QUESTION 2 Transfer Pricing from the Viewpoint of the Entire

Solution

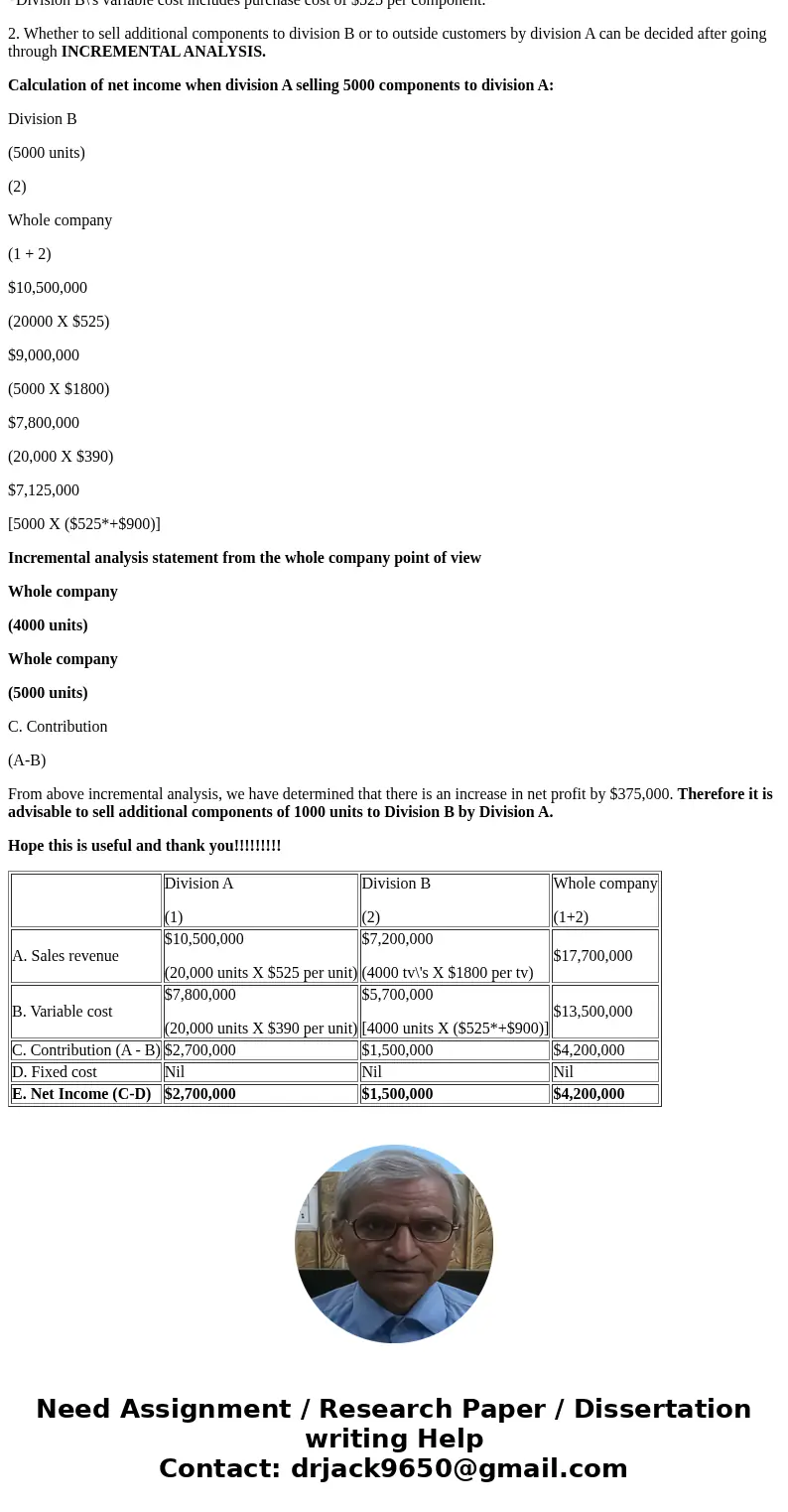

1. Income statement for the last year:

Division A

(1)

Division B

(2)

Whole company

(1+2)

$10,500,000

(20,000 units X $525 per unit)

$7,200,000

(4000 tv\'s X $1800 per tv)

$17,700,000

$7,800,000

(20,000 units X $390 per unit)

$5,700,000

[4000 units X ($525*+$900)]

C. Contribution (A - B)

*Division B\'s variable cost includes purchase cost of $525 per component.

2. Whether to sell additional components to division B or to outside customers by division A can be decided after going through INCREMENTAL ANALYSIS.

Calculation of net income when division A selling 5000 components to division A:

Division B

(5000 units)

(2)

Whole company

(1 + 2)

$10,500,000

(20000 X $525)

$9,000,000

(5000 X $1800)

$7,800,000

(20,000 X $390)

$7,125,000

[5000 X ($525*+$900)]

Incremental analysis statement from the whole company point of view

Whole company

(4000 units)

Whole company

(5000 units)

C. Contribution

(A-B)

From above incremental analysis, we have determined that there is an increase in net profit by $375,000. Therefore it is advisable to sell additional components of 1000 units to Division B by Division A.

Hope this is useful and thank you!!!!!!!!!

| Division A (1) | Division B (2) | Whole company (1+2) | |

| A. Sales revenue | $10,500,000 (20,000 units X $525 per unit) | $7,200,000 (4000 tv\'s X $1800 per tv) | $17,700,000 |

| B. Variable cost | $7,800,000 (20,000 units X $390 per unit) | $5,700,000 [4000 units X ($525*+$900)] | $13,500,000 |

| C. Contribution (A - B) | $2,700,000 | $1,500,000 | $4,200,000 |

| D. Fixed cost | Nil | Nil | Nil |

| E. Net Income (C-D) | $2,700,000 | $1,500,000 | $4,200,000 |

Homework Sourse

Homework Sourse