I NEED HELP AS SOON AS POSSIBLE THANK YOU Exercise 21A2 ac P

I NEED HELP AS SOON AS POSSIBLE. THANK YOU.

Exercise 21A-2 a-c (Part Level Submission) On December 31, 2016, Marin Corporation signed a 5-year, non-cancelable lease for a machine. The terms of the lease called for Marin to make annual payments of $8,479 at the beginning of each year, starting December 31, 2016. The machine has an estimated useful life of 6 years and a $4,600 unguaranteed residual value. The machine reverts back to the lessor at the end of the lease term. Marin uses the straight-line method of depreciation for all of its plant assets. Marin\'s incremental borrowing rate is 9%, and the lessor\'s implicit rate is unknown. Click here to view the factor table (a) Your answer is correct. What type of lease is this? This is a/arn Ufnancelease Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTSSHOW SOLUTION SHOW ANSWER LINK TO TEXT LINK TO TEXT (b) Your answer is incorrect. Try again Compute the present value of the lease payments. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answer to 0 decimal places, e.g. 5,275.) Present value of the lease payments 8950 Click if you would like to show Work for this question: Open Show Work C) Prepare all necessary journal entries through December 31, 2017. Note: C is a part of the questionSolution

Answer

Since we know that we have taken machine lease on 31 december 2016 and lease payment starts from 31 December 2016, and will be at the beginning of each year. SO,

PVAF @9% = 1 + PVAF @9% for 4 years

= 1 + 3.23971

PVAF @9% = 4.23971

We have taken 1 as first payment is in starting of year so the Present value of $1 will be $1 and for remaining 4 years, PVAF @9% = 3.23971

Present Value of Lease Payment = Annual Lease Payment * PVAF @9% for 5 Years

= $8,479 * 4.239719877

Present Value of Lease Payment = $35,948.584837

Date

Dr. $

Cr. $

31 Dec. 2016

Leased Equipment

35,948.5

Leased Liability

35,948.5

31 Dec. 2016

Lease Liability

8,479

Cash

8,479

31 Dec. 2017

Depreciation (35,948.5 / 5 Years)

7,189.7

Accumulated Depreciation – Capital Lease

7,189.7

31 Dec. 2017

Interest Expense [(35,948.5 - 8,479) * 9%]

2,472

Interest Payable

2,472

Lease Liability (Bal.)

6,007

Interest Expense

2,472

Cash

8,479

If you have any doubt plz feel free to reach me.

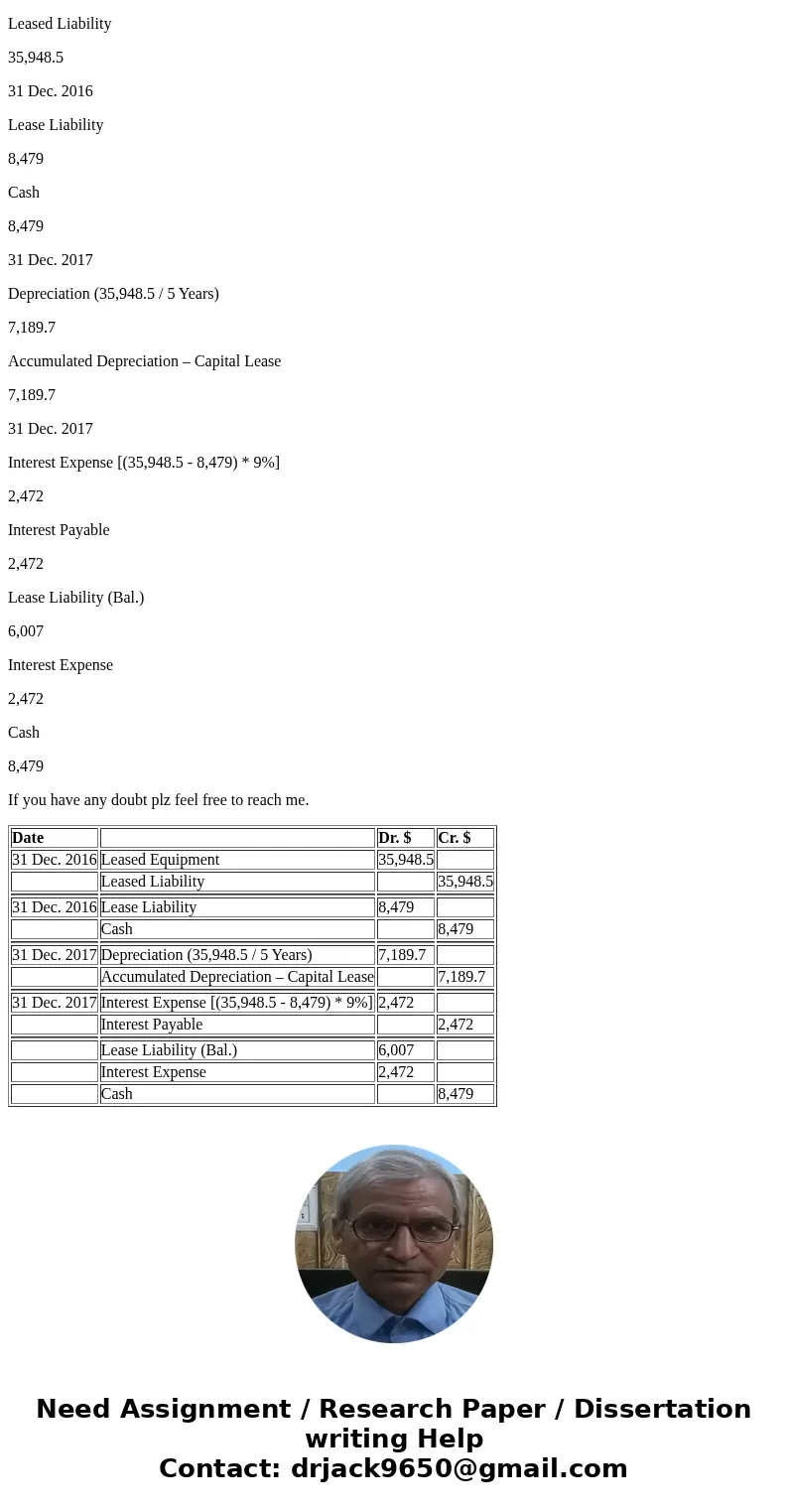

| Date | Dr. $ | Cr. $ | |

| 31 Dec. 2016 | Leased Equipment | 35,948.5 | |

| Leased Liability | 35,948.5 | ||

| 31 Dec. 2016 | Lease Liability | 8,479 | |

| Cash | 8,479 | ||

| 31 Dec. 2017 | Depreciation (35,948.5 / 5 Years) | 7,189.7 | |

| Accumulated Depreciation – Capital Lease | 7,189.7 | ||

| 31 Dec. 2017 | Interest Expense [(35,948.5 - 8,479) * 9%] | 2,472 | |

| Interest Payable | 2,472 | ||

| Lease Liability (Bal.) | 6,007 | ||

| Interest Expense | 2,472 | ||

| Cash | 8,479 |

Homework Sourse

Homework Sourse