Exercise 103 Myers Company uses a flexible budget for manufa

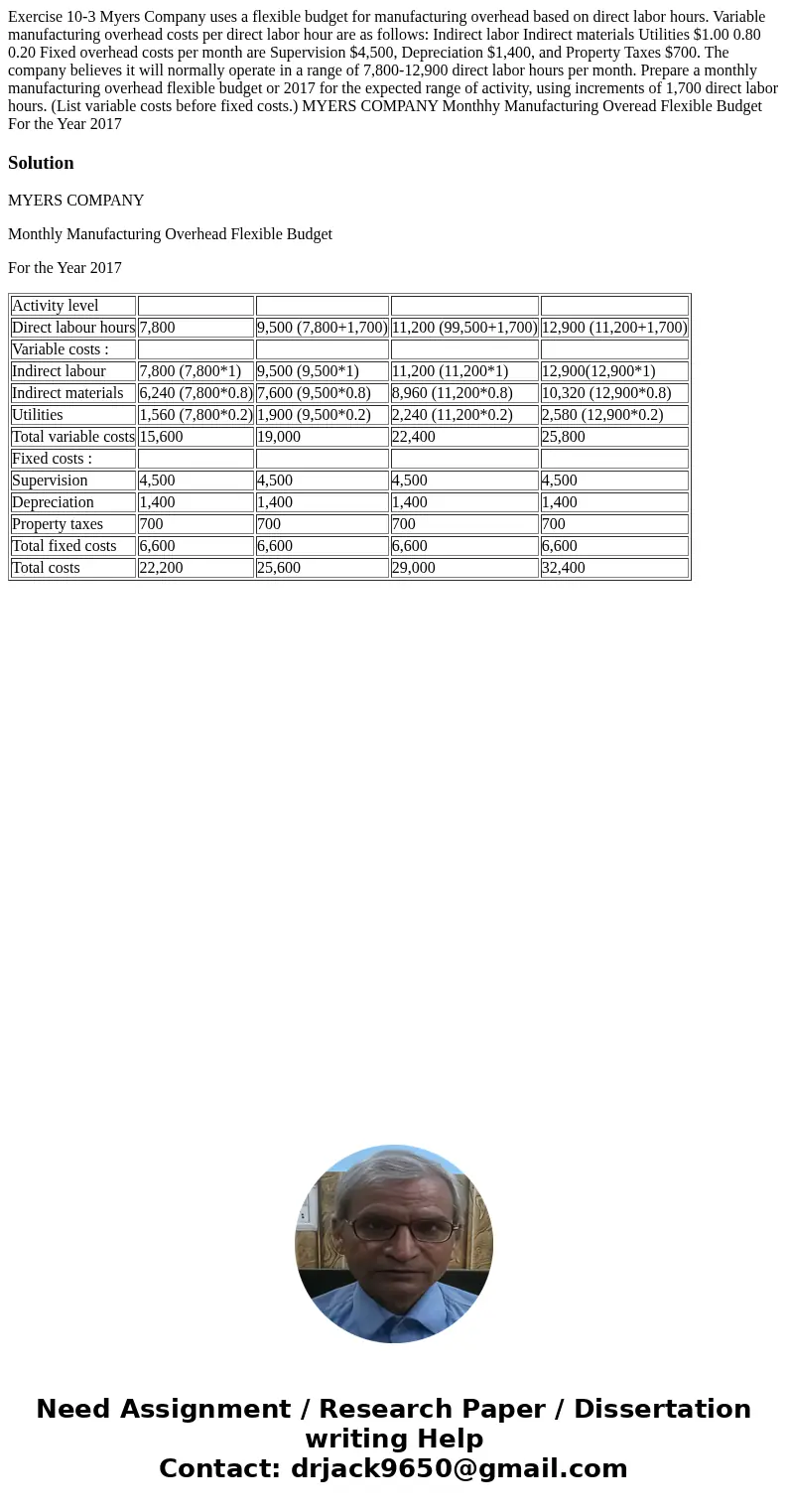

Exercise 10-3 Myers Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows: Indirect labor Indirect materials Utilities $1.00 0.80 0.20 Fixed overhead costs per month are Supervision $4,500, Depreciation $1,400, and Property Taxes $700. The company believes it will normally operate in a range of 7,800-12,900 direct labor hours per month. Prepare a monthly manufacturing overhead flexible budget or 2017 for the expected range of activity, using increments of 1,700 direct labor hours. (List variable costs before fixed costs.) MYERS COMPANY Monthhy Manufacturing Overead Flexible Budget For the Year 2017

Solution

MYERS COMPANY

Monthly Manufacturing Overhead Flexible Budget

For the Year 2017

| Activity level | ||||

| Direct labour hours | 7,800 | 9,500 (7,800+1,700) | 11,200 (99,500+1,700) | 12,900 (11,200+1,700) |

| Variable costs : | ||||

| Indirect labour | 7,800 (7,800*1) | 9,500 (9,500*1) | 11,200 (11,200*1) | 12,900(12,900*1) |

| Indirect materials | 6,240 (7,800*0.8) | 7,600 (9,500*0.8) | 8,960 (11,200*0.8) | 10,320 (12,900*0.8) |

| Utilities | 1,560 (7,800*0.2) | 1,900 (9,500*0.2) | 2,240 (11,200*0.2) | 2,580 (12,900*0.2) |

| Total variable costs | 15,600 | 19,000 | 22,400 | 25,800 |

| Fixed costs : | ||||

| Supervision | 4,500 | 4,500 | 4,500 | 4,500 |

| Depreciation | 1,400 | 1,400 | 1,400 | 1,400 |

| Property taxes | 700 | 700 | 700 | 700 |

| Total fixed costs | 6,600 | 6,600 | 6,600 | 6,600 |

| Total costs | 22,200 | 25,600 | 29,000 | 32,400 |

Homework Sourse

Homework Sourse