Question 5 Date Account Titles and Explanation Debit Credit

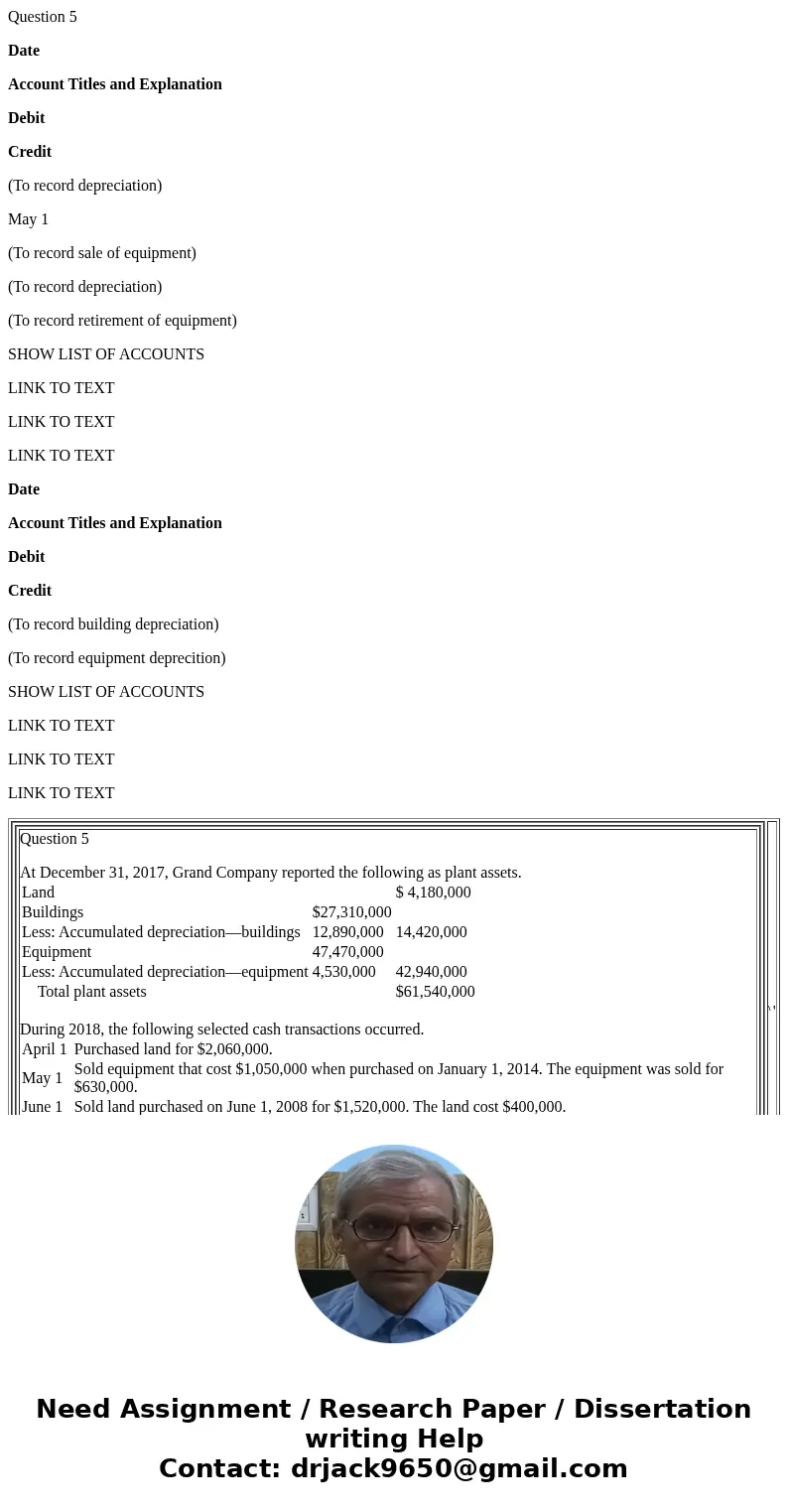

Question 5

Date

Account Titles and Explanation

Debit

Credit

(To record depreciation)

May 1

(To record sale of equipment)

(To record depreciation)

(To record retirement of equipment)

SHOW LIST OF ACCOUNTS

LINK TO TEXT

LINK TO TEXT

LINK TO TEXT

Date

Account Titles and Explanation

Debit

Credit

(To record building depreciation)

(To record equipment deprecition)

