Mackenzie Company has decided to use a predetermined rate to

Mackenzie Company has decided to use a predetermined rate to assign factory overhead to production. The following predictions have been made for 2018: Estimate total factory overhead costs $240,000 Estimate direct labor hours Estimate direct labor costs Estimate machine hours 20,000 DLH 60,000 MH 19,000 DLH 61,000 MH $200,000 Actual direct labor hours Actual direct labor costs Actual machine bours $208,000 Required: a. Compute the predetermined factory overhead rate under three different bases: (1) direct labor hours, (2) b. Assume that actual factory overhead was $253,000 and that Mackenzie Company elected to apply factory direct labor costs, and (3) machine hours. (Round amounts to 2 decimal places.) overhead to Work in Process based on direct labor costs i. Was factory overhead or 2018 over-or under-applied? How much? ii. Give the journal entry to record the application of overhead Mackenzie Company follows the policy of writing off any under-or over-applied Factory Overhead balance to Cost of Goods Sold at the end of the year. Give the journal entry necessary at the end of 2018 to dispose of the Factory Overhead balance determined in Part (b) c.

Solution

a) Predetermined Overhead Rate :-

Based on Direct Labor Hours ;-

= Estimated total factory overhead costs / Estimated direct labor hours

= $240000 / 20000 H

= $12 per direct labor hour

Based on Direct Labor Costs :-

= Estimated total factory overhead costs / Estimated direct labor costs

= $240000 / $200000

= 120% of direct labor costs

Based on Machine Hours ;-

= Estimated total factory overhead costs / Estimated Machine hours

= $240000 / 60000 H

= $4 per machine hour

Calculation of Under or Overapplied factory overheads :-

= Actual Factory Overhead - Applied Factory Overhead

= $253000 - (Actual Direct Labor Costs * Predetermined Overhead Rate)

= $253000 - ($208000 * 120%)

= $253000 - $249600

= $3400 Underapplied

Journal Entry ;-

c) Journal Entry :-

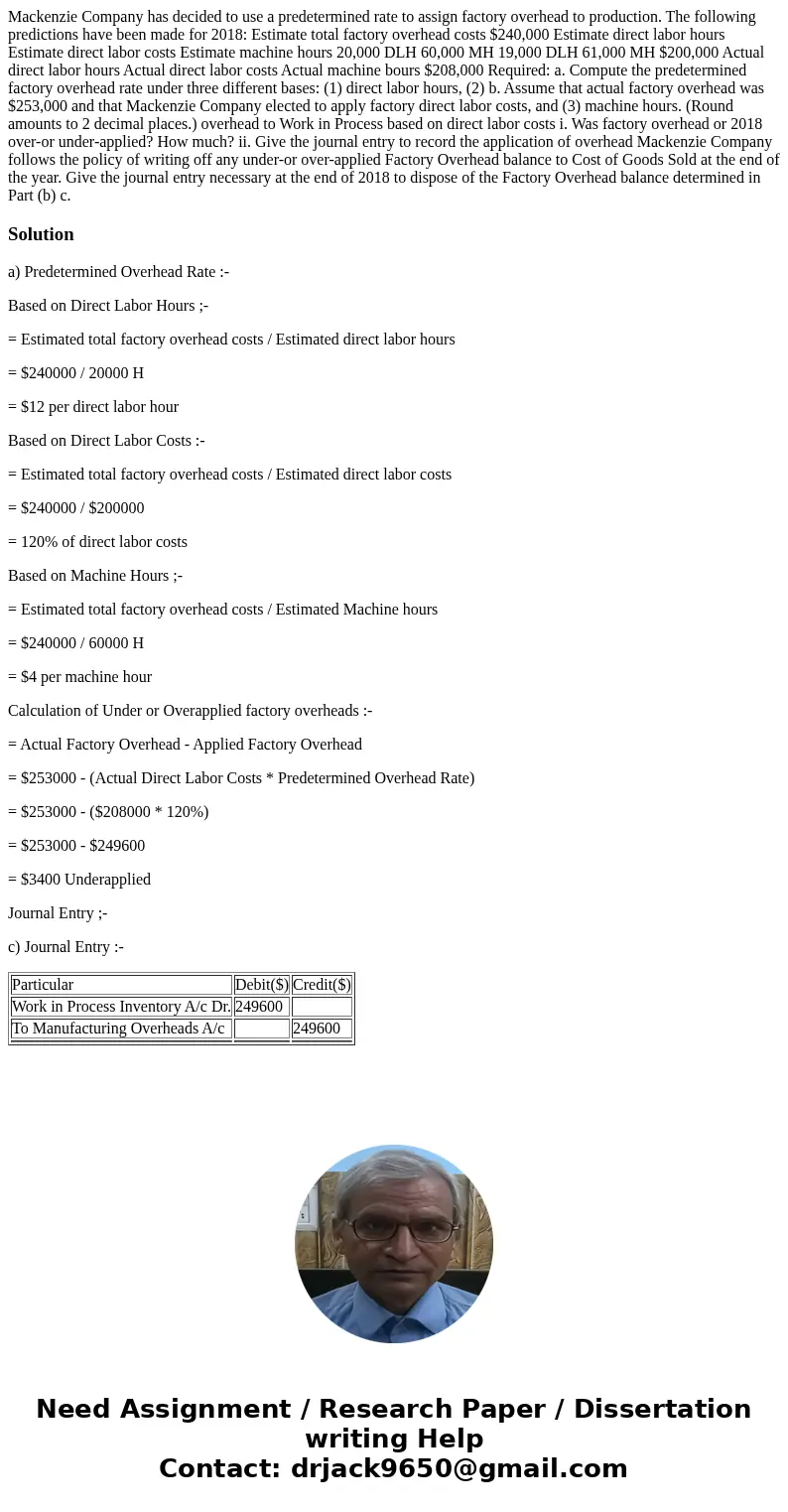

| Particular | Debit($) | Credit($) |

| Work in Process Inventory A/c Dr. | 249600 | |

| To Manufacturing Overheads A/c | 249600 | |

Homework Sourse

Homework Sourse