for doubtful 10940 debit tobe 4 of credit sales SolutionAnsw

Solution

Answers

Working;

A

Total Credit Sale

$ 31,49,000.00

B = A x 4%

Bad Debt expense at 4%

$ 1,25,960.00

C [given]

Allowance for Doubtful Account balance - (Debit)/Credit

$ (10,940.00)

D = B + C

Adjusted Allowance for Doubtful Account balance - (Debit) Credit

$ 1,15,020.00

Transaction

Accounts title

Debit

Credit

a

Bad Debt Expense

$ 1,25,960.00

Allowance for Doubtful Account

$ 1,25,960.00

(bad debt expense recorded0

Balance Sheet (Partial)

Current Assets:

Accounts Receivables

$ 9,54,147.00

Less: Allowance for Doubtful Accounts

$ 1,15,020.00

Accounts receivables, net

$ 8,39,127.00

Working:

1

Total Cash Sale

$ 16,54,970.00

2

Total Credit Sale

$ 31,49,000.00

A=1+2

Total Sales

$ 48,03,970.00

B = A x 4%

Bad Debt expense at 3%

$ 1,44,119.10

C [given]

Allowance for Doubtful Account balance - (Debit)/Credit

$ (10,940.00)

D = B + C

Adjusted Allowance for Doubtful Account balance - (Debit) Credit

$ 1,33,179.10

Answers:

Transaction

Accounts title

Debit

Credit

b

Bad Debt Expense

$ 1,44,119.10

Allowance for Doubtful Account

$ 1,44,119.10

(bad debt expense recorded0

Balance Sheet (Partial)

Current Assets:

Accounts Receivables

$ 9,54,147.00

Less: Allowance for Doubtful Accounts

$ 1,33,179.10

Accounts receivables, net

$ 8,20,967.90

Working:

A

Accounts receivables balance

$ 9,54,147.00

B = A x 7%

Adjusted Allowance for Doubtful Account balance - (Debit) Credit, required

$ 66,790.29

C [given]

Unadjusted Allowance for Doubtful Account balance - (Debit)/Credit existing

$ (10,940.00)

D = B - C

Bad Debt Expense [66790.29 – ( - 10940)]

$ 77,730.29

Answers:

Transaction

Accounts title

Debit

Credit

c

Bad Debt Expense

$ 77,730.29

Allowance for Doubtful Account

$ 77,730.29

(bad debt expense recorded0

Balance Sheet (Partial)

Current Assets:

Accounts Receivables

$ 9,54,147.00

Less: Allowance for Doubtful Accounts

$ 66,790.29

Accounts receivables, net

$ 8,87,356.71

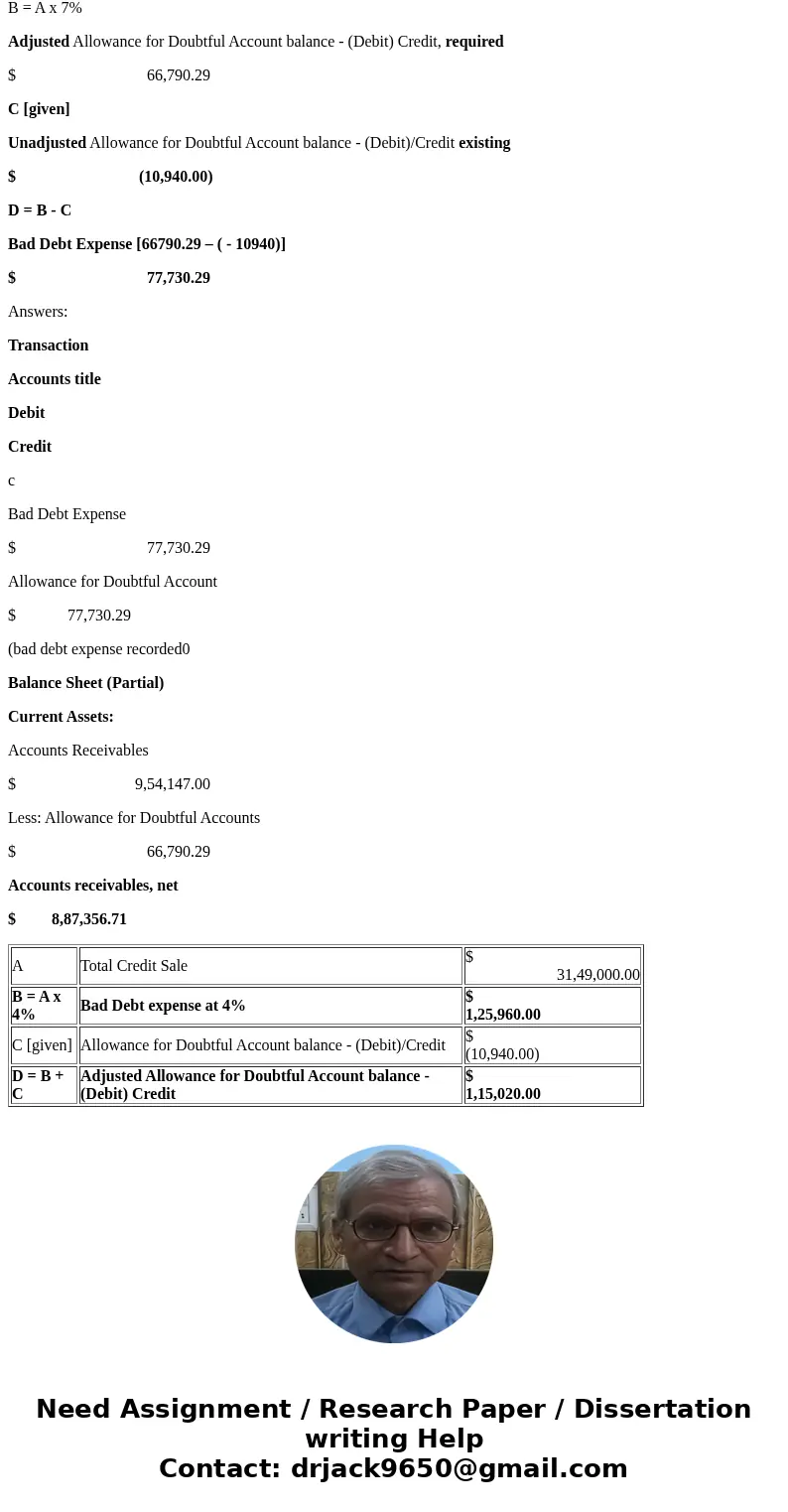

| A | Total Credit Sale | $ 31,49,000.00 |

| B = A x 4% | Bad Debt expense at 4% | $ 1,25,960.00 |

| C [given] | Allowance for Doubtful Account balance - (Debit)/Credit | $ (10,940.00) |

| D = B + C | Adjusted Allowance for Doubtful Account balance - (Debit) Credit | $ 1,15,020.00 |

Homework Sourse

Homework Sourse