Thermal Rising Inc makes paragliders for sale through specia

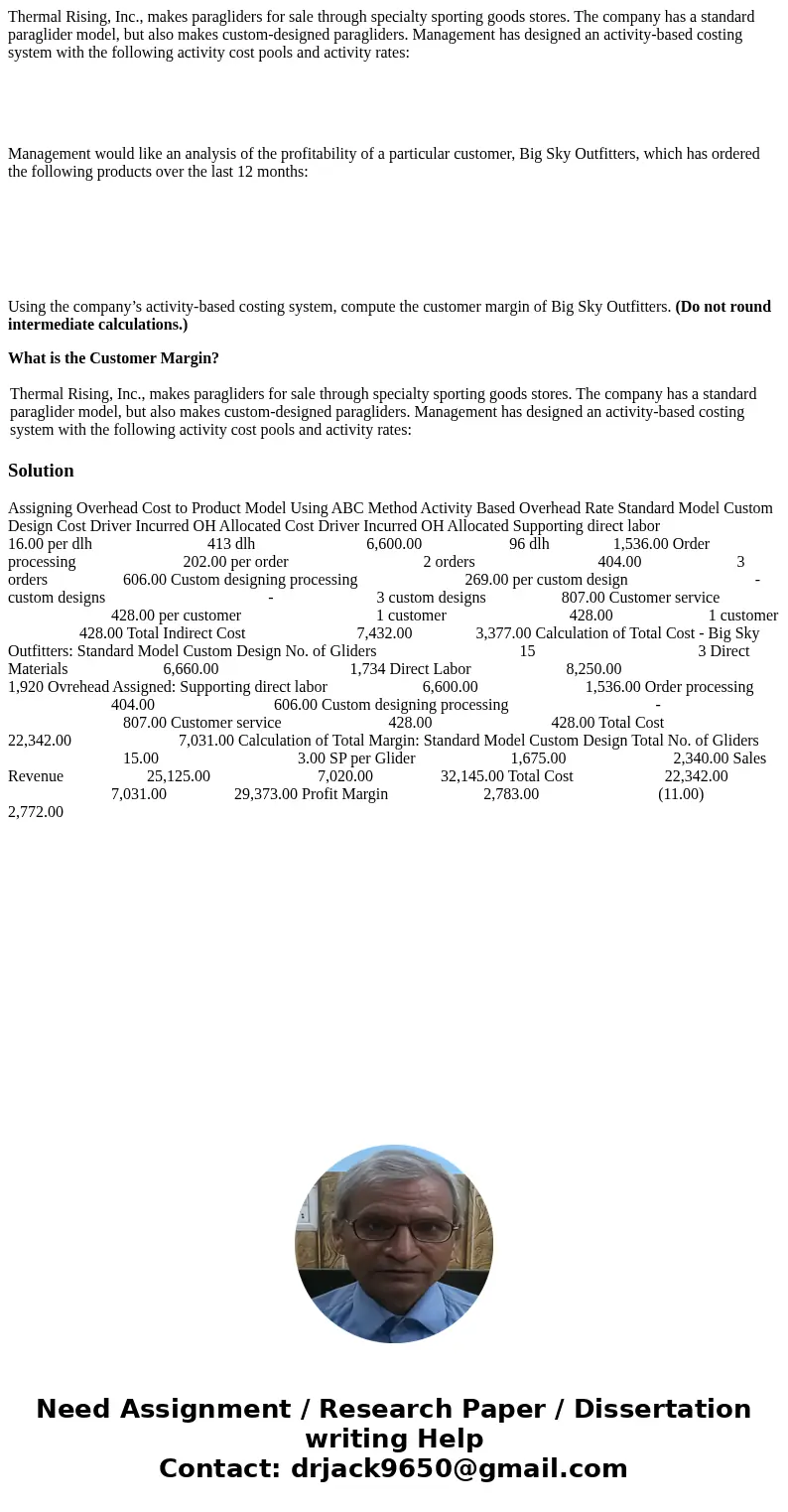

Thermal Rising, Inc., makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management has designed an activity-based costing system with the following activity cost pools and activity rates:

Management would like an analysis of the profitability of a particular customer, Big Sky Outfitters, which has ordered the following products over the last 12 months:

Using the company’s activity-based costing system, compute the customer margin of Big Sky Outfitters. (Do not round intermediate calculations.)

What is the Customer Margin?

| Thermal Rising, Inc., makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management has designed an activity-based costing system with the following activity cost pools and activity rates: |

Solution

Assigning Overhead Cost to Product Model Using ABC Method Activity Based Overhead Rate Standard Model Custom Design Cost Driver Incurred OH Allocated Cost Driver Incurred OH Allocated Supporting direct labor 16.00 per dlh 413 dlh 6,600.00 96 dlh 1,536.00 Order processing 202.00 per order 2 orders 404.00 3 orders 606.00 Custom designing processing 269.00 per custom design - custom designs - 3 custom designs 807.00 Customer service 428.00 per customer 1 customer 428.00 1 customer 428.00 Total Indirect Cost 7,432.00 3,377.00 Calculation of Total Cost - Big Sky Outfitters: Standard Model Custom Design No. of Gliders 15 3 Direct Materials 6,660.00 1,734 Direct Labor 8,250.00 1,920 Ovrehead Assigned: Supporting direct labor 6,600.00 1,536.00 Order processing 404.00 606.00 Custom designing processing - 807.00 Customer service 428.00 428.00 Total Cost 22,342.00 7,031.00 Calculation of Total Margin: Standard Model Custom Design Total No. of Gliders 15.00 3.00 SP per Glider 1,675.00 2,340.00 Sales Revenue 25,125.00 7,020.00 32,145.00 Total Cost 22,342.00 7,031.00 29,373.00 Profit Margin 2,783.00 (11.00) 2,772.00

Homework Sourse

Homework Sourse