oncomflowconnecthtml Help Week 1 Practice Problems 6 2 On Ja

Solution

Straight line method

Year

Acquisition cost

salvage value

useful life

annual depreciation =(acquisition cost-salvage value)/no of years

Accumulated depreciation

2019

633000

43000

4

147500

147500

2020

633000

43000

4

147500

295000

2021

633000

43000

4

147500

442500

Double declining method

Straight line rate of depreciation

1/4

25%

double declining rate

.25*2

50%

Year

Book value of machine

Double declining rate

annual depreciation

Accumulated depreciation

Year end balance

2019

633000

50%

316500

316500

316500

2020

316500

50%

158250

474750

158250

2021

158250

50%

79125

553875

79125

Sum of year digit method

sum of year

4+3+2+1

10

Year

Book value of machine

salvage value

sum of year digit

annual depreciation

Accumulated depreciation

2019

633000

43000

4/10

236000

236000

2020

633000

43000

3/10

177000

413000

2021

633000

43000

2/10

118000

531000

Book value of asset at the end of year 2020 using double declining method

(633000-442500)

190500

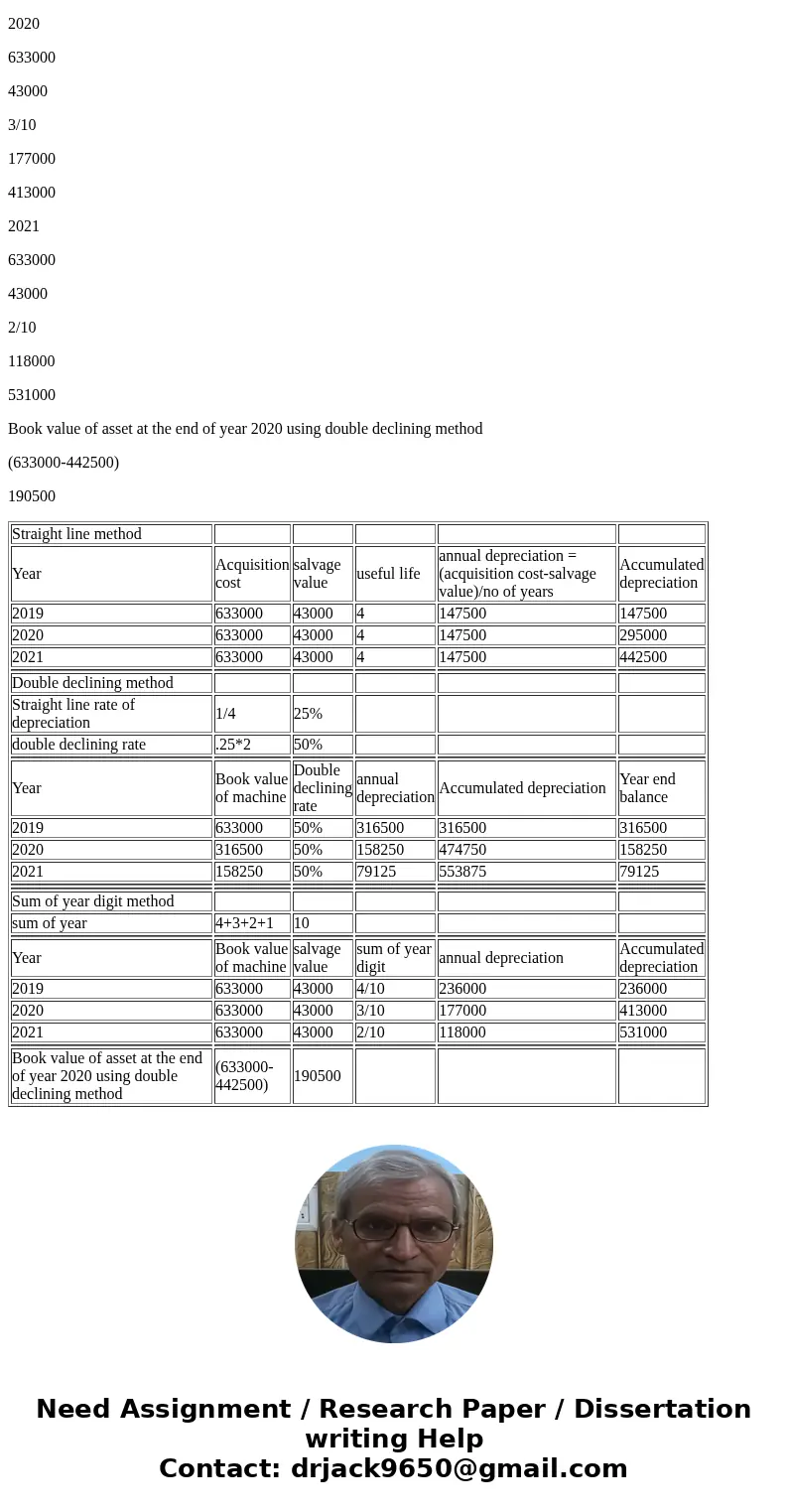

| Straight line method | |||||

| Year | Acquisition cost | salvage value | useful life | annual depreciation =(acquisition cost-salvage value)/no of years | Accumulated depreciation |

| 2019 | 633000 | 43000 | 4 | 147500 | 147500 |

| 2020 | 633000 | 43000 | 4 | 147500 | 295000 |

| 2021 | 633000 | 43000 | 4 | 147500 | 442500 |

| Double declining method | |||||

| Straight line rate of depreciation | 1/4 | 25% | |||

| double declining rate | .25*2 | 50% | |||

| Year | Book value of machine | Double declining rate | annual depreciation | Accumulated depreciation | Year end balance |

| 2019 | 633000 | 50% | 316500 | 316500 | 316500 |

| 2020 | 316500 | 50% | 158250 | 474750 | 158250 |

| 2021 | 158250 | 50% | 79125 | 553875 | 79125 |

| Sum of year digit method | |||||

| sum of year | 4+3+2+1 | 10 | |||

| Year | Book value of machine | salvage value | sum of year digit | annual depreciation | Accumulated depreciation |

| 2019 | 633000 | 43000 | 4/10 | 236000 | 236000 |

| 2020 | 633000 | 43000 | 3/10 | 177000 | 413000 |

| 2021 | 633000 | 43000 | 2/10 | 118000 | 531000 |

| Book value of asset at the end of year 2020 using double declining method | (633000-442500) | 190500 |

Homework Sourse

Homework Sourse