Must use codeblocks C An IRS agent is checking taxpayers ret

Solution

#include <iostream>

#include <fstream>

using namespace std;

const int size=100;

//read tax data from file and save into parallel arrauys

int readFromFile(int taxid[size],double earnings[size],double tax[size])

{

int n=0;

int tmp;

ifstream myfile (\"earnings.txt\");

if (myfile.is_open())

{

while(myfile>>tmp)

{

n++;

taxid[n]=tmp;

myfile>>earnings[n];

myfile>>tax[n];

}

myfile.close();

}

else

cout << \"Unable to open file\";

return n;

}

//calculate tax based on conditions provided

void calTax(int n,int taxid[],double earnings[],double tax[],double refund[],double penalty[])

{

cout<<\"\ ******Calculating tax*********\ \";

//loop though each tax payer

for(int i=0;i<=n;i++)

{

//display the detils ofe ach tx payer

cout<<\"\ ID: \"<<taxid[i];

cout<<\"\ Earnings: \"<<earnings[i];

cout<<\"\ Tax Paid: \"<<tax[i];

//if earnings aren\'t between 30K and 40K,just exit

if(earnings[i]>30000 && earnings[i]<=40000)

{

cout<<\"\ You are currently outside the tax cal bracket. Hence,no tax ia calauclated.\";

}

//else actual tax calculation comes into picture

else

{

//calculate taxtobe paid based on income and check if refund/penalty has to be initiated

double taxToBePaid=earnings[i]*0.205;

//if he has paid less tax

if(tax[i]<taxToBePaid)

{

//caculate tax due

double taxDue=taxToBePaid-tax[i];

if(taxDue>1300)

{

penalty[i]+=0.02*(taxDue-1300);

}

penalty[i]+=taxDue*.04;

tax[i]+=penalty[i];

cout<<\"\ Penalty of \"<<penalty[i]<<\" has to be paid. You new tax now is \"<<tax[i];

}

//else calculate refund amt

else if(tax[i]>taxToBePaid)

{

refund[i]=tax[i]-taxToBePaid;

cout<<\"\ Refund of \"<<refund[i] <<\"will be initiated\";

}

}

}

cout<<\"\ ******Calculating tax DONE*********\";

}

//get count of tax payers

int getTaxPayerinRange(int n,double penalty[])

{

int count=0;

for(int i=0;i<=n;i++)

{

if(penalty[i]==0)

count++;

}

return count;

}

//get count of tax payers who has refund

int getTaxPayerRefund(int n,double refund[])

{

int count=0;

for(int i=0;i<=n;i++)

{

if(refund[i]>0)

count++;

}

return count;

}

//get amt of refund amount

double getRefundAmt(int n,double refund[])

{

double amt=0;

for(int i=0;i<=n;i++)

{

if(refund[i]>0)

amt+=refund[i];

}

return amt;

}

//get count of tax payers who pay penalty

int getTaxPayerPenalty(int n,double penalty[])

{

int count=0;

for(int i=0;i<=n;i++)

{

if(penalty[i]>0)

count++;

}

return count;

}

//get penalty amount

double getPenaltyAmt(int n,double penalty[])

{

double amt=0;

for(int i=0;i<=n;i++)

{

if(penalty[i]>0)

amt+=penalty[i];

}

return amt;

