1 Formulas shall be used for all calculations including the

Solution

a. Cash budget:

Cash budget:

July

August

September

Beginning cash balance

10,000

13,850

19,640

Add: Cash collection from sales

25,200

25,450

24,580

Total cash available

35,200

39,300

44,220

Less: Disbursements

Purchase for inventory

(14,550)

(12,960)

(12,015)

Sales and administrative expenses

(4,700)

(4,700)

(4,700)

Commission paid

(2,100)

(2,000)

(2,880)

Total disbursements

(21,350)

(19,660)

(19,595)

Excess cash / (deficiency)

13,850

19,640

24,625

Ending cash balance

13,850

19,640

24,625

Budgeted income statement:

Income statement:

Sales

69,600

Less: cost of goods sold

39,525

Gross profit

30,075

Less: operating expenses

Sales commission

6,980

Sales and administrative expenses

15,000

Net income before taxes

8,095

Budgeted balance sheet:

Balance sheet

Assets:

Cash

24,625

Accounts receivable (34,700-16,500-18,200+12,750+16,320)

29,070

Inventory

3,675

Total current assets

57,370

Property plant and equipment

12,000

Less: Accumulated depreciation (7,200+900)

(8,100)

3,900

Total assets

61,270

Liabilities and equity:

Accounts payable

14,850

Common stock

100

Retained earnings (17,875+8,095+20,350revenue-costs in trail balance)

46,320

61,270

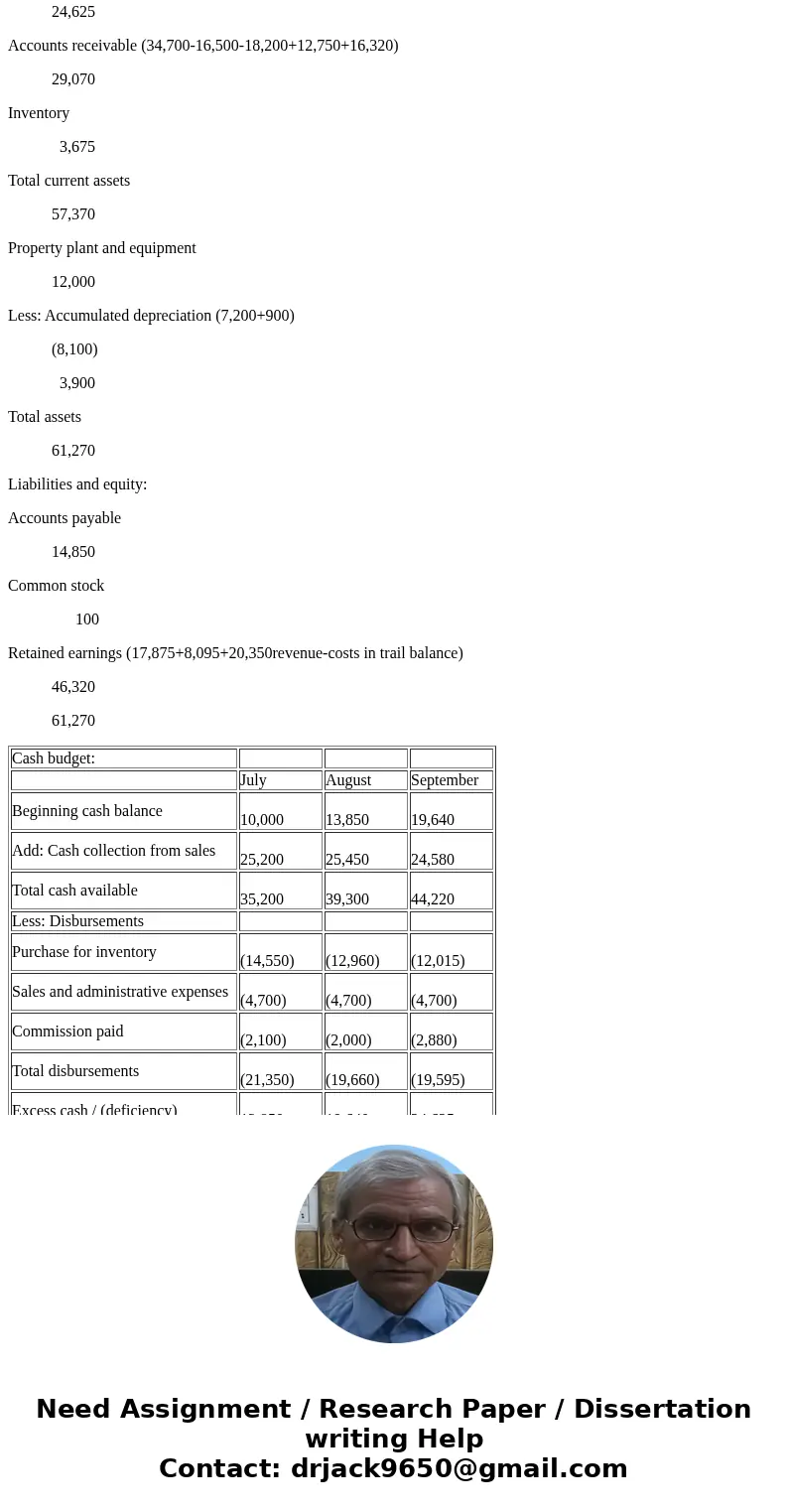

| Cash budget: | |||

| July | August | September | |

| Beginning cash balance | 10,000 | 13,850 | 19,640 |

| Add: Cash collection from sales | 25,200 | 25,450 | 24,580 |

| Total cash available | 35,200 | 39,300 | 44,220 |

| Less: Disbursements | |||

| Purchase for inventory | (14,550) | (12,960) | (12,015) |

| Sales and administrative expenses | (4,700) | (4,700) | (4,700) |

| Commission paid | (2,100) | (2,000) | (2,880) |

| Total disbursements | (21,350) | (19,660) | (19,595) |

| Excess cash / (deficiency) | 13,850 | 19,640 | 24,625 |

| Ending cash balance | 13,850 | 19,640 | 24,625 |

Homework Sourse

Homework Sourse