1 An insurer sells a very large number of policies to people

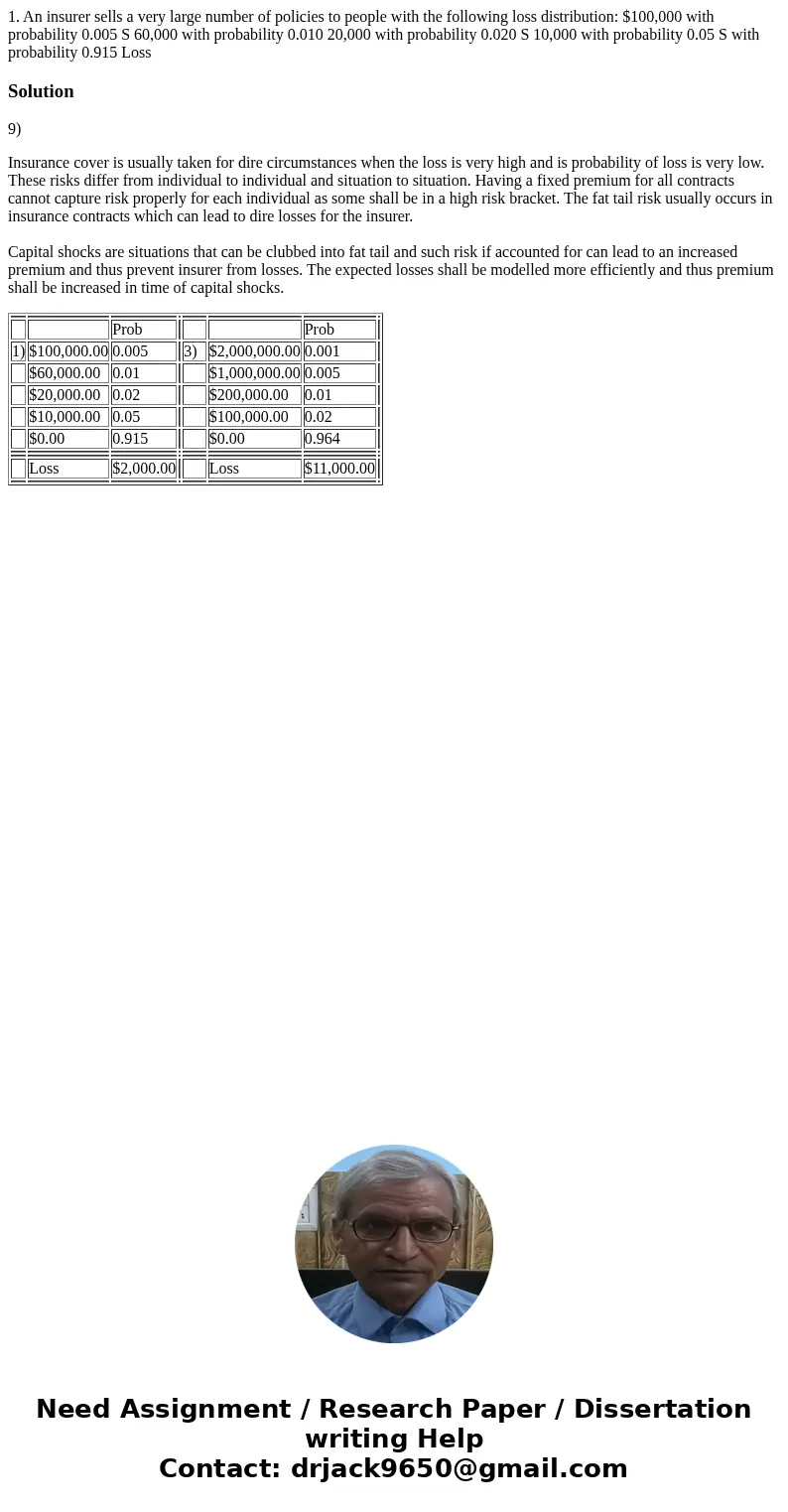

1. An insurer sells a very large number of policies to people with the following loss distribution: $100,000 with probability 0.005 S 60,000 with probability 0.010 20,000 with probability 0.020 S 10,000 with probability 0.05 S with probability 0.915 Loss

Solution

9)

Insurance cover is usually taken for dire circumstances when the loss is very high and is probability of loss is very low. These risks differ from individual to individual and situation to situation. Having a fixed premium for all contracts cannot capture risk properly for each individual as some shall be in a high risk bracket. The fat tail risk usually occurs in insurance contracts which can lead to dire losses for the insurer.

Capital shocks are situations that can be clubbed into fat tail and such risk if accounted for can lead to an increased premium and thus prevent insurer from losses. The expected losses shall be modelled more efficiently and thus premium shall be increased in time of capital shocks.

| Prob | Prob | ||||||

| 1) | $100,000.00 | 0.005 | 3) | $2,000,000.00 | 0.001 | ||

| $60,000.00 | 0.01 | $1,000,000.00 | 0.005 | ||||

| $20,000.00 | 0.02 | $200,000.00 | 0.01 | ||||

| $10,000.00 | 0.05 | $100,000.00 | 0.02 | ||||

| $0.00 | 0.915 | $0.00 | 0.964 | ||||

| Loss | $2,000.00 | Loss | $11,000.00 | ||||

Homework Sourse

Homework Sourse