cengageNOWv2lOnlir Cengage Learni Cengage Learning Cengage

Solution

Purchased land for $320,000

Sold land of the book value of $176,000 for $157,000

Hence, loss on sale of land = $19,000

Loss on sale of land $ 19,000- It will be added to the net income

Cash received from the sale of land $157,000 - It is part of cash inflows from investing activities. It will be added.

Cash paid for purchase of land $320,000 - It is a part of cash outflows used in investing activities. It will be subtracted.

Dividends per share

20,000 shares of cumulative preferred 3% stock $100 par

50,000 shares of $30 par common stock

Dividends paid during the last 3 years :

Year 1 = $120,000

Year 2 = $30,000

Year 3 = $180,000

Dividend payable on preferred stock is $3 per share per year

Year 1

Dividend payable on preferred stock = 20,000 x 3

= $60,000

Hence, dividends paid on common shares = 120,000 - 60,000

= $60,000

Hence, dividend per share paid on common stock = 60,000/50,000

=$1.2

Year 3

Since, dividend per share paid on preferred stock in the year 2 was $1.5, although the dividend payable per share is $3, hence remaining $1.5 dividend per share will accumulate and it will be paid in the year 3.

Hence, dividend per share on preferred stock in year 3 will be = 3 + 1.5

= $4.5

Dividend payable on preferred stock = 20,000 x 4.5

= $90,000

Hence, dividends paid on common shares = 180,000 - 90,000

= $90,000

Hence, dividend per share paid on common stock = 90,000/50,000

=$1.8

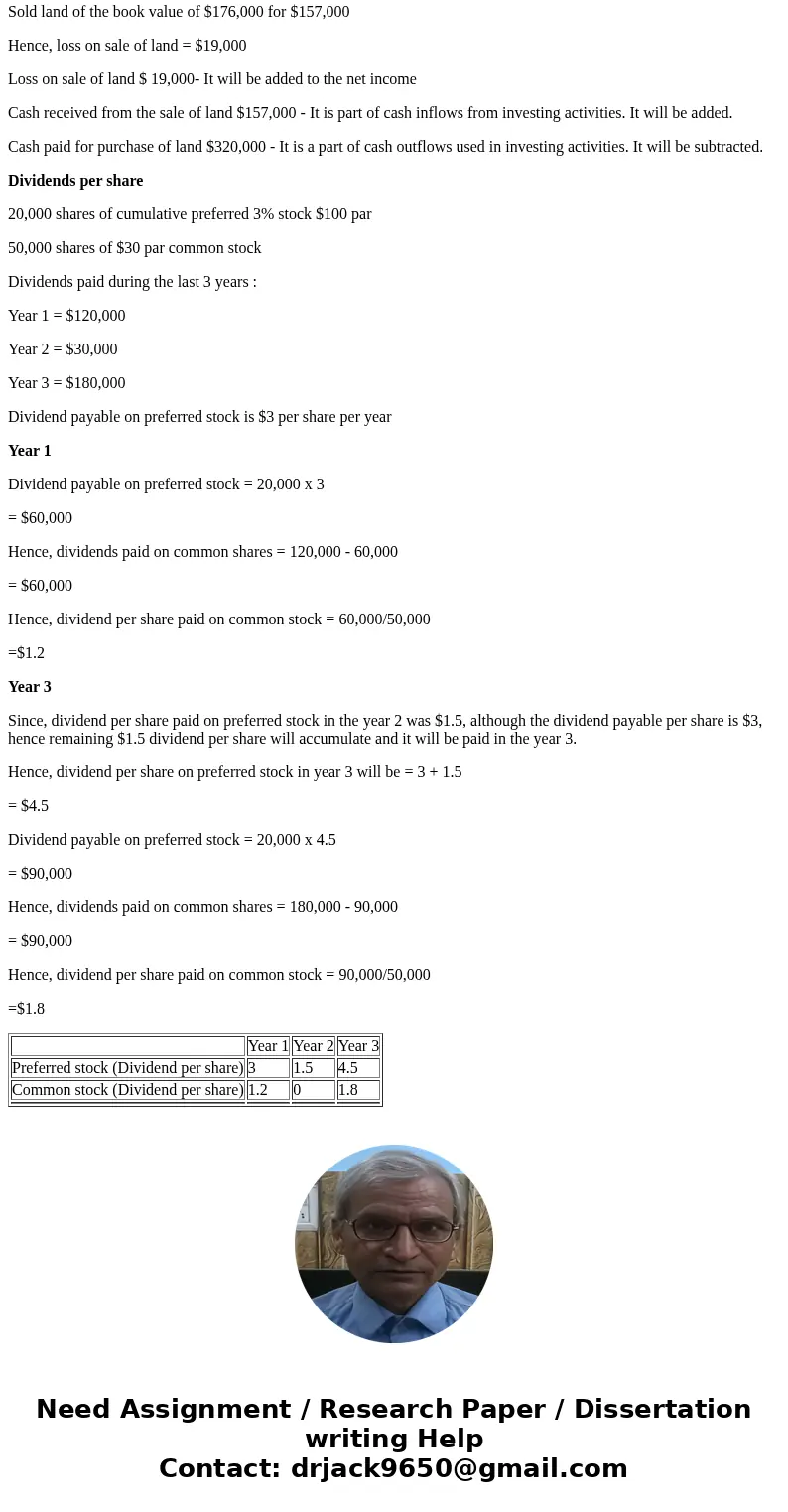

| Year 1 | Year 2 | Year 3 | |

| Preferred stock (Dividend per share) | 3 | 1.5 | 4.5 |

| Common stock (Dividend per share) | 1.2 | 0 | 1.8 |

Homework Sourse

Homework Sourse