Exercise 31 Part Level Submission Oriole Cash Ltd operates a

Exercise 3-1 (Part Level Submission) Oriole Cash, Ltd. operates a chain of exclusive ski hat boutiques in the western United States. The stores purchase several hat styles from a single distributor at $14 each. All other costs incurred by the company are fixed. Oriole Cash, Ltd. sells the hats for $38 each Your answer is correct. If fixed costs total $240,000 per year, what is the breakeven point in units? In sales dollars? (Use your answer of breakeven units to calculate the breakeven point in dollars.) 100001 hats The breakeven point The breakeven sales $ Click if you would like to Show Work for this question: 380000 Open Show Work SHOW SOLUTION LINK TO TEXT LINK TO VIDEO

Solution

b. Contribution margin 63%

(contribution/sales)*100

contribution=$38-$14=$24

=$24/$38=0.6315*100=63.15%

Variable cost ratio 36%

(variable cost/sales)*100

=$14/$38=0.36*100=36%

No of cakes to be sold to earn a net income of $101,920 per month 60960 units

=$101920*12+$240,000=$1,463,040

= $1,463,040/$24 = 60960 units

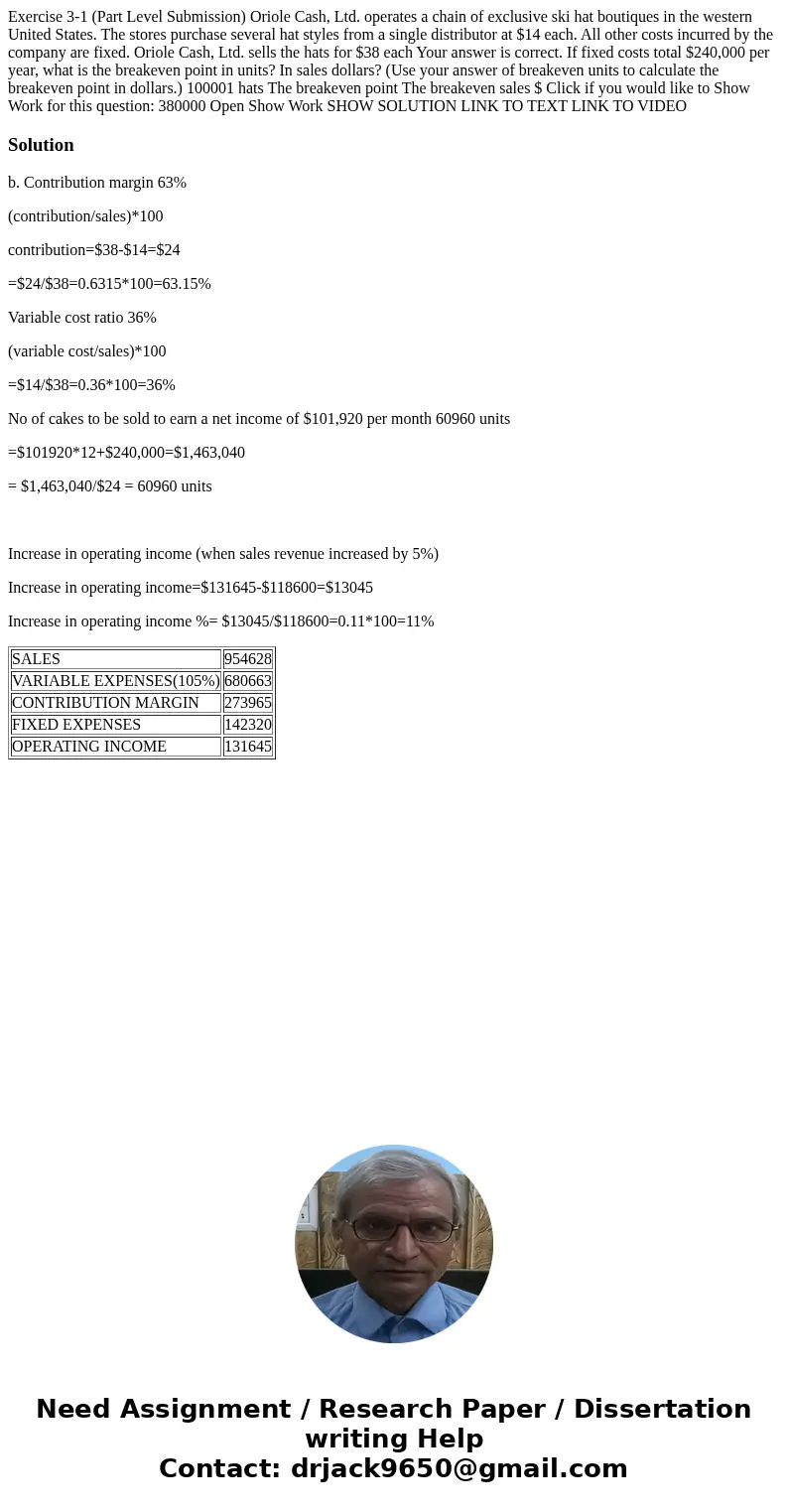

Increase in operating income (when sales revenue increased by 5%)

Increase in operating income=$131645-$118600=$13045

Increase in operating income %= $13045/$118600=0.11*100=11%

| SALES | 954628 |

| VARIABLE EXPENSES(105%) | 680663 |

| CONTRIBUTION MARGIN | 273965 |

| FIXED EXPENSES | 142320 |

| OPERATING INCOME | 131645 |

Homework Sourse

Homework Sourse