Company issued a 60000 40 7year bond payable Journalize the

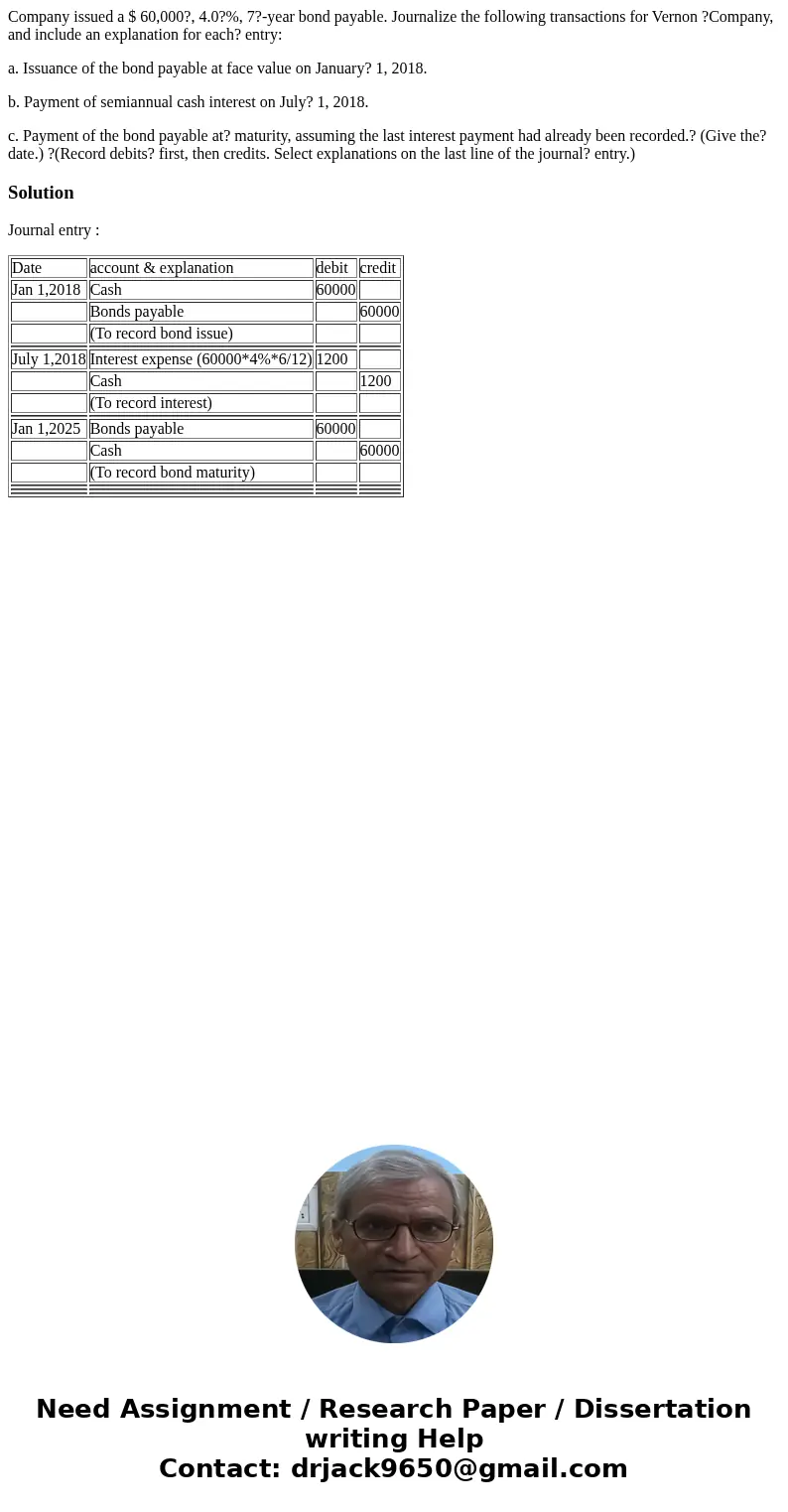

Company issued a $ 60,000?, 4.0?%, 7?-year bond payable. Journalize the following transactions for Vernon ?Company, and include an explanation for each? entry:

a. Issuance of the bond payable at face value on January? 1, 2018.

b. Payment of semiannual cash interest on July? 1, 2018.

c. Payment of the bond payable at? maturity, assuming the last interest payment had already been recorded.? (Give the? date.) ?(Record debits? first, then credits. Select explanations on the last line of the journal? entry.)

Solution

Journal entry :

| Date | account & explanation | debit | credit |

| Jan 1,2018 | Cash | 60000 | |

| Bonds payable | 60000 | ||

| (To record bond issue) | |||

| July 1,2018 | Interest expense (60000*4%*6/12) | 1200 | |

| Cash | 1200 | ||

| (To record interest) | |||

| Jan 1,2025 | Bonds payable | 60000 | |

| Cash | 60000 | ||

| (To record bond maturity) | |||

Homework Sourse

Homework Sourse