Please help It would be greatly appreciated On December 1 20

Please help! It would be greatly appreciated!

On December 1, 2017, Wildhorse Co. had the account balances shown below Debits Cash Accounts Receivable Inventory (3,100 x $0.60 Equipment Credits $4,580 Accumulated Depreciation-Equipment $1,490 3,240 10,900 17,630 $33,260 4,020 Accounts Payable 1,860 Common Stock 22,800 Retained Earnings $33,260 The following transactions occurred during December. Dec. 3 Purchased 4,100 units of inventory on account at a cost of $0.67 per unit. 5 Sold 4,500 units of inventory on account for $0.90 per unit. (It sold 3,100 of the $0.60 units and 1,400 of the $0.67.) 7 Granted the December 5 customer $270 credit for 300 units of inventory returned costing $240. These units were returned to inventory 17 Purchased 2,500 units of inventory for cash at $0.70 each 22 Sold 2,400 units of inventory on account for $0.86 per unit. (It sold 2,400 of the $0.67 units.) Adjustment data: 1. Accrued salaries and wages payable $390. 2. Depreciation on equipment $190 per month 3. Income tax expense was $230, to be paid next year.Solution

Inventory at end :

Beginning inventory :sold

dec 3 purchase: 4100-1400-2400 sale = 300 units * .67 = 201 +240 return = 441

dec 17 purchase = 2500*.7= 1750

Total inventory at end = 441+1750=2191

2)

