1 Selected balances for Tyner Company are as follows 2017 20

1. Selected balances for Tyner Company are as follows:

2017; 2016

Equipment 100,000; 40,000

Accumulated Depreciation (30,000); (10,000)

A. Tyner sold equipment that originally cost $50,000 at a gain of $4,000

B. Depreciaton expense for the year was $60,000

C. Tyner had an equipment purchase for cash during the year

Prepare the investing section of the cash flow statement for Tyner.

2. Selected balances for Cole Company are as follows:

2017; 2016

Long-Term Notes Payable 100,000; 150,000

Common Stock 150,000; 100,000

Paid in Capital 200,000; 100,000

Retained Earnings 100,000; 50,000

A. No new notes were borrowed during the year

B. Common stock was issued for cash

C. Net income for the year was $75,000

Prepare the financing section of the cash flow statement for Cole.

Solution

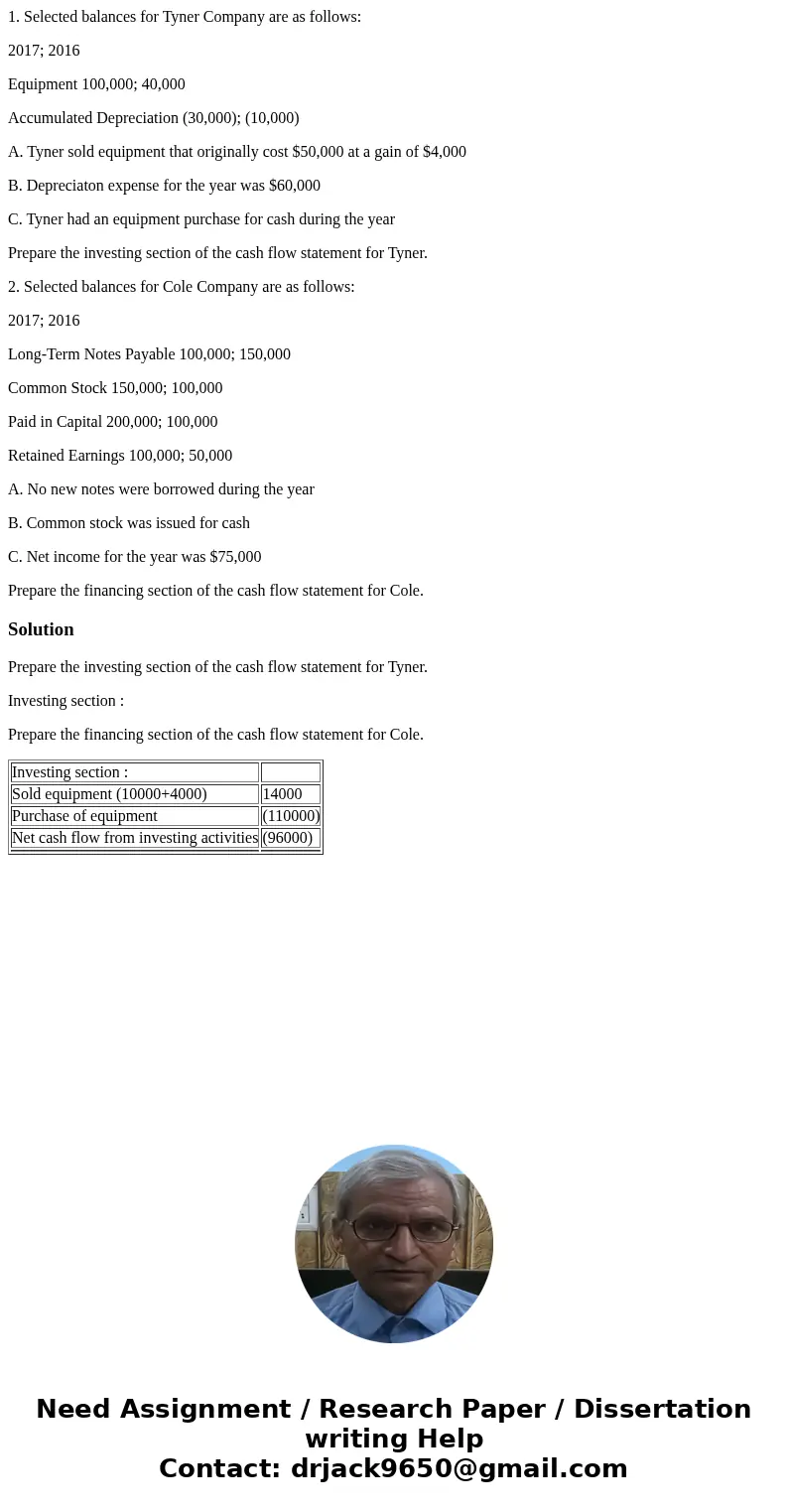

Prepare the investing section of the cash flow statement for Tyner.

Investing section :

Prepare the financing section of the cash flow statement for Cole.

| Investing section : | |

| Sold equipment (10000+4000) | 14000 |

| Purchase of equipment | (110000) |

| Net cash flow from investing activities | (96000) |

Homework Sourse

Homework Sourse