}

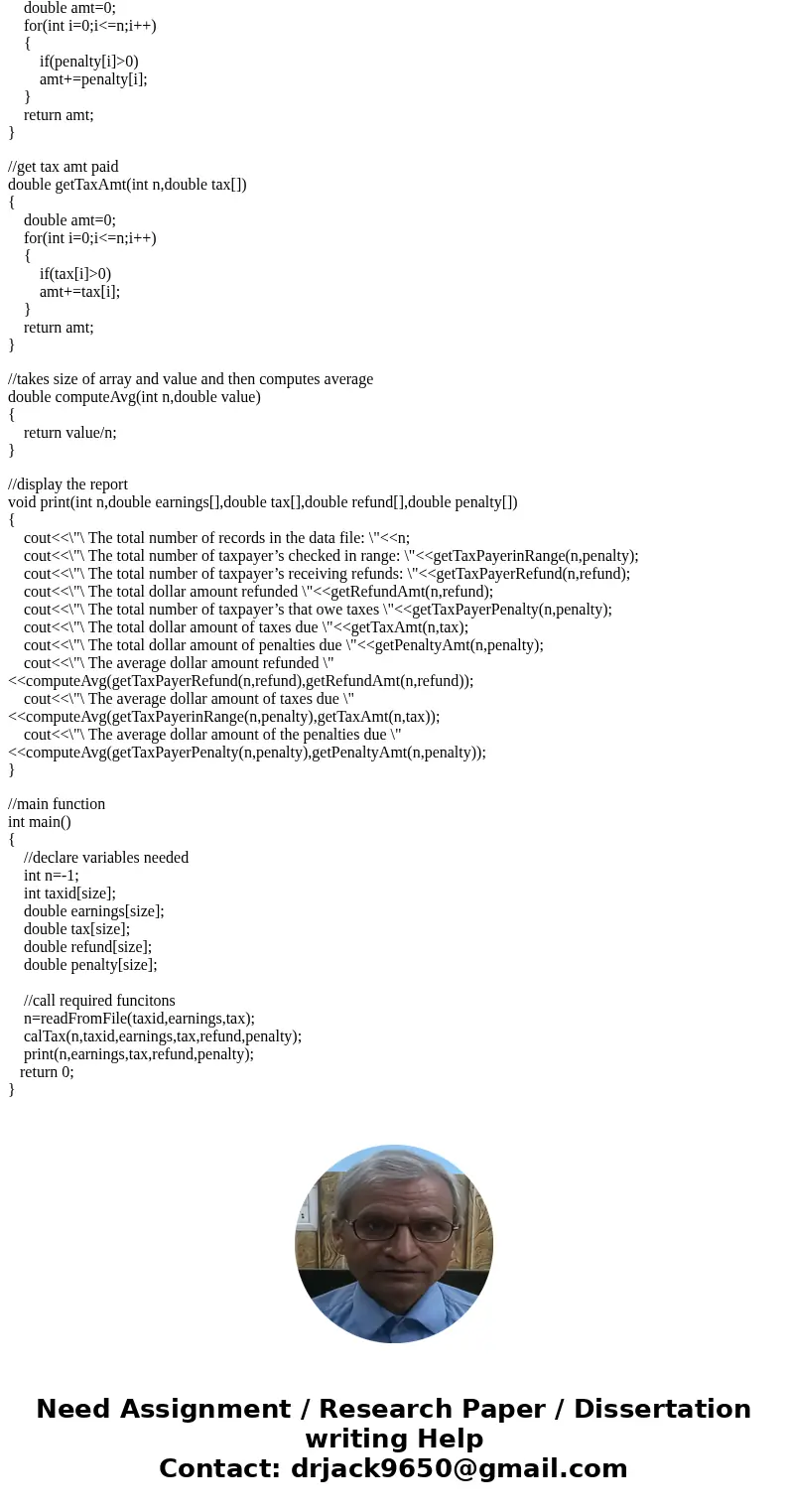

//get tax amt paid

double getTaxAmt(int n,double tax[])

{

double amt=0;

for(int i=0;i<=n;i++)

{

if(tax[i]>0)

amt+=tax[i];

}

return amt;

}

//takes size of array and value and then computes average

double computeAvg(int n,double value)

{

return value/n;

}

//display the report

void print(int n,double earnings[],double tax[],double refund[],double penalty[])

{

cout<<\"\ The total number of records in the data file: \"<<n;

cout<<\"\ The total number of taxpayer’s checked in range: \"<<getTaxPayerinRange(n,penalty);

cout<<\"\ The total number of taxpayer’s receiving refunds: \"<<getTaxPayerRefund(n,refund);

cout<<\"\ The total dollar amount refunded \"<<getRefundAmt(n,refund);

cout<<\"\ The total number of taxpayer’s that owe taxes \"<<getTaxPayerPenalty(n,penalty);

cout<<\"\ The total dollar amount of taxes due \"<<getTaxAmt(n,tax);

cout<<\"\ The total dollar amount of penalties due \"<<getPenaltyAmt(n,penalty);

cout<<\"\ The average dollar amount refunded \"<<computeAvg(getTaxPayerRefund(n,refund),getRefundAmt(n,refund));

cout<<\"\ The average dollar amount of taxes due \"<<computeAvg(getTaxPayerinRange(n,penalty),getTaxAmt(n,tax));

cout<<\"\ The average dollar amount of the penalties due \"<<computeAvg(getTaxPayerPenalty(n,penalty),getPenaltyAmt(n,penalty));

}

//main function

int main()

{

//declare variables needed

int n=-1;

int taxid[size];

double earnings[size];

double tax[size];

double refund[size];

double penalty[size];

//call required funcitons

n=readFromFile(taxid,earnings,tax);

calTax(n,taxid,earnings,tax,refund,penalty);

print(n,earnings,tax,refund,penalty);

return 0;

}

Homework Sourse

Homework Sourse