82 StandAlone Risk Expected returns Stocks X and Y have the

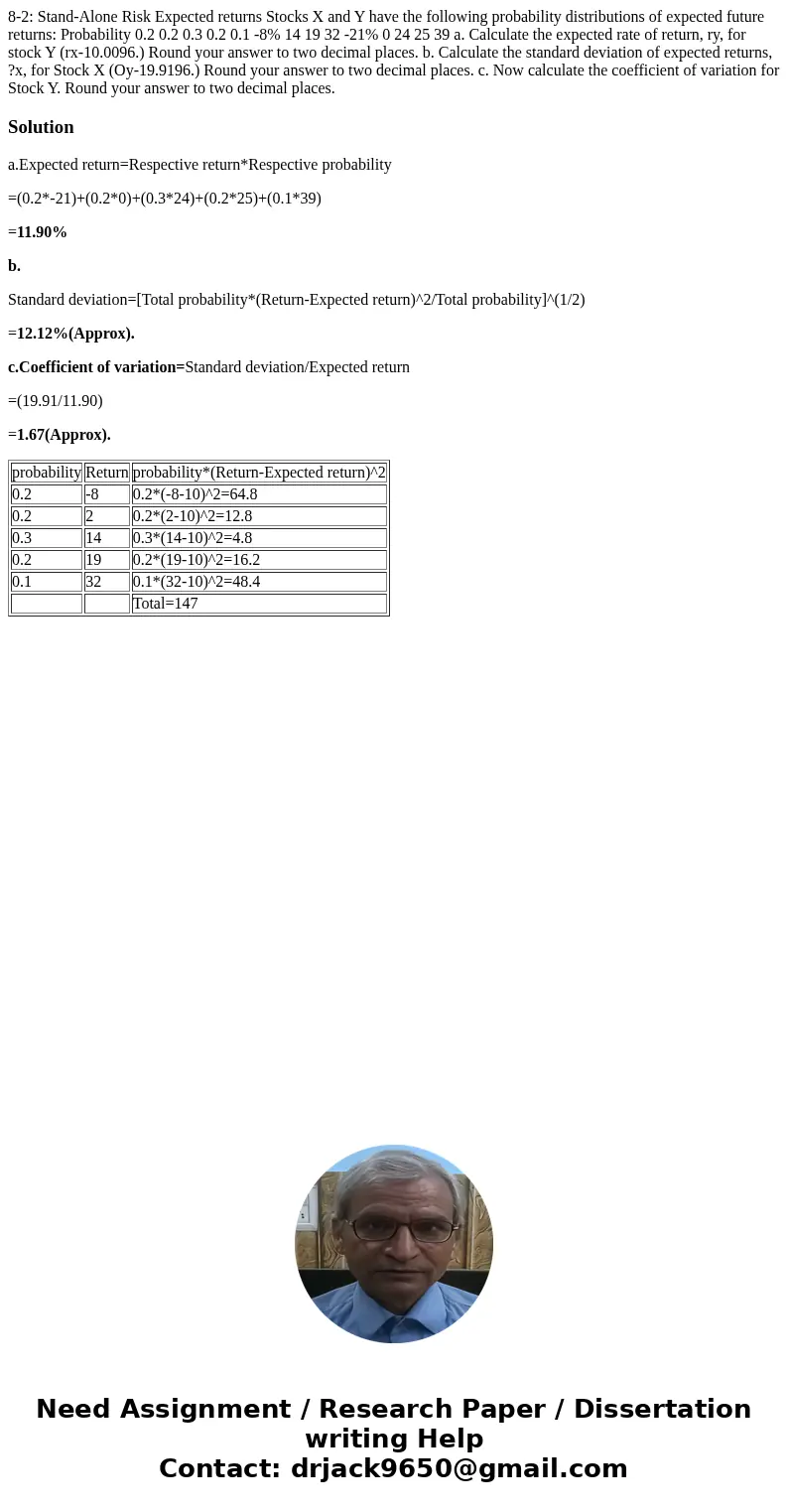

8-2: Stand-Alone Risk Expected returns Stocks X and Y have the following probability distributions of expected future returns: Probability 0.2 0.2 0.3 0.2 0.1 -8% 14 19 32 -21% 0 24 25 39 a. Calculate the expected rate of return, ry, for stock Y (rx-10.0096.) Round your answer to two decimal places. b. Calculate the standard deviation of expected returns, ?x, for Stock X (Oy-19.9196.) Round your answer to two decimal places. c. Now calculate the coefficient of variation for Stock Y. Round your answer to two decimal places.

Solution

a.Expected return=Respective return*Respective probability

=(0.2*-21)+(0.2*0)+(0.3*24)+(0.2*25)+(0.1*39)

=11.90%

b.

Standard deviation=[Total probability*(Return-Expected return)^2/Total probability]^(1/2)

=12.12%(Approx).

c.Coefficient of variation=Standard deviation/Expected return

=(19.91/11.90)

=1.67(Approx).

| probability | Return | probability*(Return-Expected return)^2 |

| 0.2 | -8 | 0.2*(-8-10)^2=64.8 |

| 0.2 | 2 | 0.2*(2-10)^2=12.8 |

| 0.3 | 14 | 0.3*(14-10)^2=4.8 |

| 0.2 | 19 | 0.2*(19-10)^2=16.2 |

| 0.1 | 32 | 0.1*(32-10)^2=48.4 |

| Total=147 |

Homework Sourse

Homework Sourse