Problem 254A Analysis of income effects of additional busine

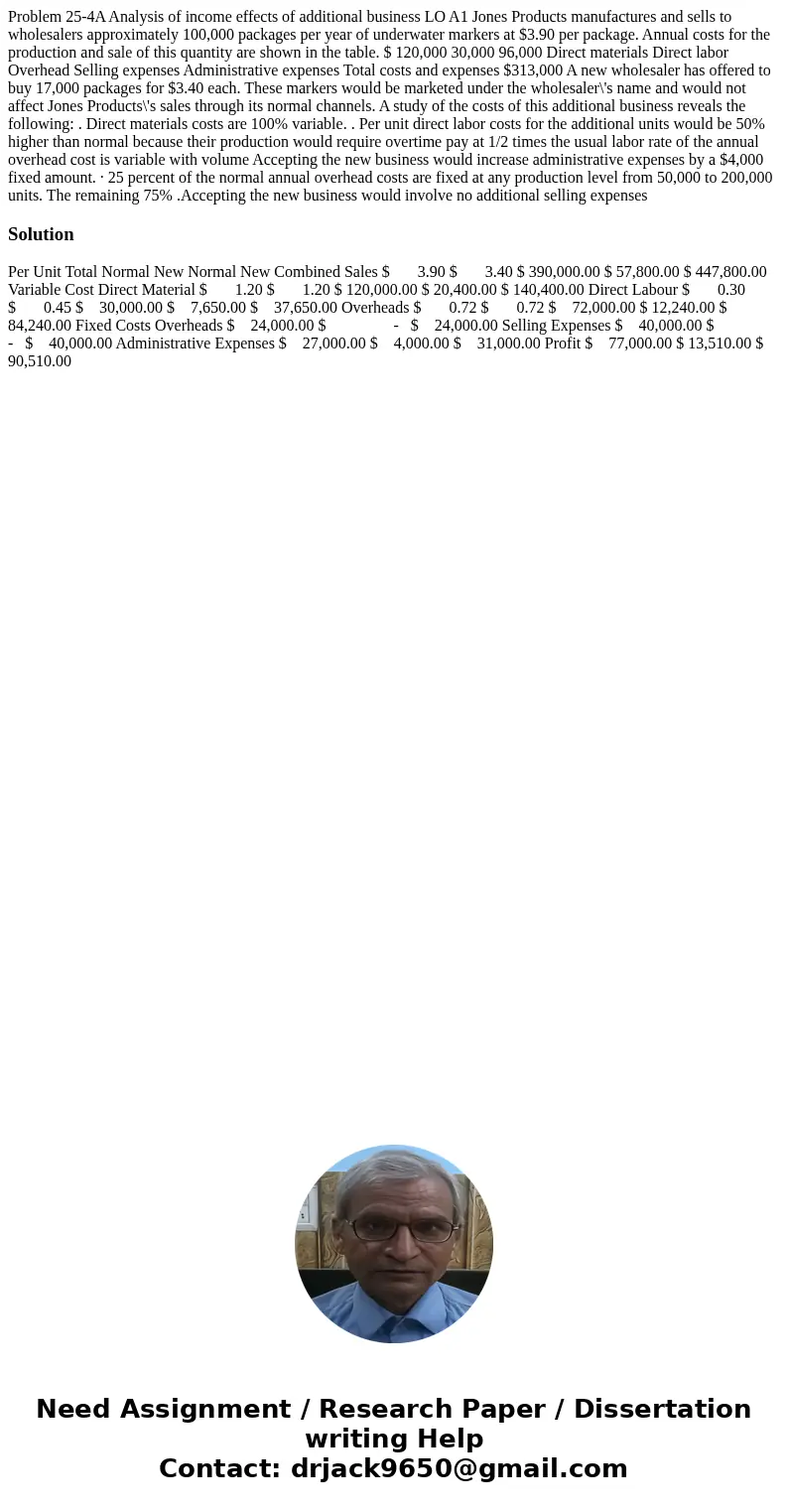

Problem 25-4A Analysis of income effects of additional business LO A1 Jones Products manufactures and sells to wholesalers approximately 100,000 packages per year of underwater markers at $3.90 per package. Annual costs for the production and sale of this quantity are shown in the table. $ 120,000 30,000 96,000 Direct materials Direct labor Overhead Selling expenses Administrative expenses Total costs and expenses $313,000 A new wholesaler has offered to buy 17,000 packages for $3.40 each. These markers would be marketed under the wholesaler\'s name and would not affect Jones Products\'s sales through its normal channels. A study of the costs of this additional business reveals the following: . Direct materials costs are 100% variable. . Per unit direct labor costs for the additional units would be 50% higher than normal because their production would require overtime pay at 1/2 times the usual labor rate of the annual overhead cost is variable with volume Accepting the new business would increase administrative expenses by a $4,000 fixed amount. · 25 percent of the normal annual overhead costs are fixed at any production level from 50,000 to 200,000 units. The remaining 75% .Accepting the new business would involve no additional selling expenses

Solution

Per Unit Total Normal New Normal New Combined Sales $ 3.90 $ 3.40 $ 390,000.00 $ 57,800.00 $ 447,800.00 Variable Cost Direct Material $ 1.20 $ 1.20 $ 120,000.00 $ 20,400.00 $ 140,400.00 Direct Labour $ 0.30 $ 0.45 $ 30,000.00 $ 7,650.00 $ 37,650.00 Overheads $ 0.72 $ 0.72 $ 72,000.00 $ 12,240.00 $ 84,240.00 Fixed Costs Overheads $ 24,000.00 $ - $ 24,000.00 Selling Expenses $ 40,000.00 $ - $ 40,000.00 Administrative Expenses $ 27,000.00 $ 4,000.00 $ 31,000.00 Profit $ 77,000.00 $ 13,510.00 $ 90,510.00

Homework Sourse

Homework Sourse