SHOW LIST OF ACCOUNTS

LINK TO TEXT

LINK TO TEXT

LINK TO TEXT

|

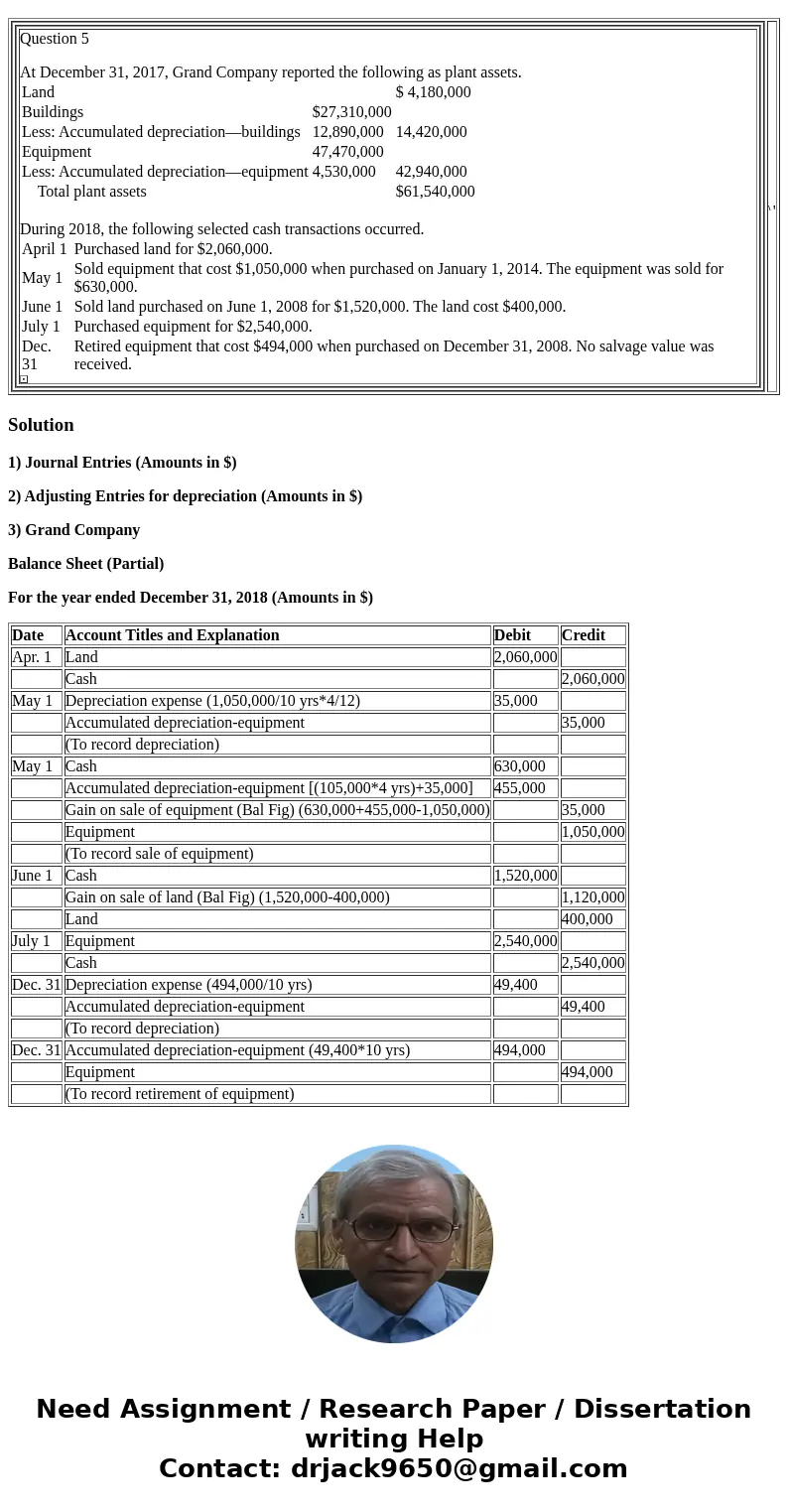

Solution

1) Journal Entries (Amounts in $)

2) Adjusting Entries for depreciation (Amounts in $)

3) Grand Company

Balance Sheet (Partial)

For the year ended December 31, 2018 (Amounts in $)

| Date | Account Titles and Explanation | Debit | Credit |

| Apr. 1 | Land | 2,060,000 | |

| Cash | 2,060,000 | ||

| May 1 | Depreciation expense (1,050,000/10 yrs*4/12) | 35,000 | |

| Accumulated depreciation-equipment | 35,000 | ||

| (To record depreciation) | |||

| May 1 | Cash | 630,000 | |

| Accumulated depreciation-equipment [(105,000*4 yrs)+35,000] | 455,000 | ||

| Gain on sale of equipment (Bal Fig) (630,000+455,000-1,050,000) | 35,000 | ||

| Equipment | 1,050,000 | ||

| (To record sale of equipment) | |||

| June 1 | Cash | 1,520,000 | |

| Gain on sale of land (Bal Fig) (1,520,000-400,000) | 1,120,000 | ||

| Land | 400,000 | ||

| July 1 | Equipment | 2,540,000 | |

| Cash | 2,540,000 | ||

| Dec. 31 | Depreciation expense (494,000/10 yrs) | 49,400 | |

| Accumulated depreciation-equipment | 49,400 | ||

| (To record depreciation) | |||

| Dec. 31 | Accumulated depreciation-equipment (49,400*10 yrs) | 494,000 | |

| Equipment | 494,000 | ||

| (To record retirement of equipment) |

Homework Sourse

Homework Sourse