Exercise 810 Coronado Industries has the following transacti

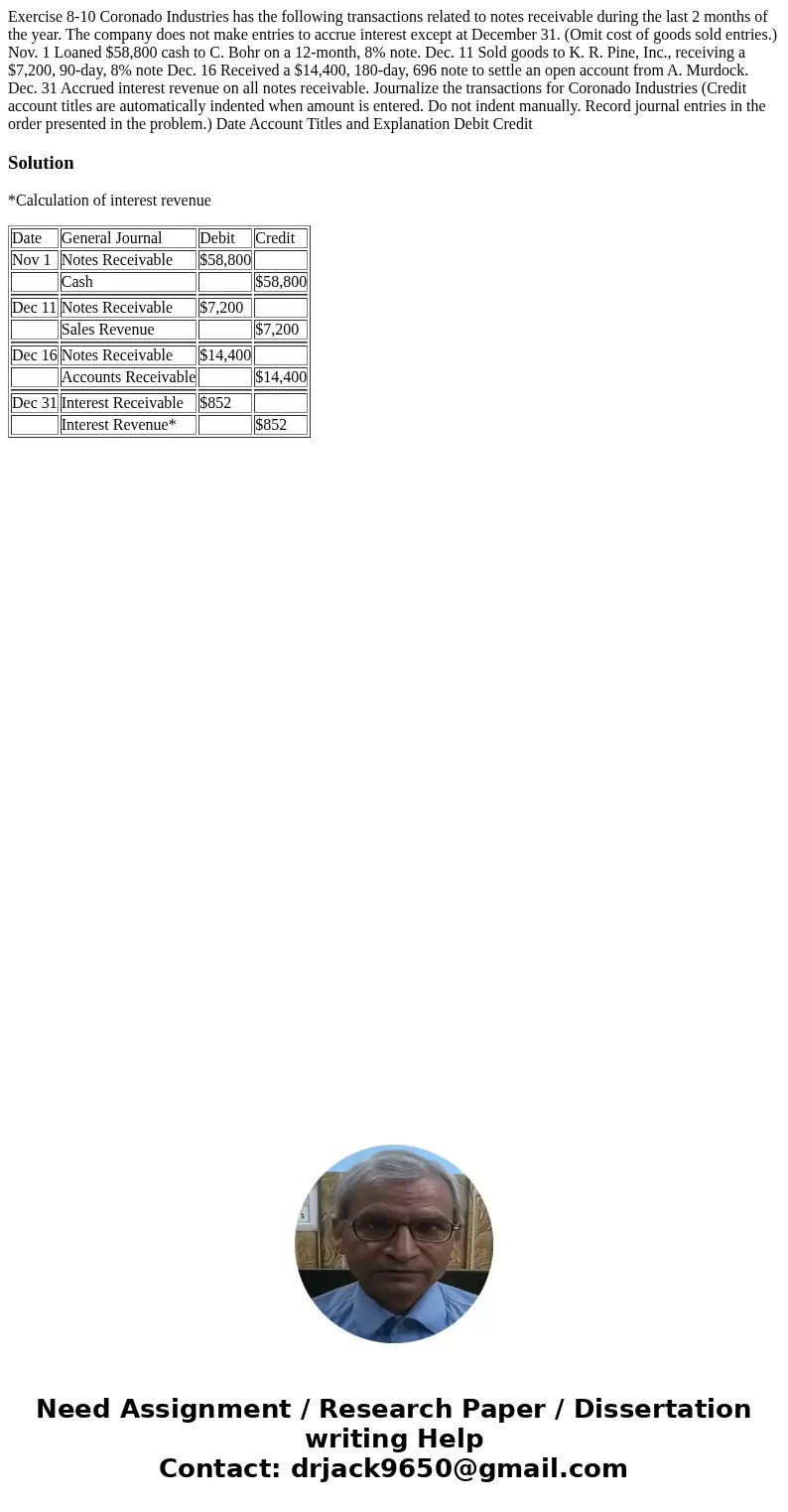

Exercise 8-10 Coronado Industries has the following transactions related to notes receivable during the last 2 months of the year. The company does not make entries to accrue interest except at December 31. (Omit cost of goods sold entries.) Nov. 1 Loaned $58,800 cash to C. Bohr on a 12-month, 8% note. Dec. 11 Sold goods to K. R. Pine, Inc., receiving a $7,200, 90-day, 8% note Dec. 16 Received a $14,400, 180-day, 696 note to settle an open account from A. Murdock. Dec. 31 Accrued interest revenue on all notes receivable. Journalize the transactions for Coronado Industries (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit

Solution

*Calculation of interest revenue

| Date | General Journal | Debit | Credit |

| Nov 1 | Notes Receivable | $58,800 | |

| Cash | $58,800 | ||

| Dec 11 | Notes Receivable | $7,200 | |

| Sales Revenue | $7,200 | ||

| Dec 16 | Notes Receivable | $14,400 | |

| Accounts Receivable | $14,400 | ||

| Dec 31 | Interest Receivable | $852 | |

| Interest Revenue* | $852 |

Homework Sourse

Homework Sourse