Bed and Bath Company has two departments Hardware and Linens

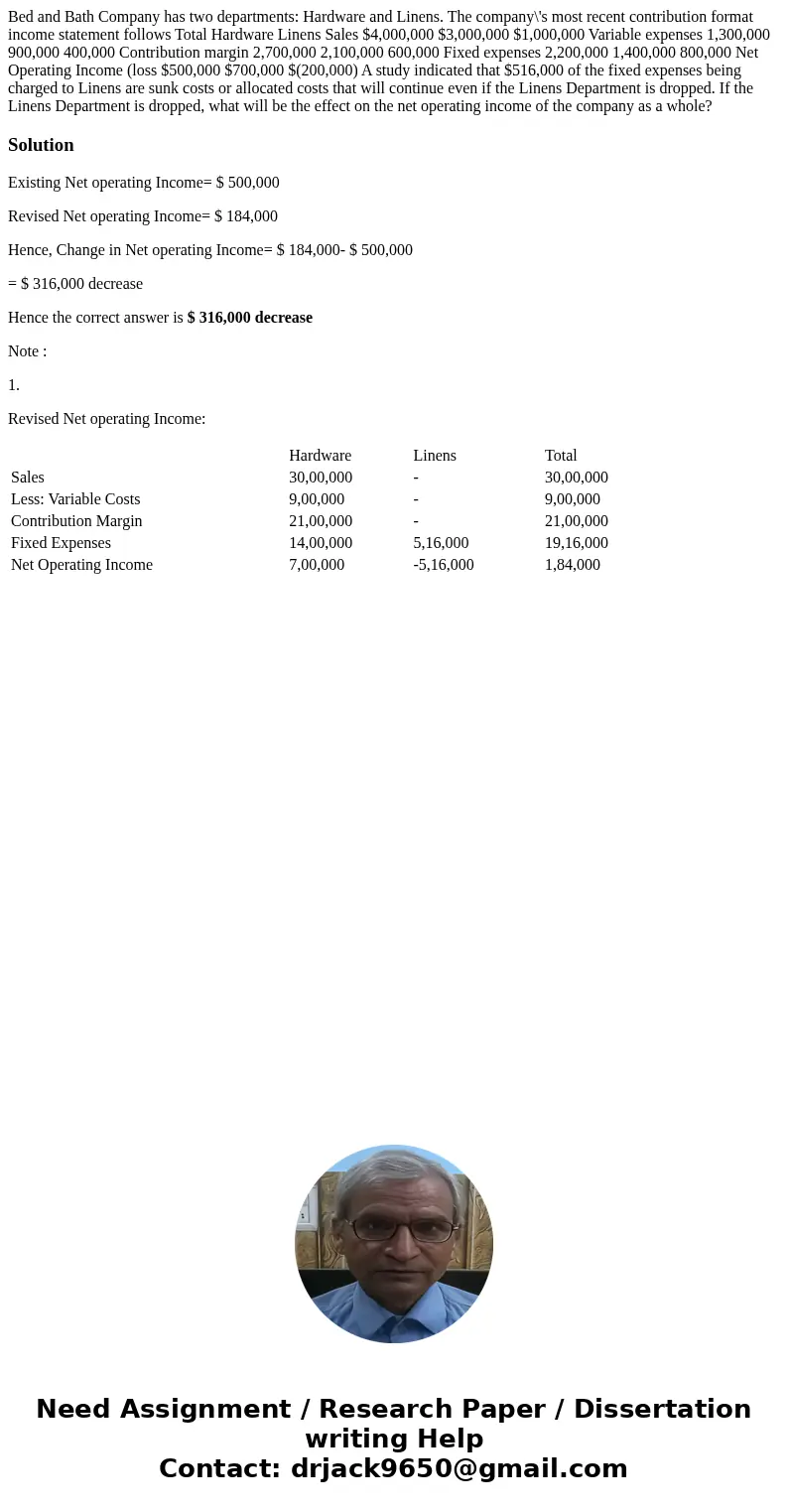

Bed and Bath Company has two departments: Hardware and Linens. The company\'s most recent contribution format income statement follows Total Hardware Linens Sales $4,000,000 $3,000,000 $1,000,000 Variable expenses 1,300,000 900,000 400,000 Contribution margin 2,700,000 2,100,000 600,000 Fixed expenses 2,200,000 1,400,000 800,000 Net Operating Income (loss $500,000 $700,000 $(200,000) A study indicated that $516,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. If the Linens Department is dropped, what will be the effect on the net operating income of the company as a whole?

Solution

Existing Net operating Income= $ 500,000

Revised Net operating Income= $ 184,000

Hence, Change in Net operating Income= $ 184,000- $ 500,000

= $ 316,000 decrease

Hence the correct answer is $ 316,000 decrease

Note :

1.

Revised Net operating Income:

| Hardware | Linens | Total | |

| Sales | 30,00,000 | - | 30,00,000 |

| Less: Variable Costs | 9,00,000 | - | 9,00,000 |

| Contribution Margin | 21,00,000 | - | 21,00,000 |

| Fixed Expenses | 14,00,000 | 5,16,000 | 19,16,000 |

| Net Operating Income | 7,00,000 | -5,16,000 | 1,84,000 |

Homework Sourse

Homework Sourse