Question 8 Record the following transactions for Redeker Co

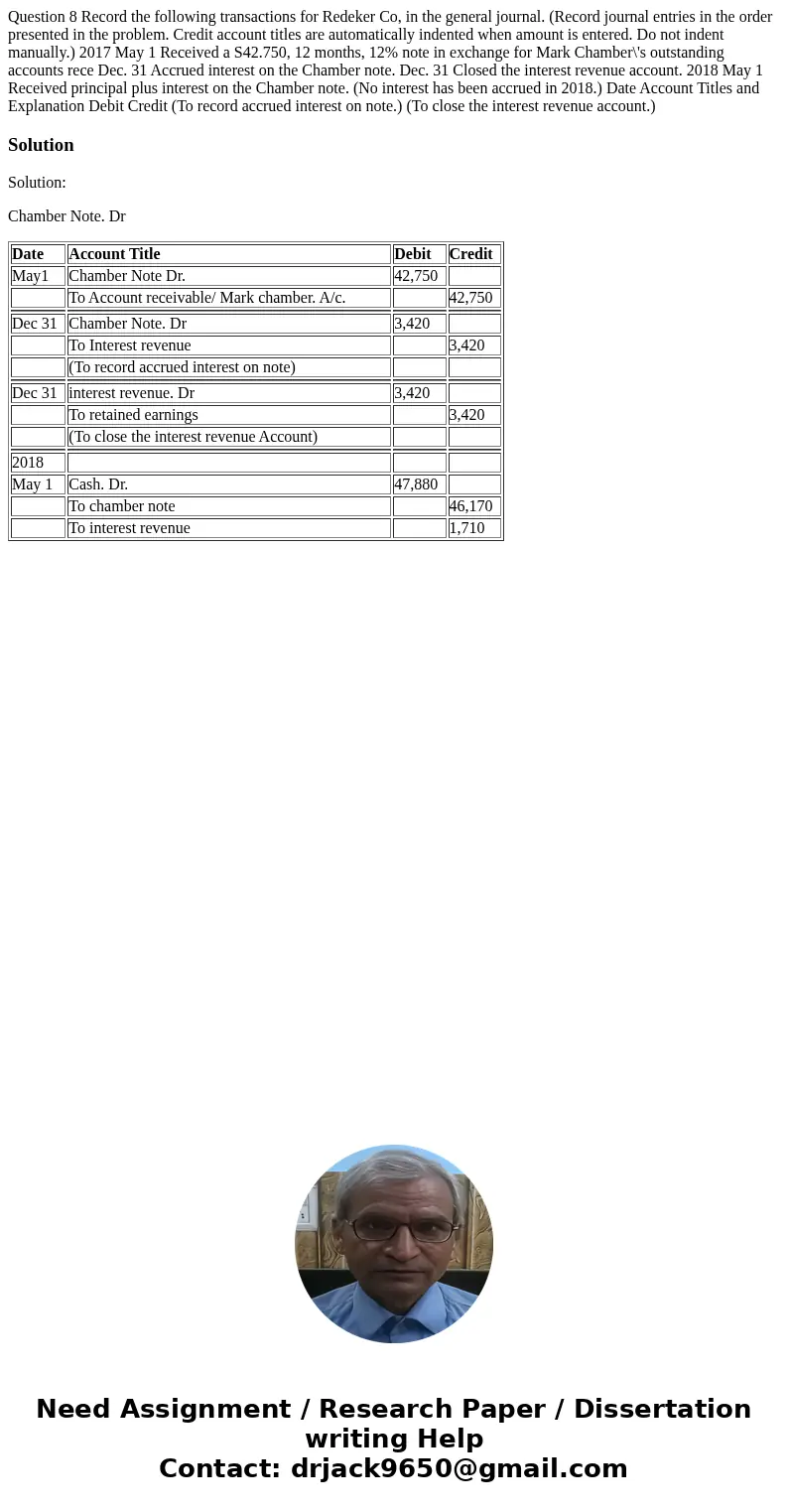

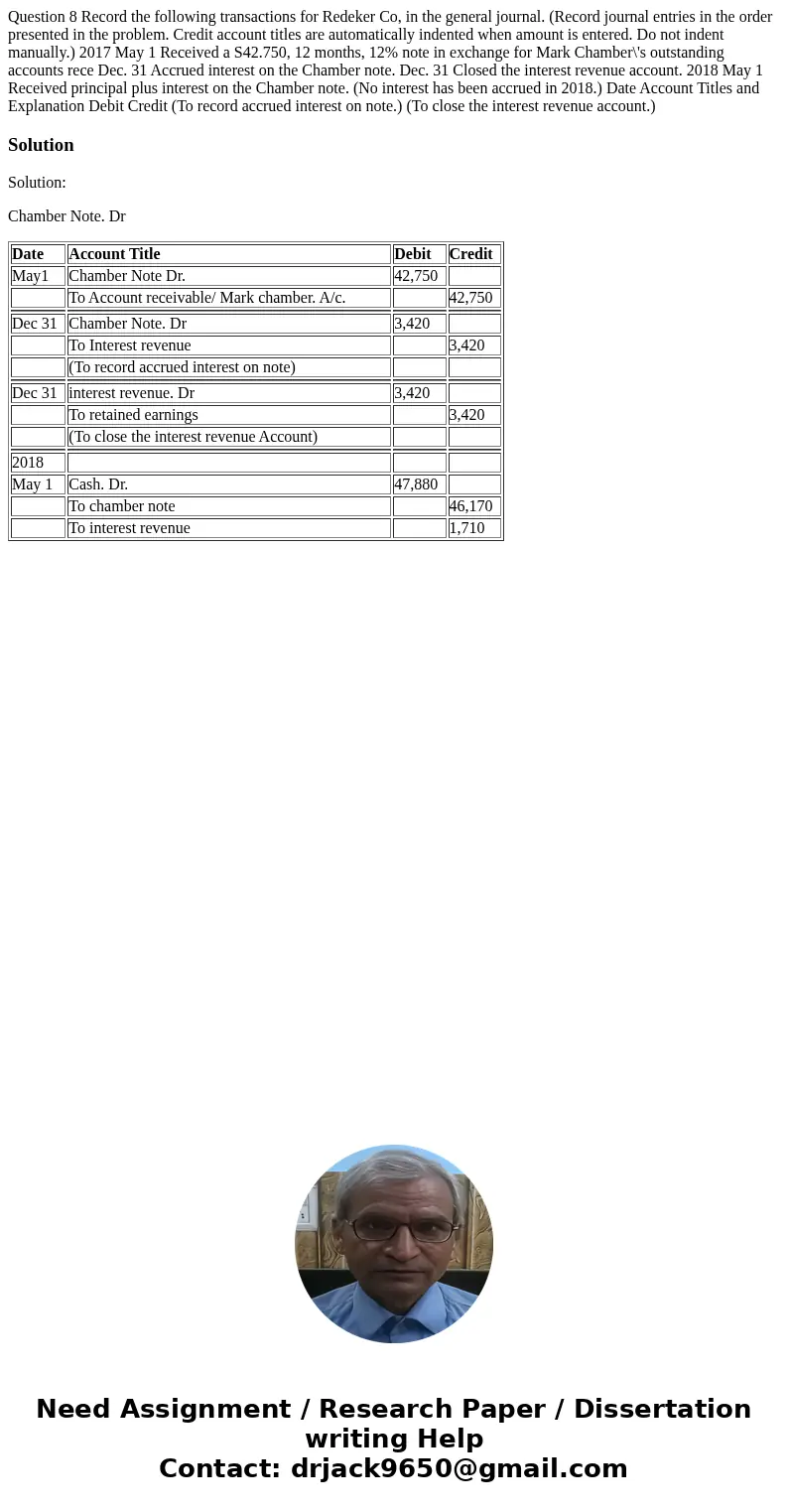

Question 8 Record the following transactions for Redeker Co, in the general journal. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.) 2017 May 1 Received a S42.750, 12 months, 12% note in exchange for Mark Chamber\'s outstanding accounts rece Dec. 31 Accrued interest on the Chamber note. Dec. 31 Closed the interest revenue account. 2018 May 1 Received principal plus interest on the Chamber note. (No interest has been accrued in 2018.) Date Account Titles and Explanation Debit Credit (To record accrued interest on note.) (To close the interest revenue account.)

Solution

Solution:

Chamber Note. Dr

| Date | Account Title | Debit | Credit |

| May1 | Chamber Note Dr. | 42,750 | |

| To Account receivable/ Mark chamber. A/c. | 42,750 | ||

| Dec 31 | Chamber Note. Dr | 3,420 | |

| To Interest revenue | 3,420 | ||

| (To record accrued interest on note) | |||

| Dec 31 | interest revenue. Dr | 3,420 | |

| To retained earnings | 3,420 | ||

| (To close the interest revenue Account) | |||

| 2018 | |||

| May 1 | Cash. Dr. | 47,880 | |

| To chamber note | 46,170 | ||

| To interest revenue | 1,710 |

Homework Sourse

Homework Sourse