Q2 6 Points A company purchased a machine for 35000 with exp

Q.2 (6 Points) A company purchased a machine for $35000 with expected useful life of 7 years and market value of $10000 at the end of 7 years. Compute the depreciation amount in year 4 (D4) and the Book Value at the end of year 5 (BV5) using (a) SL Depreciation Methood (b) MACRS Depreciation Method (c) DDB depreciation method

Solution

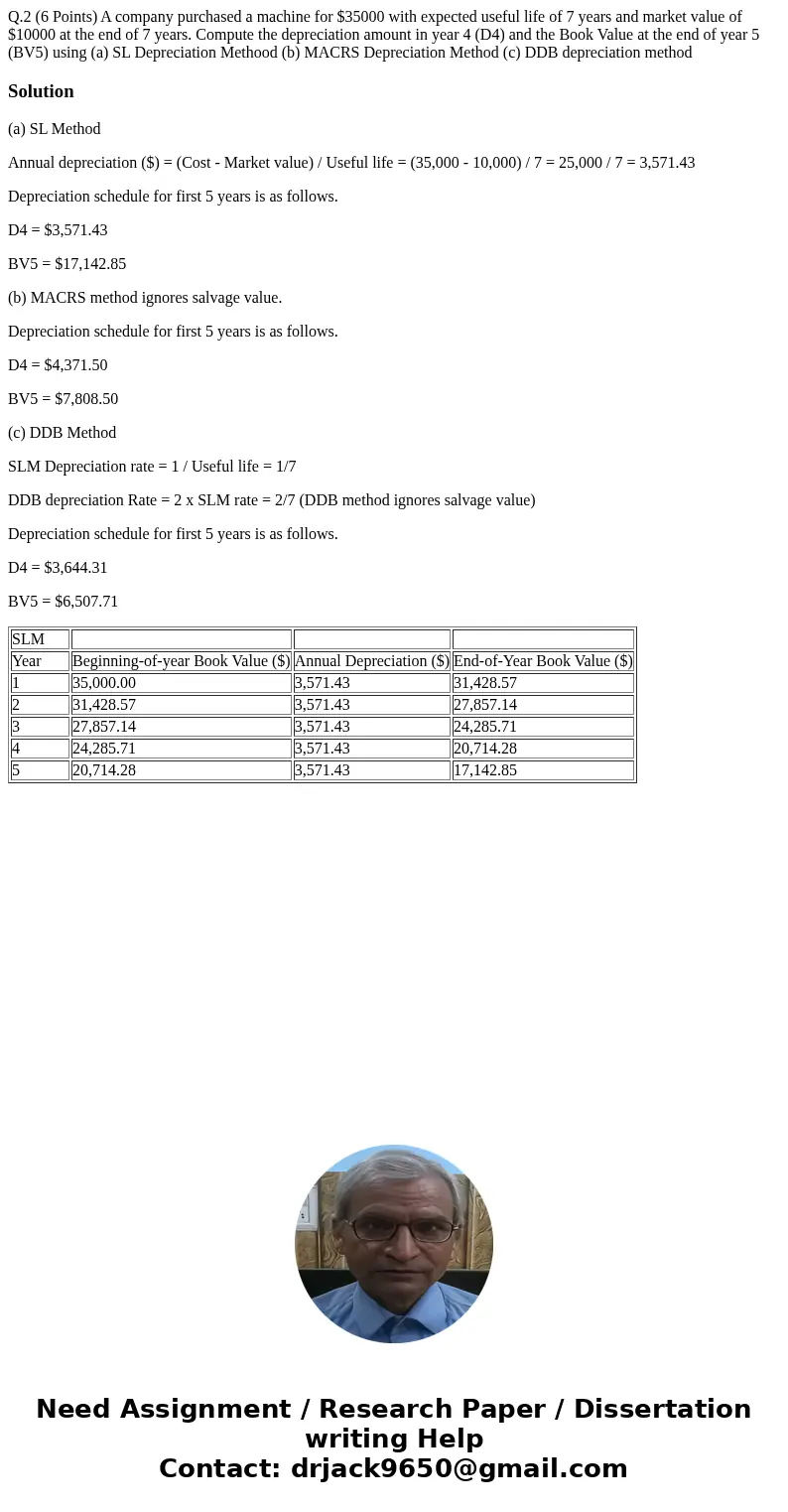

(a) SL Method

Annual depreciation ($) = (Cost - Market value) / Useful life = (35,000 - 10,000) / 7 = 25,000 / 7 = 3,571.43

Depreciation schedule for first 5 years is as follows.

D4 = $3,571.43

BV5 = $17,142.85

(b) MACRS method ignores salvage value.

Depreciation schedule for first 5 years is as follows.

D4 = $4,371.50

BV5 = $7,808.50

(c) DDB Method

SLM Depreciation rate = 1 / Useful life = 1/7

DDB depreciation Rate = 2 x SLM rate = 2/7 (DDB method ignores salvage value)

Depreciation schedule for first 5 years is as follows.

D4 = $3,644.31

BV5 = $6,507.71

| SLM | |||

| Year | Beginning-of-year Book Value ($) | Annual Depreciation ($) | End-of-Year Book Value ($) |

| 1 | 35,000.00 | 3,571.43 | 31,428.57 |

| 2 | 31,428.57 | 3,571.43 | 27,857.14 |

| 3 | 27,857.14 | 3,571.43 | 24,285.71 |

| 4 | 24,285.71 | 3,571.43 | 20,714.28 |

| 5 | 20,714.28 | 3,571.43 | 17,142.85 |

Homework Sourse

Homework Sourse