A pension plan is obligated to make disbursements of 15 mill

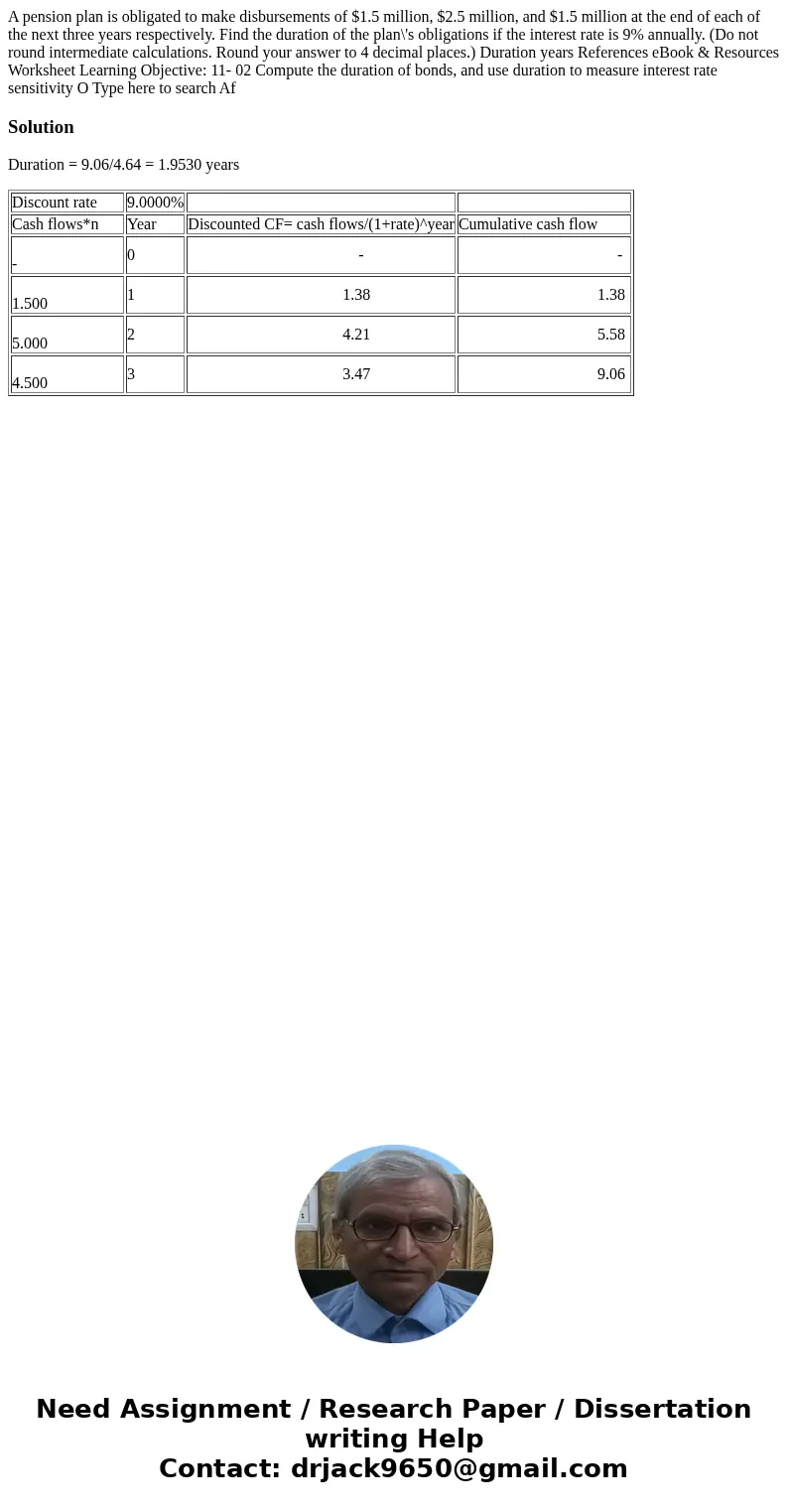

A pension plan is obligated to make disbursements of $1.5 million, $2.5 million, and $1.5 million at the end of each of the next three years respectively. Find the duration of the plan\'s obligations if the interest rate is 9% annually. (Do not round intermediate calculations. Round your answer to 4 decimal places.) Duration years References eBook & Resources Worksheet Learning Objective: 11- 02 Compute the duration of bonds, and use duration to measure interest rate sensitivity O Type here to search Af

Solution

Duration = 9.06/4.64 = 1.9530 years

| Discount rate | 9.0000% | ||

| Cash flows*n | Year | Discounted CF= cash flows/(1+rate)^year | Cumulative cash flow |

| - | 0 | - | - |

| 1.500 | 1 | 1.38 | 1.38 |

| 5.000 | 2 | 4.21 | 5.58 |

| 4.500 | 3 | 3.47 | 9.06 |

Homework Sourse

Homework Sourse