Question 1 1 point At the beginning of the year XYZ had 2500

Question 1 (1 point) At the beginning of the year, XYZ had $250,000 in Accounts Receivable and $45,000 in Allowance for Doubtful Accounts. During the year XYZ sold $1,500,000 of product on account and collected $1,350,000 in cash. In addition, a customer declared bankruptcy so XYZ wrote-off $30,000 of outstanding Accounts Receivable. Question 1: Determine the ending balance in Accounts Receivable and Allowance for Doubtful Accounts before any adjusting entry or provision for bad debt expense is recorded

Solution

Q1) Determine ending balance of Account receivable and allowance for doubtful accounts

Ending balance of account receivable = 250000+1500000-1350000-30000 = 370000

Ending balance of allowance for doubtful accounts = 45000-30000 = 15000

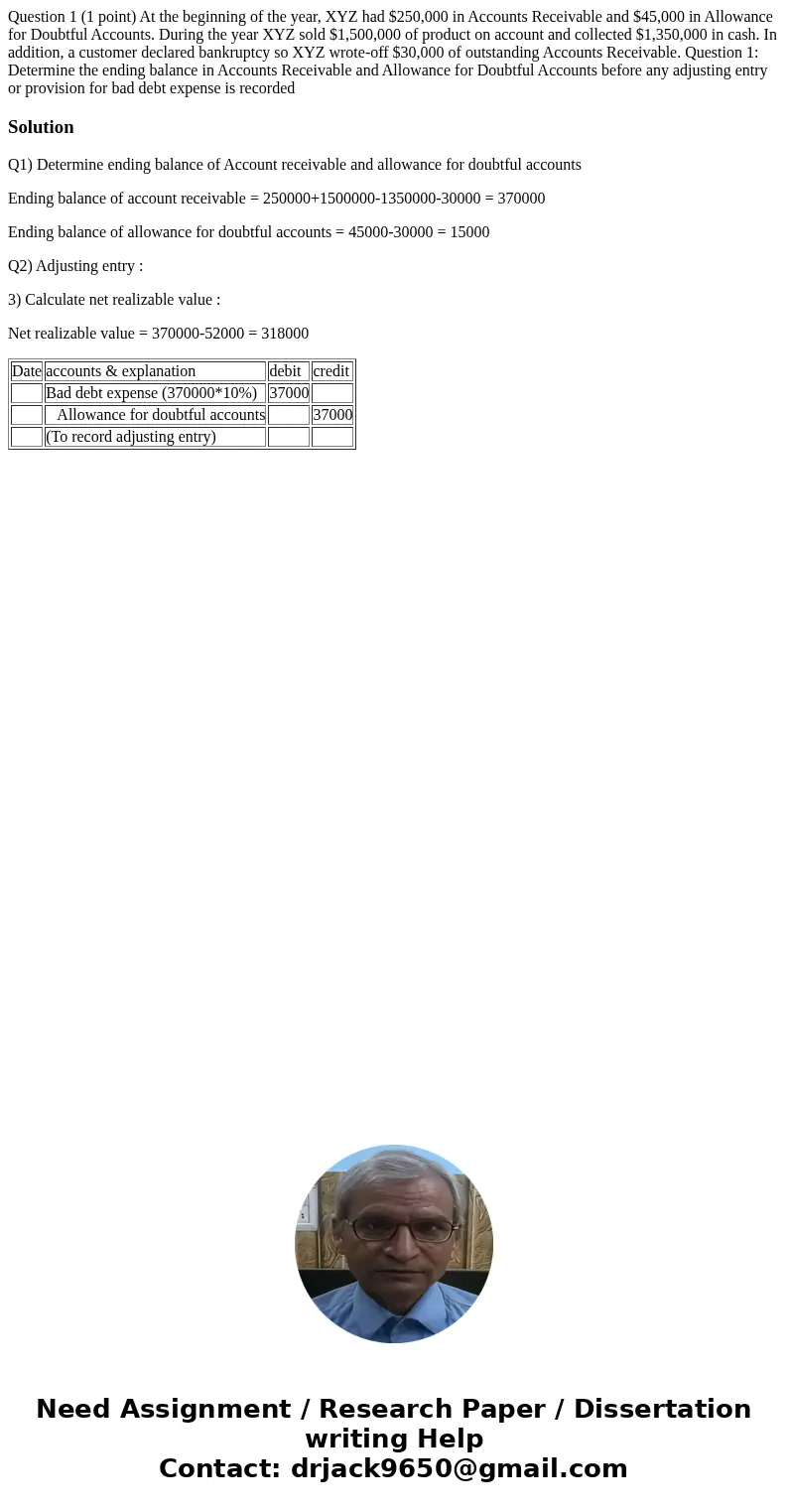

Q2) Adjusting entry :

3) Calculate net realizable value :

Net realizable value = 370000-52000 = 318000

| Date | accounts & explanation | debit | credit |

| Bad debt expense (370000*10%) | 37000 | ||

| Allowance for doubtful accounts | 37000 | ||

| (To record adjusting entry) |

Homework Sourse

Homework Sourse