Rodriguez Company pays 350000 for real estate plus 18550 in

Rodriguez Company pays $350,000 for real estate plus $18,550 in closing costs. The real estate consists of land appraised at $216,000; land improvements appraised at $81,000; and a building appraised at $243,000.

Required:

1. Allocate the total cost among the three purchased assets.

2. Prepare the journal entry to record the purchase.

Solution

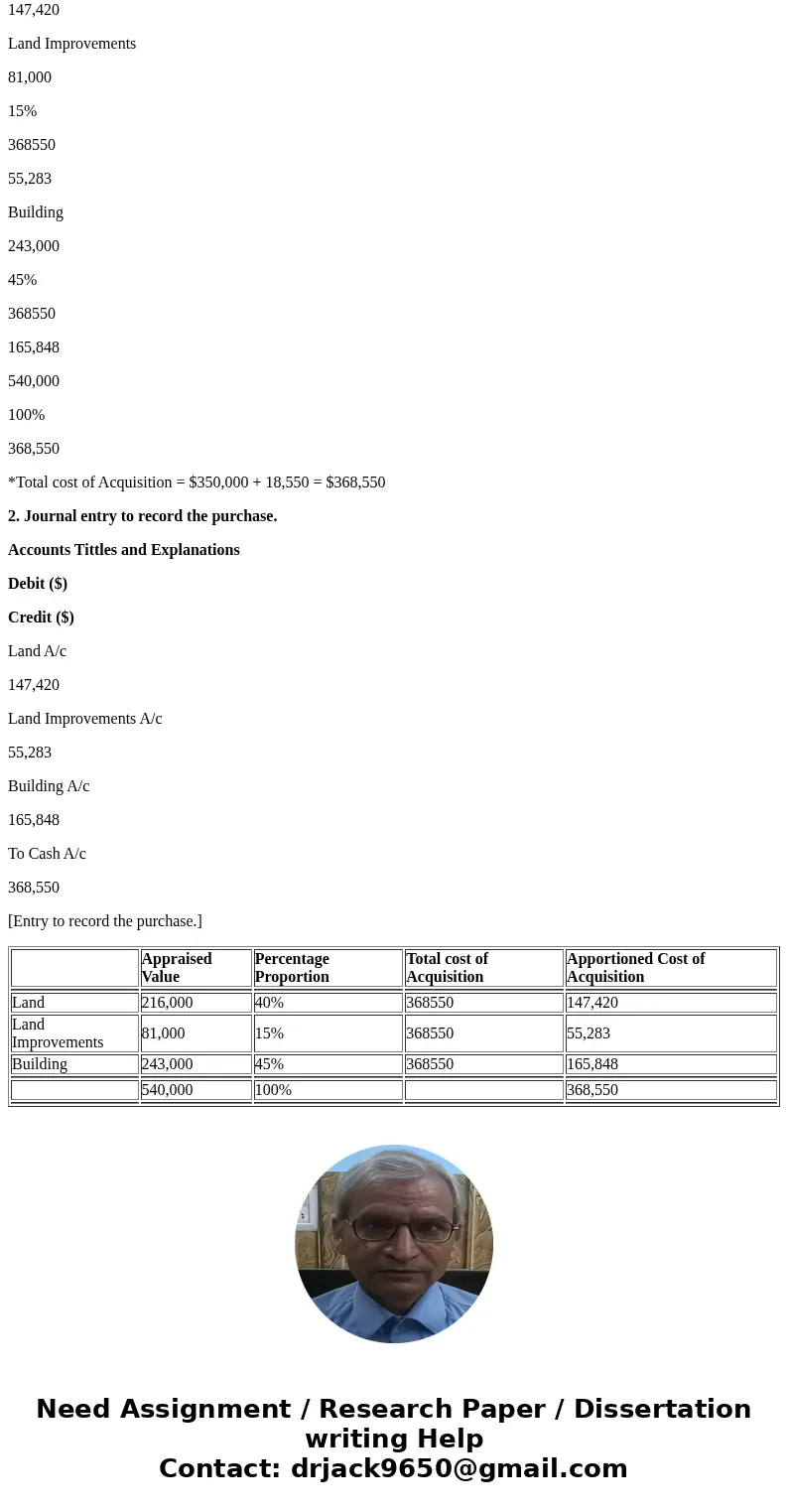

1. Allocation of the total cost among the three purchased assets.

Appraised Value

Percentage Proportion

Total cost of Acquisition

Apportioned Cost of Acquisition

Land

216,000

40%

368550

147,420

Land Improvements

81,000

15%

368550

55,283

Building

243,000

45%

368550

165,848

540,000

100%

368,550

*Total cost of Acquisition = $350,000 + 18,550 = $368,550

2. Journal entry to record the purchase.

Accounts Tittles and Explanations

Debit ($)

Credit ($)

Land A/c

147,420

Land Improvements A/c

55,283

Building A/c

165,848

To Cash A/c

368,550

[Entry to record the purchase.]

| Appraised Value | Percentage Proportion | Total cost of Acquisition | Apportioned Cost of Acquisition | |

| Land | 216,000 | 40% | 368550 | 147,420 |

| Land Improvements | 81,000 | 15% | 368550 | 55,283 |

| Building | 243,000 | 45% | 368550 | 165,848 |

| 540,000 | 100% | 368,550 | ||

Homework Sourse

Homework Sourse