sales = [4500*.90]+[2400*.86 ] = 6114

Accounts receivable = 4020beginning+6114sales-270 return = 9864

Accounts payable = 3240+ [4100*.67]=5987

cost of goods sold = [3100*.60]+[1400*.67]+[2400*.67]-240 = 4166

3)cash = 4580- [2500*.7] purchase for cash= 2830

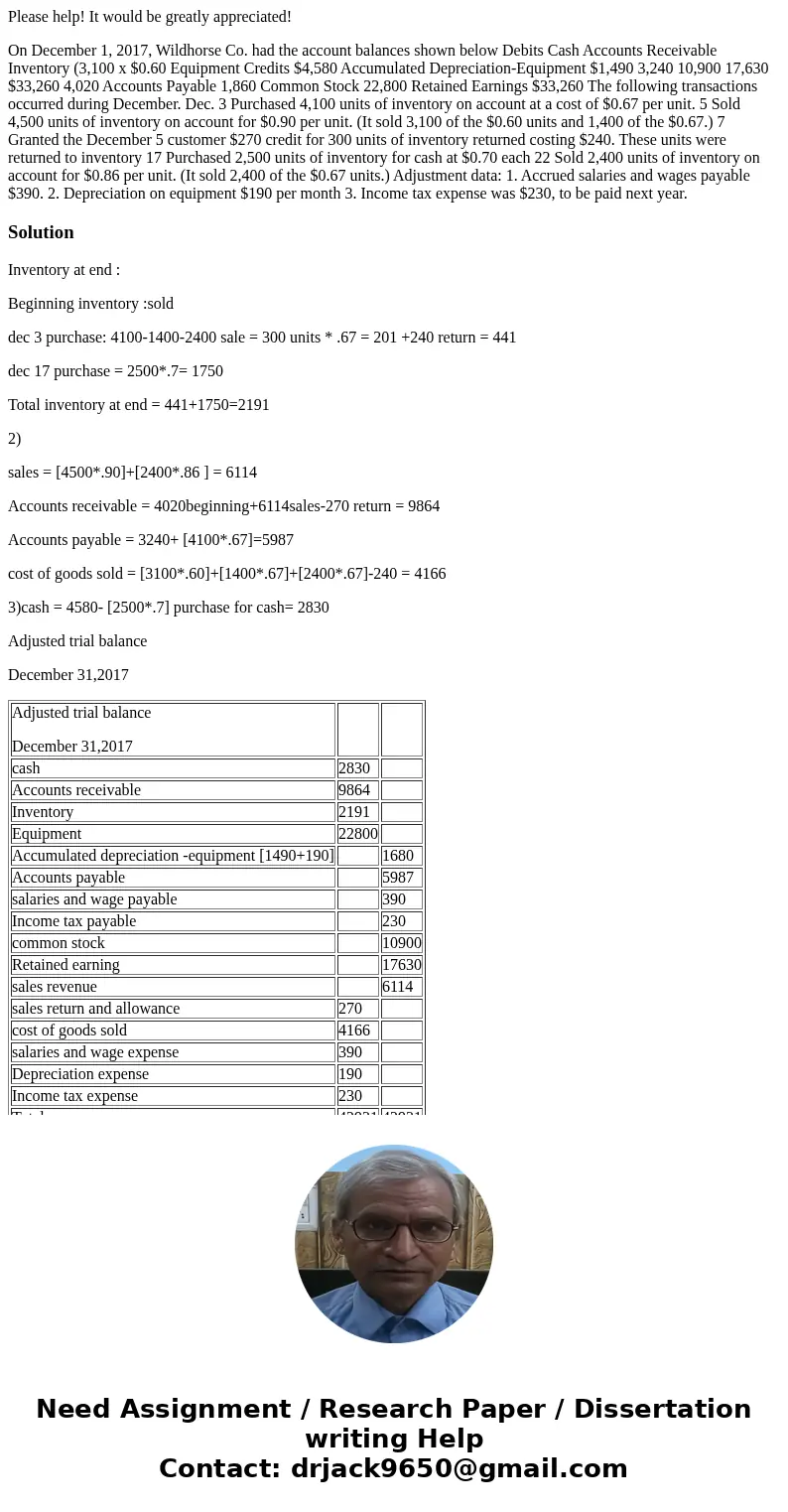

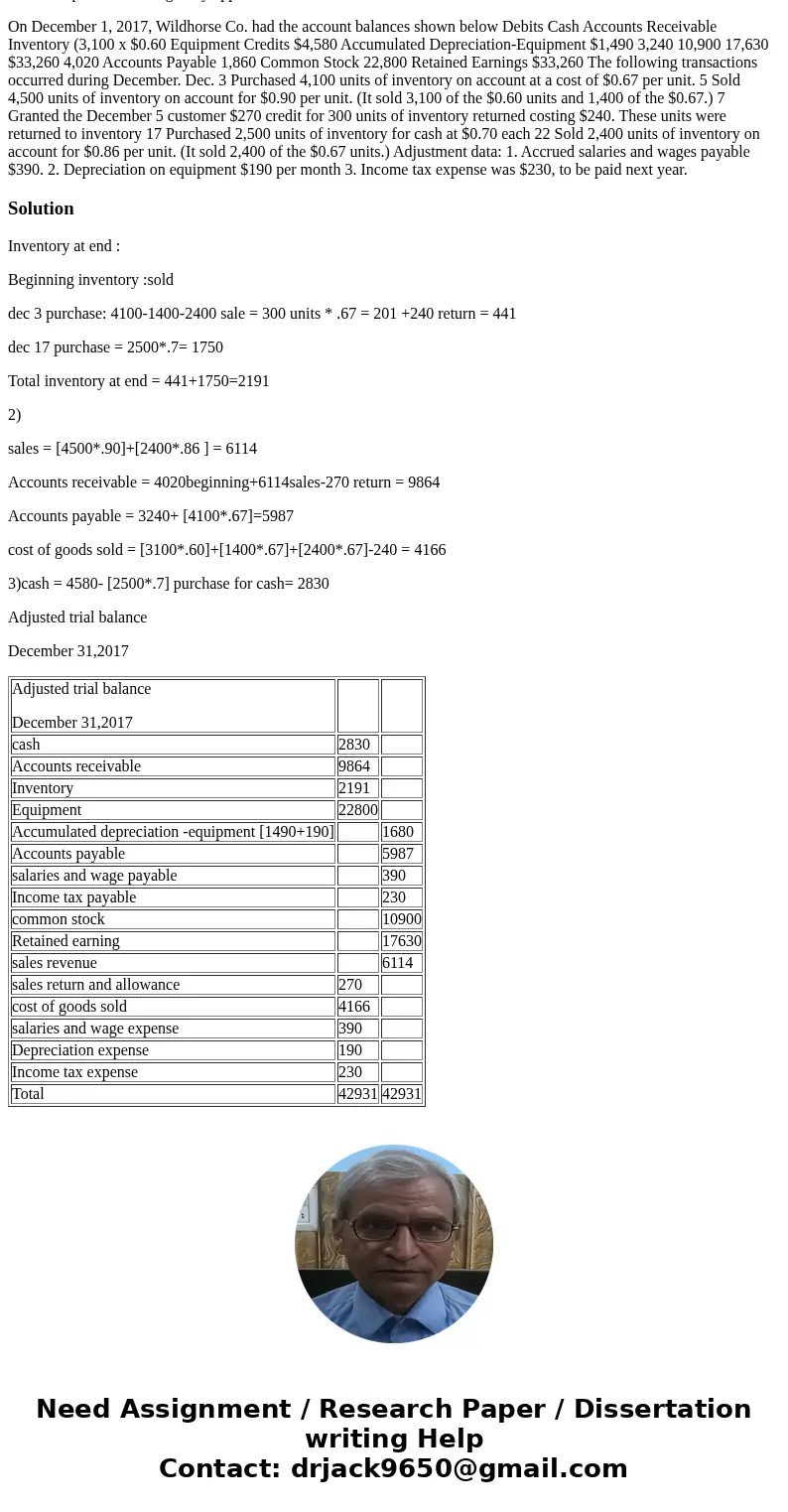

Adjusted trial balance

December 31,2017

| Adjusted trial balance December 31,2017 | ||

| cash | 2830 | |

| Accounts receivable | 9864 | |

| Inventory | 2191 | |

| Equipment | 22800 | |

| Accumulated depreciation -equipment [1490+190] | 1680 | |

| Accounts payable | 5987 | |

| salaries and wage payable | 390 | |

| Income tax payable | 230 | |

| common stock | 10900 | |

| Retained earning | 17630 | |

| sales revenue | 6114 | |

| sales return and allowance | 270 | |

| cost of goods sold | 4166 | |

| salaries and wage expense | 390 | |

| Depreciation expense | 190 | |

| Income tax expense | 230 | |

| Total | 42931 | 42931 |

Homework Sourse

Homework Sourse