CommonSized Income Statement Revenue and expense data for th

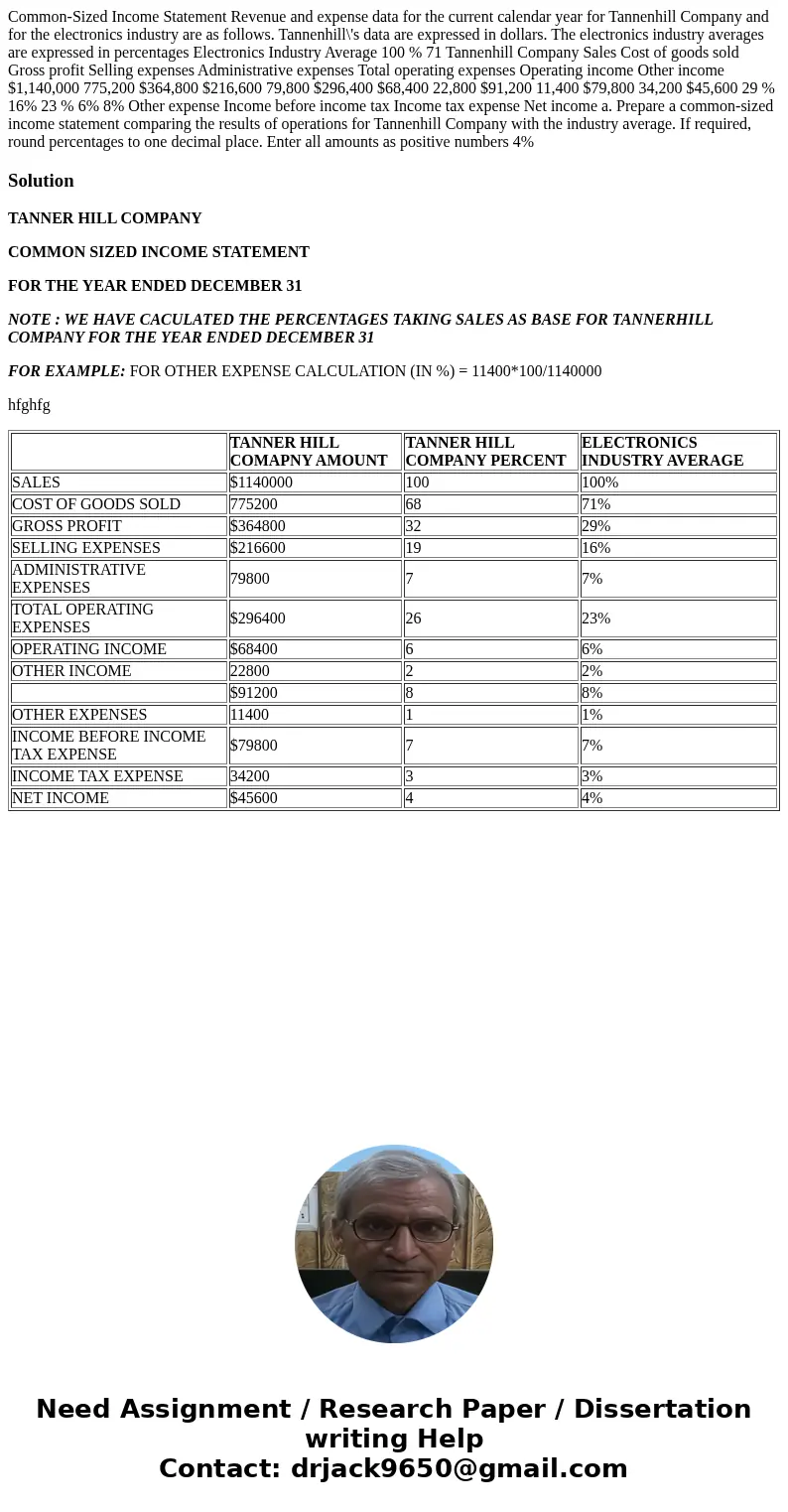

Common-Sized Income Statement Revenue and expense data for the current calendar year for Tannenhill Company and for the electronics industry are as follows. Tannenhill\'s data are expressed in dollars. The electronics industry averages are expressed in percentages Electronics Industry Average 100 % 71 Tannenhill Company Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total operating expenses Operating income Other income $1,140,000 775,200 $364,800 $216,600 79,800 $296,400 $68,400 22,800 $91,200 11,400 $79,800 34,200 $45,600 29 % 16% 23 % 6% 8% Other expense Income before income tax Income tax expense Net income a. Prepare a common-sized income statement comparing the results of operations for Tannenhill Company with the industry average. If required, round percentages to one decimal place. Enter all amounts as positive numbers 4%

Solution

TANNER HILL COMPANY

COMMON SIZED INCOME STATEMENT

FOR THE YEAR ENDED DECEMBER 31

NOTE : WE HAVE CACULATED THE PERCENTAGES TAKING SALES AS BASE FOR TANNERHILL COMPANY FOR THE YEAR ENDED DECEMBER 31

FOR EXAMPLE: FOR OTHER EXPENSE CALCULATION (IN %) = 11400*100/1140000

hfghfg

| TANNER HILL COMAPNY AMOUNT | TANNER HILL COMPANY PERCENT | ELECTRONICS INDUSTRY AVERAGE | |

| SALES | $1140000 | 100 | 100% |

| COST OF GOODS SOLD | 775200 | 68 | 71% |

| GROSS PROFIT | $364800 | 32 | 29% |

| SELLING EXPENSES | $216600 | 19 | 16% |

| ADMINISTRATIVE EXPENSES | 79800 | 7 | 7% |

| TOTAL OPERATING EXPENSES | $296400 | 26 | 23% |

| OPERATING INCOME | $68400 | 6 | 6% |

| OTHER INCOME | 22800 | 2 | 2% |

| $91200 | 8 | 8% | |

| OTHER EXPENSES | 11400 | 1 | 1% |

| INCOME BEFORE INCOME TAX EXPENSE | $79800 | 7 | 7% |

| INCOME TAX EXPENSE | 34200 | 3 | 3% |

| NET INCOME | $45600 | 4 | 4% |

Homework Sourse

Homework Sourse