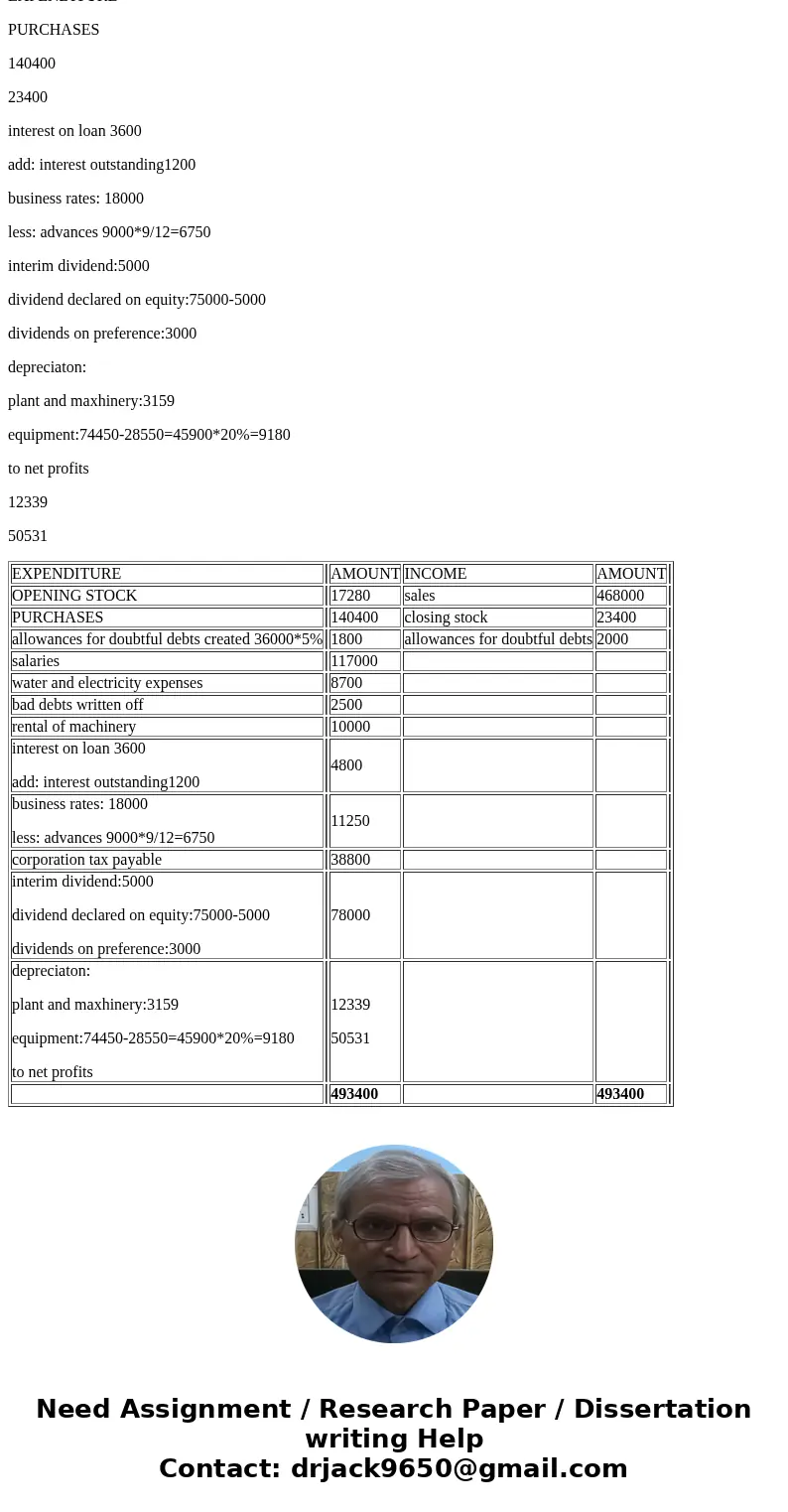

| EXPENDITURE | AMOUNT | INCOME | AMOUNT | ||

| OPENING STOCK | 17280 | sales | 468000 | ||

| PURCHASES | 140400 | closing stock | 23400 | ||

| allowances for doubtful debts created 36000*5% | 1800 | allowances for doubtful debts | 2000 | ||

| salaries | 117000 | ||||

| water and electricity expenses | 8700 | ||||

| bad debts written off | 2500 | ||||

| rental of machinery | 10000 | ||||

| interest on loan 3600 add: interest outstanding1200 | 4800 | ||||

| business rates: 18000 less: advances 9000*9/12=6750 | 11250 | ||||

| corporation tax payable | 38800 | ||||

| interim dividend:5000 dividend declared on equity:75000-5000 dividends on preference:3000 | 78000 | ||||

| depreciaton: plant and maxhinery:3159 equipment:74450-28550=45900*20%=9180 to net profits | 12339 50531 | ||||

| 493400 | 493400 |

Homework Sourse

Homework Sourse