On January 1 2012 Aspen Company acquired 80 percent of Birch

On January 1, 2012, Aspen Company acquired 80 percent of Birch Company’s outstanding voting stock for $504,000. Birch reported a $510,000 book value and the fair value of the noncontrolling interest was $126,000 on that date. Also, on January 1, 2013, Birch acquired 80 percent of Cedar Company for $160,000 when Cedar had a $164,000 book value and the 20 percent noncontrolling interest was valued at $40,000. In each acquisition, the subsidiary’s excess acquisition-date fair over book value was assigned to a trade name with a 30-year life. These companies report the following financial information. Investment income figures are not included. 2012 2013 2014 Sales: Aspen Company $ 515,000 $ 595,000 $ 740,000 Birch Company 285,000 398,750 631,000 Cedar Company Not available 249,800 258,800 Expenses: Aspen Company $ 397,500 $ 442,500 $ 530,000 Birch Company 237,000 315,000 557,500 Cedar Company Not available 233,000 216,000 Dividends declared: Aspen Company $ 20,000 $ 45,000 $ 55,000 Birch Company 10,000 15,000 15,000 Cedar Company Not available 2,000 6,000 a If all companies use the equity method for internal reporting purposes, what is the December 31, 2013, balance in Aspen\'s Investment in Birch Company account b What is the consolidated net income for this business combination for 2014? c What is the net income attributable to the noncontrolling interest in 2014? d Assume that Birch made intra-entity inventory transfers to Aspen that have resulted in the following unrealized gross profits at the end of each year: Date Amount 12/31/12 $11,100 12/31/13 20,700 12/31/14 28,400 What is the realized income of Birch in 2013 and 2014, respectively?

Solution

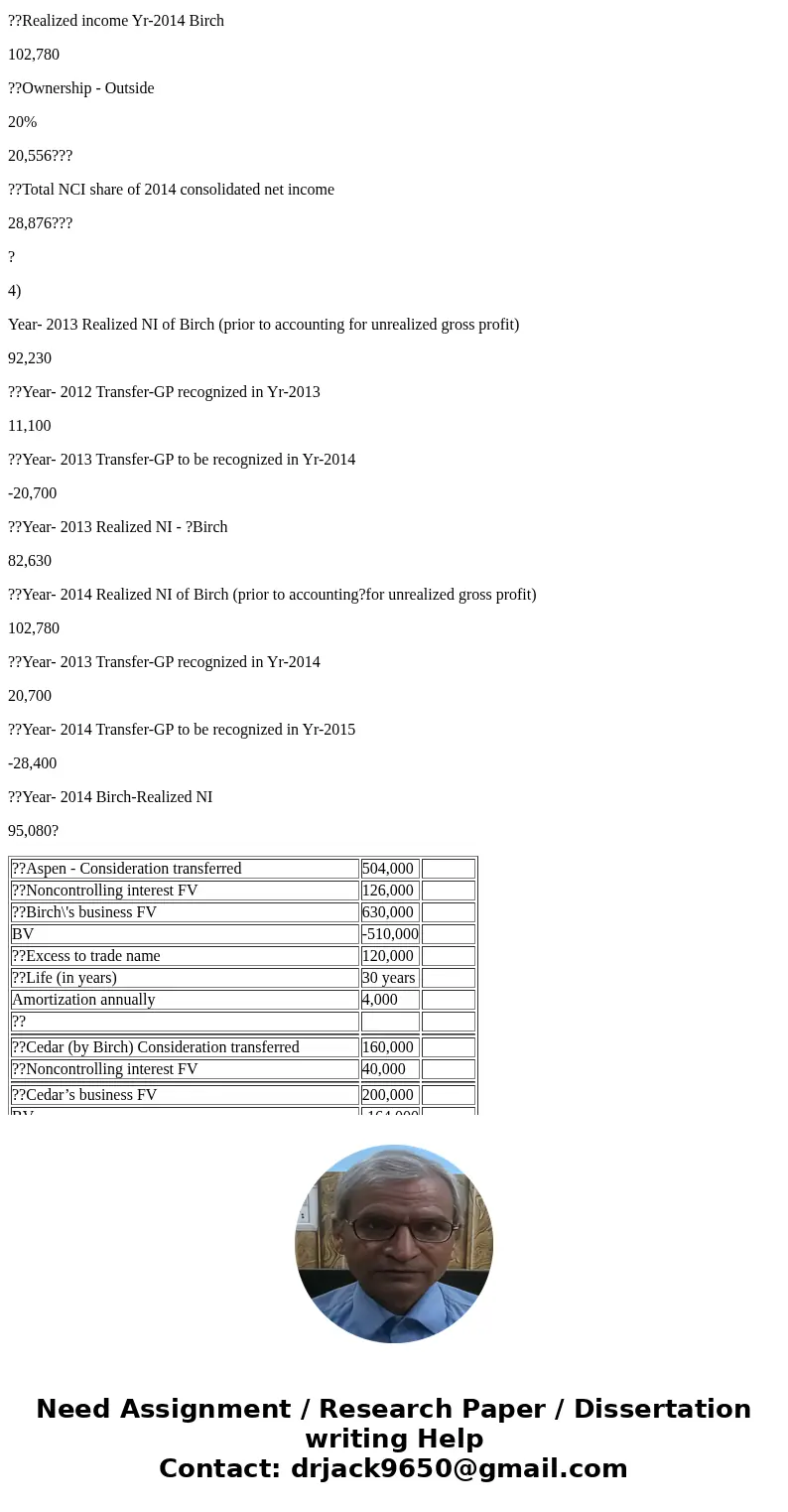

1)

