In the current year Redland Corporations regular tax liabili

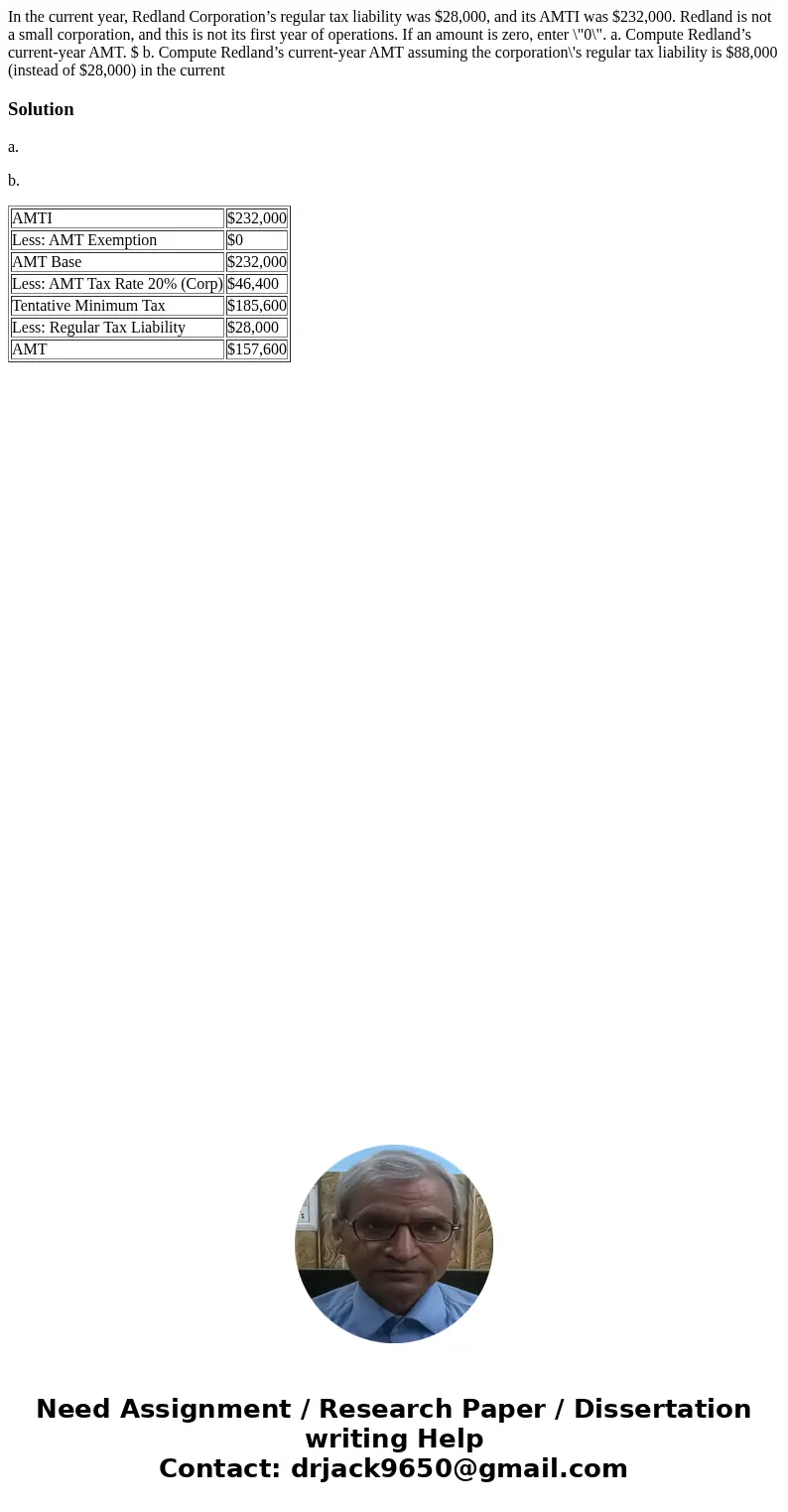

In the current year, Redland Corporation’s regular tax liability was $28,000, and its AMTI was $232,000. Redland is not a small corporation, and this is not its first year of operations. If an amount is zero, enter \"0\". a. Compute Redland’s current-year AMT. $ b. Compute Redland’s current-year AMT assuming the corporation\'s regular tax liability is $88,000 (instead of $28,000) in the current

Solution

a.

b.

| AMTI | $232,000 |

| Less: AMT Exemption | $0 |

| AMT Base | $232,000 |

| Less: AMT Tax Rate 20% (Corp) | $46,400 |

| Tentative Minimum Tax | $185,600 |

| Less: Regular Tax Liability | $28,000 |

| AMT | $157,600 |

Homework Sourse

Homework Sourse