On 1 July 2014 Stokes Ltd acquires 25 per cent of the issued

On 1 July 2014 Stokes Ltd acquires 25 per cent of the issued capital of Cotter Ltd for a cash consideration of $120 000. At the date of acquisition, the shareholders’ equity of Cotter Ltd is: Share capital $150 000 Retained earnings $100 000 Total shareholders’ equity $250 000 Additional information: ? On the date of acquisition, buildings have a carrying amount in the accounts of Cotter Ltd of $80 000 and a market value of $100 000. The buildings have an estimated useful life of 10 years after 1 July 2014. ? For the year ending 30 June 2015 Cotter Ltd records an after-tax profit of $30 000, from which it pays a dividend of $10 000. ? For the year ending 30 June 2016 Cotter Ltd records an after-tax profit of $100 000, from which it pays a dividend of $50 000. ? Stokes LTD. Has a number of subsidiaries ? Assume a tax rate of 30% is assumed Required: Applying equity method of accounting (a) Calculate the amount of goodwill at the date of acquisition. (3 marks) (b) Prepare the journal entries for the year ending 30 June 2015. (3 marks) (c) Prepare the journal entries for the year ending 30 June 2016. (6 marks)

Solution

A)Goodwill calculation

Purchase Consideration =120,000

Net Asset of Cotter Ltd @acquasition

(w1) 350,000*25% =(87,500)

Goodwill @ aquasition=32,500

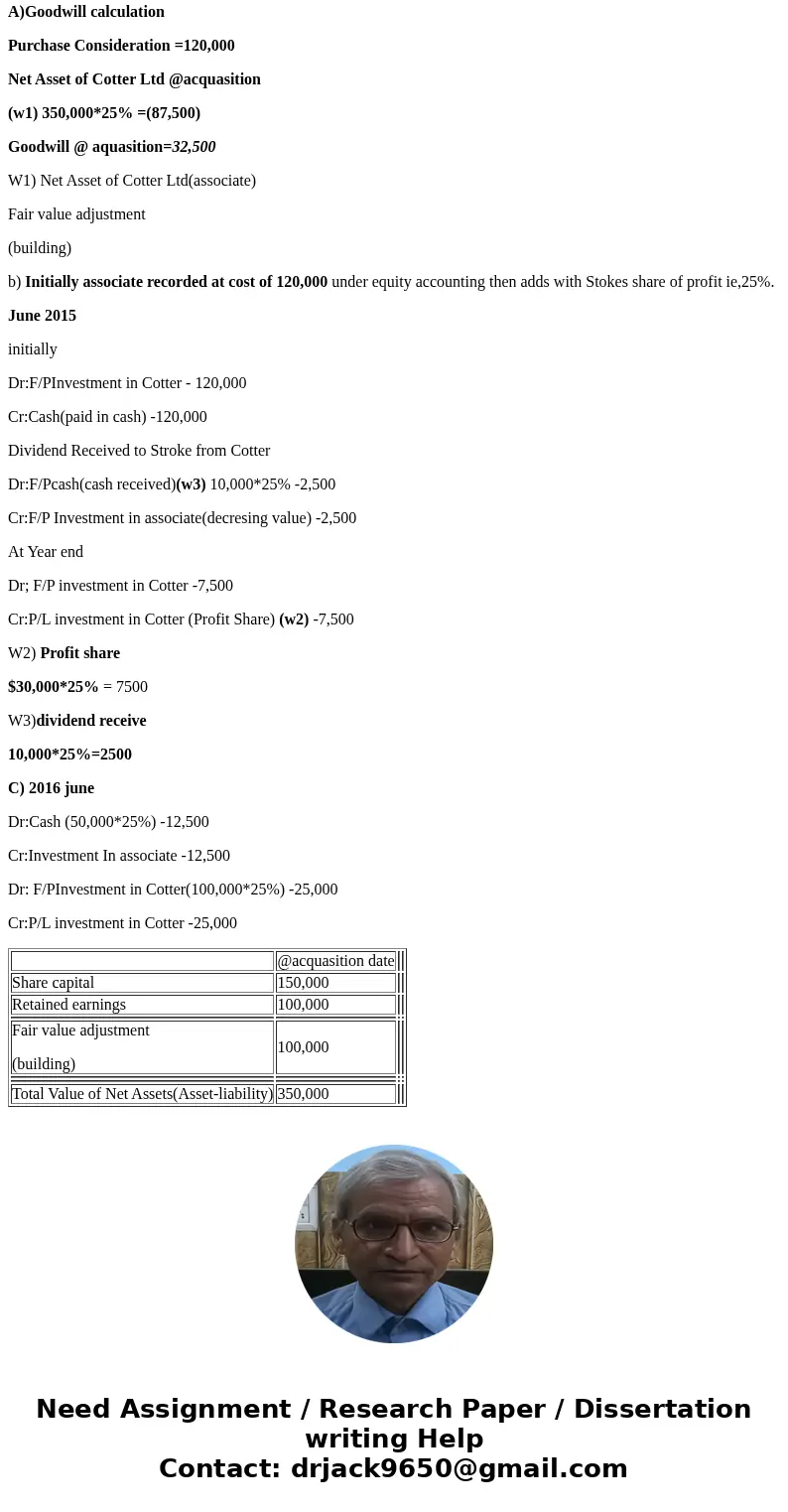

W1) Net Asset of Cotter Ltd(associate)

Fair value adjustment

(building)

b) Initially associate recorded at cost of 120,000 under equity accounting then adds with Stokes share of profit ie,25%.

June 2015

initially

Dr:F/PInvestment in Cotter - 120,000

Cr:Cash(paid in cash) -120,000

Dividend Received to Stroke from Cotter

Dr:F/Pcash(cash received)(w3) 10,000*25% -2,500

Cr:F/P Investment in associate(decresing value) -2,500

At Year end

Dr; F/P investment in Cotter -7,500

Cr:P/L investment in Cotter (Profit Share) (w2) -7,500

W2) Profit share

$30,000*25% = 7500

W3)dividend receive

10,000*25%=2500

C) 2016 june

Dr:Cash (50,000*25%) -12,500

Cr:Investment In associate -12,500

Dr: F/PInvestment in Cotter(100,000*25%) -25,000

Cr:P/L investment in Cotter -25,000

| @acquasition date | |||

| Share capital | 150,000 | ||

| Retained earnings | 100,000 | ||

| Fair value adjustment (building) | 100,000 | ||

| Total Value of Net Assets(Asset-liability) | 350,000 |

Homework Sourse

Homework Sourse