7 On January 2 2018 Sax Company disposed of equipment for 16

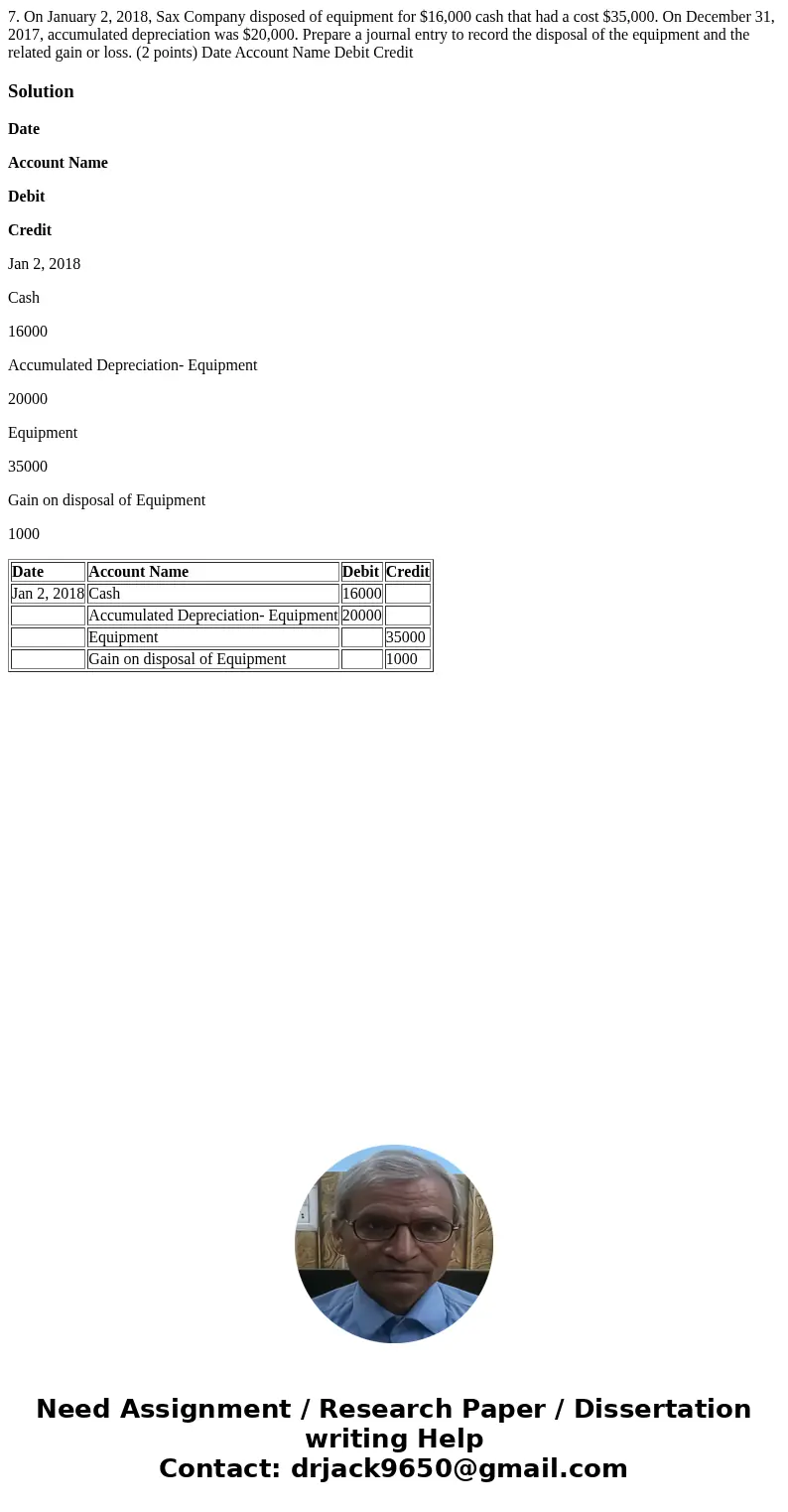

7. On January 2, 2018, Sax Company disposed of equipment for $16,000 cash that had a cost $35,000. On December 31, 2017, accumulated depreciation was $20,000. Prepare a journal entry to record the disposal of the equipment and the related gain or loss. (2 points) Date Account Name Debit Credit

Solution

Date

Account Name

Debit

Credit

Jan 2, 2018

Cash

16000

Accumulated Depreciation- Equipment

20000

Equipment

35000

Gain on disposal of Equipment

1000

| Date | Account Name | Debit | Credit |

| Jan 2, 2018 | Cash | 16000 | |

| Accumulated Depreciation- Equipment | 20000 | ||

| Equipment | 35000 | ||

| Gain on disposal of Equipment | 1000 |

Homework Sourse

Homework Sourse