??Aspen - Consideration transferred

504,000

??Noncontrolling interest FV

126,000

??Birch\'s business FV

630,000

BV

-510,000

??Excess to trade name

120,000

??Life (in years)

30 years

Amortization annually

4,000

??

??Cedar (by Birch) Consideration transferred

160,000

??Noncontrolling interest FV

40,000

??Cedar’s business FV

200,000

BV

-164,000

??Excess to trade name

36,000

??Life (in years)

30 years

Amortization annually

1,200

??Investment in Birch

504,000

??Birch\'s reported net income-2012

48,000

??Amortization expense

-4,000

??Accrual-based net income

44,000

??Birch’s percentage ownership

80

??Equity accrual Yr -2012

35,200

??Dividends received Yr-2012

-8,000

?Net income -?Birch\'s reported Yr -2013

83,750

??Amortization expense

-4,000

??Net income from Cedar [80% * ($16,800 -?$1,200)]

12,480

??Accrual-based net income

92,230

??Birch’s % ownership

80%

??Equity accrual Yr-2013

73,784

??Dividends received from Birch Yr-2013

-12,000

??Investment in Birch 31st Dec

592,984

2)

Sales - Consolidated

1,629,800

Expenses - Consolidated

-1,303,500

Amortization expense total

-5,200

??Consolidated net income for 2014

321,100

?

3)

NCI in consolidated NI-??Cedar’s

??Revenues minus expenses

42,800

??Excess amortization

-1,200

??Income - Accrual-based

41,600

??Noncontrolling interest percentage

20%

NCI in consolidated NI-??Cedar’s

8,320 ??

NCI in consolidated NI- Birch’s

??Revenues minus expenses

73,500

??Excess amortization

-4,000

??Equity in Cedar income [(42,800 -1,200) * 80%]

33,280

??Realized income Yr-2014 Birch

102,780

??Ownership - Outside

20%

20,556???

??Total NCI share of 2014 consolidated net income

28,876???

?

4)

Year- 2013 Realized NI of Birch (prior to accounting for unrealized gross profit)

92,230

??Year- 2012 Transfer-GP recognized in Yr-2013

11,100

??Year- 2013 Transfer-GP to be recognized in Yr-2014

-20,700

??Year- 2013 Realized NI - ?Birch

82,630

??Year- 2014 Realized NI of Birch (prior to accounting?for unrealized gross profit)

102,780

??Year- 2013 Transfer-GP recognized in Yr-2014

20,700

??Year- 2014 Transfer-GP to be recognized in Yr-2015

-28,400

??Year- 2014 Birch-Realized NI

95,080?

| ??Aspen - Consideration transferred | 504,000 | |

| ??Noncontrolling interest FV | 126,000 | |

| ??Birch\'s business FV | 630,000 | |

| BV | -510,000 | |

| ??Excess to trade name | 120,000 | |

| ??Life (in years) | 30 years | |

| Amortization annually | 4,000 | |

| ?? | ||

| ??Cedar (by Birch) Consideration transferred | 160,000 | |

| ??Noncontrolling interest FV | 40,000 | |

| ??Cedar’s business FV | 200,000 | |

| BV | -164,000 | |

| ??Excess to trade name | 36,000 | |

| ??Life (in years) | 30 years | |

| Amortization annually | 1,200 | |

| ??Investment in Birch | 504,000 | |

| ??Birch\'s reported net income-2012 | 48,000 | |

| ??Amortization expense | -4,000 | |

| ??Accrual-based net income | 44,000 | |

| ??Birch’s percentage ownership | 80 | |

| ??Equity accrual Yr -2012 | 35,200 | |

| ??Dividends received Yr-2012 | -8,000 | |

| ?Net income -?Birch\'s reported Yr -2013 | 83,750 | |

| ??Amortization expense | -4,000 | |

| ??Net income from Cedar [80% * ($16,800 -?$1,200)] | 12,480 | |

| ??Accrual-based net income | 92,230 | |

| ??Birch’s % ownership | 80% | |

| ??Equity accrual Yr-2013 | 73,784 | |

| ??Dividends received from Birch Yr-2013 | -12,000 | |

| ??Investment in Birch 31st Dec | 592,984 |

Homework Sourse

Homework Sourse